“Bitcoin is very unique in a way that no one has talked about at all, and this chain of logic leads to profound conclusions.” – John S. Rhodes

In a world where digital currencies are becoming increasingly prevalent, Bitcoin stands out as a revolutionary force in the financial landscape. But have you ever wondered what truly gives Bitcoin its value? Is it just another speculative asset, or is there something more fundamental at play?

Today, we’re diving deep into the heart of Bitcoin’s worth, uncovering insights that might just change the way you think about this digital phenomenon.

TL;DR

- Bitcoin’s value is rooted in a unique chain of commodities: energy, mining power, and the coin itself

- The proof-of-work concept gives Bitcoin inherent value through real-world energy expenditure

- Trust and network effects play a crucial role in Bitcoin’s increasing value over time

- Bitcoin’s capped supply of 21 million coins contributes to its potential for long-term value appreciation

- The blockchain’s transparency and immutability foster trust among users

- Bitcoin offers permissionless, peer-to-peer value transfer without intermediaries

The Commodity Chain: Energy, Mining, and Bitcoin

To understand the true value of Bitcoin, we need to start at the beginning: the mining process. This is where the magic happens, and it all starts with a simple yet profound concept – energy.

Energy: The First Link in the Chain

At its core, Bitcoin mining requires energy. This isn’t just any energy; it’s real-world, tangible power that comes from various sources like solar, wind, or fossil fuels. This energy is a commodity in itself, with its own supply and demand dynamics.

“Energy is a commodity and it is an essential absolutely essential input into Bitcoin ultimately,” explains John S. Rhodes. This connection to real-world resources grounds Bitcoin in something tangible from the very start.

Mining Power: Transforming Energy into Computation

The second link in this chain is the mining power, represented by specialized computers called miners or the computational power known as hash rate. These miners use the energy input to solve complex mathematical puzzles, essentially converting one commodity (energy) into another (computational power).

Bitcoin: The Digital Commodity

Finally, we arrive at Bitcoin itself – a digital commodity born from the fusion of energy and computational power. It’s important to note that the U.S. government has officially designated Bitcoin as a commodity, not a security or currency.

“Bitcoin itself is indeed a commodity,” Rhodes emphasizes. This classification puts Bitcoin in the same category as gold, oil, or wheat – tangible assets with inherent value.

The Unique Value Proposition of Bitcoin

Now that we understand the commodity chain behind Bitcoin, let’s explore what makes it truly special.

Proof of Work: Value Through Effort

Unlike traditional fiat currencies that can be created at will by central banks, every new Bitcoin comes into existence through provable work. This concept, known as “proof of work,” ensures that real-world resources have been expended to create each coin.

“Bitcoin was not created out of thin air,” Rhodes explains. “Every new Bitcoin at a minimum is not created out of thin air by magic, by fiat. There isn’t some dictator, some king, there is no government, there is no bank, there is no single person, there’s not even some group that has determined that Bitcoin will come into existence.”

This intrinsic link to real-world effort gives Bitcoin a fundamental value that many other assets lack.

Trust and Network Effects

As more people understand and believe in the value of Bitcoin, its worth continues to grow. This increasing trust creates a network effect, where the value of the network grows exponentially as more users join.

“Bitcoin continues to garner more and more attention, more trust. There are network effects, or more people believe in Bitcoin, and they believe it has value,” Rhodes notes.

Transparency and Immutability

One of Bitcoin’s most powerful features is its transparent and immutable blockchain. Anyone can verify transactions and the entire history of the Bitcoin network, fostering trust among users.

“An individual can look at the Bitcoin blockchain and verify with their own two eyes that indeed everything from the very, very start of Bitcoin until this very second when you look is real,” Rhodes explains.

Scarcity and Value Appreciation

Bitcoin’s capped supply of 21 million coins creates a scarcity that contrasts sharply with the inflationary nature of fiat currencies. As demand increases and supply remains fixed, the potential for long-term value appreciation becomes apparent.

“If you hold on to dollars, they will inflate away,” Rhodes points out. “On the other hand, a Bitcoin over time… over time up, up and away.”

How to Leverage Bitcoin’s Value Proposition

Now that we understand what gives Bitcoin its value, let’s explore how you can leverage this knowledge:

- Educate Yourself: Start by thoroughly understanding Bitcoin’s technology, economics, and philosophy. This foundational knowledge is crucial for making informed decisions.

- Read “The Bitcoin Standard” by Saifedean Ammous for a comprehensive overview of Bitcoin’s economic principles.

- Explore online courses like Coursera’s “Bitcoin and Cryptocurrency Technologies” offered by Princeton University.

- Join local Bitcoin meetups or online forums to engage with the community and learn from experienced users.

- Follow thought leaders like Andreas Antonopoulos, Lyn Alden, and Vijay Boyapati on social media for ongoing insights.

- Start Small: Begin with a small investment to get comfortable with buying, storing, and using Bitcoin.

- Start with a small amount you’re comfortable potentially losing, perhaps 1-2% of your investment portfolio.

- Practice sending and receiving small amounts to understand transaction fees and confirmation times.

- Experiment with different wallet types (mobile, desktop, hardware) to find what works best for you.

- Secure Your Assets: Investing in proper security measures is crucial for protecting your Bitcoin.

- Purchase a hardware wallet like Ledger Nano X or Trezor Model T for long-term storage of significant amounts.

- Use a reputable software wallet like Electrum or BlueWallet for smaller amounts and frequent transactions.

- Implement strong passwords and enable two-factor authentication on all your crypto-related accounts.

- Consider multi-signature setups for added security on large holdings.

- Learn about and implement proper seed phrase storage techniques, such as using metal backups and storing copies in multiple secure locations.

- Dollar-Cost Average: Instead of trying to time the market, consider regular, small purchases to average out price volatility over time.

- Set up automatic weekly or monthly purchases on platforms like Swan Bitcoin or River Financial.

- Choose a fixed dollar amount to invest regularly, regardless of Bitcoin’s price.

- Stick to your plan even during market downturns to potentially benefit from lower prices.

- Use tools like dcabtc.com to track and analyze your dollar-cost averaging strategy.

- Stay Informed: Follow reputable news sources and analysts to stay updated on Bitcoin developments and market trends.

- Subscribe to newsletters like “The Bitcoin Daily” or “The Pomp Letter” for curated news and analysis.

- Listen to podcasts such as “What Bitcoin Did” or “The Investor’s Podcast Network – Bitcoin Fundamentals” for in-depth discussions.

- Use tracking apps like CoinGecko or CoinMarketCap to monitor price movements and market sentiment.

- Follow Bitcoin-focused Twitter accounts and participate in discussions to stay on top of real-time developments.

- Explore Use Cases: Look into ways to use Bitcoin for payments or remittances to experience its utility firsthand.

- Experiment with Lightning Network payments for fast, low-fee transactions using wallets like Muun or Phoenix.

- If applicable, explore using Bitcoin for international remittances through services like Strike or BitPesa.

- Consider allocating a small portion of your savings to Bitcoin as a potential hedge against inflation.

- Consider Mining: If you have access to cheap electricity, Bitcoin mining could be a way to directly participate in the network and potentially earn rewards.

- Research mining profitability using calculators like CryptoCompare’s Mining Calculator.

- Start with cloud mining services like Genesis Mining to understand the process without significant hardware investment.

- If viable, invest in ASIC miners like the Antminer S19 Pro for home mining, ensuring proper cooling and noise management.

- Join mining pools like Slush Pool or F2Pool to increase your chances of earning consistent rewards.

- Engage in the Ecosystem: Participate actively in the Bitcoin ecosystem to fully leverage its potential.

- Run a full node using Bitcoin Core to support the network and verify transactions independently.

- Contribute to open-source Bitcoin projects on GitHub if you have programming skills.

- Attend Bitcoin conferences like Bitcoin 2024 to network and learn from industry experts.

- Consider accepting Bitcoin payments if you run a business, using services like BTCPay Server.

- Understand Tax Implications: Be aware of the tax consequences of your Bitcoin activities.

- Consult with a crypto-savvy tax professional to understand your obligations.

- Use tax tracking software like CoinTracker or TokenTax to maintain accurate records of your transactions.

- Keep detailed logs of all your Bitcoin purchases, sales, and transfers for tax reporting purposes.

- Stay informed about changing regulations and how they might affect your Bitcoin strategy.

10. Plan for the Long Term: Develop a long-term strategy that aligns with your financial goals and risk tolerance.

- Define clear objectives for your Bitcoin investment, whether it’s long-term savings, portfolio diversification, or speculation.

- Create a plan for securing and potentially passing on your Bitcoin holdings to heirs.

- Consider incorporating Bitcoin into your retirement planning, exploring options like Bitcoin IRAs.

- Regularly reassess your Bitcoin allocation as your financial situation and market conditions change.

By following these expanded strategies, you can more effectively leverage Bitcoin’s unique value proposition while managing risks and staying aligned with your financial goals. Remember, the world of Bitcoin is constantly evolving, so continuous learning and adaptation are key to success in this space.

Tools and Examples

• Wallets: Ledger Nano X, Trezor Model T

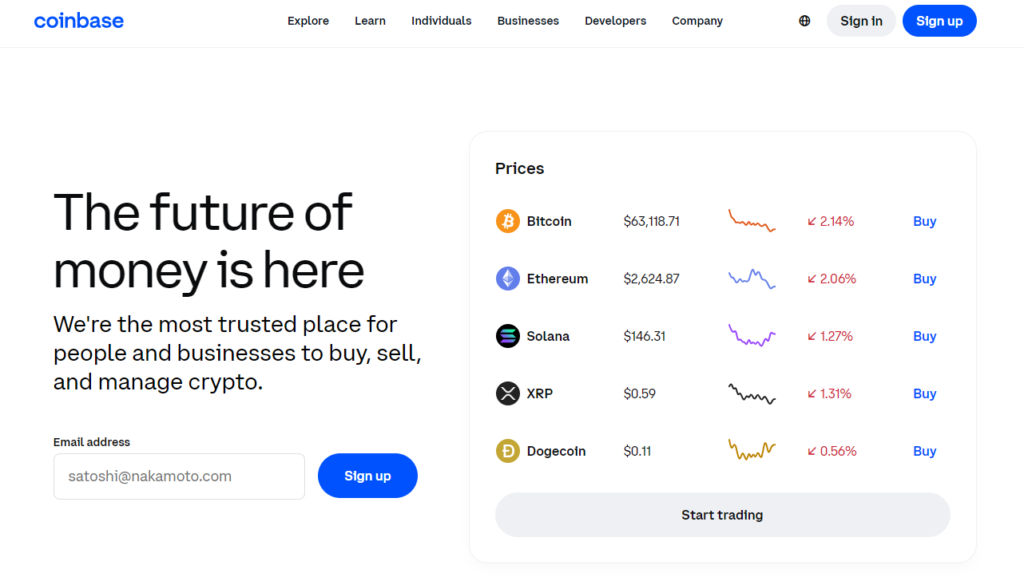

• Exchanges: Coinbase Pro, Kraken, Gemini

• Price Tracking: CoinGecko, CoinMarketCap

• News and Analysis: CoinDesk, Cointelegraph

• Mining Calculator: CryptoCompare Mining Calculator

Remember, “The reason that Bitcoin as a commodity continues to accrue, gather, increase in value is something very, very simple,” as Rhodes puts it. It’s the combination of real-world input, provable scarcity, and growing trust that makes Bitcoin a unique and potentially valuable asset.

Actionable Steps to Leverage Bitcoin’s Value Proposition

Here’s a breakdown of practical, step-by-step strategies catering to different experience levels:

Beginner Level:

Educate Yourself

- Step 1: Read “The Bitcoin Standard” by Saifedean Ammous.

- Step 2: Take a free online course like Coursera’s “Bitcoin and Cryptocurrency Technologies”.

- Step 3: Join r/Bitcoin on Reddit and follow reputable Bitcoin news sites like CoinDesk.

Set Up Your First Wallet

- Step 1: Download a beginner-friendly mobile wallet like BlueWallet (iOS/Android).

- Step 2: Follow the app’s instructions to create a new wallet.

- Step 3: Write down your seed phrase and store it securely offline.

Make Your First Purchase

- Step 1: Sign up for a user-friendly exchange like Coinbase.

- Step 2: Complete the verification process.

- Step 3: Link your bank account or credit card.

- Step 4: Buy a small amount of Bitcoin (e.g., $50-$100).

Practice Transactions

- Step 1: Send a small amount (e.g., $10 worth) of Bitcoin from your exchange to your mobile wallet.

- Step 2: Send a small amount back to the exchange or to a friend’s wallet.

- Step 3: Observe transaction fees and confirmation times.

Implement Basic Security

- Step 1: Enable two-factor authentication on your exchange account.

- Step 2: Use a password manager to generate and store strong, unique passwords.

- Step 3: Never share your seed phrase or private keys with anyone.

Intermediate Level:

Upgrade Your Storage

- Step 1: Research and purchase a hardware wallet like Ledger Nano X or Trezor Model T.

- Step 2: Set up your hardware wallet following the manufacturer’s instructions.

- Step 3: Transfer your Bitcoin from your mobile wallet or exchange to your hardware wallet.

Implement Dollar-Cost Averaging

- Step 1: Set up an account on a platform that supports automated buying, like Swan Bitcoin.

- Step 2: Configure weekly or monthly purchases of a fixed dollar amount.

- Step 3: Automate transfers to your hardware wallet for added security.

Explore Bitcoin’s Use Cases

- Step 1: Find online retailers that accept Bitcoin payments (e.g., Overstock, Newegg).

- Step 2: Make a small purchase using Bitcoin to experience its use as a medium of exchange.

- Step 3: If applicable, try using Bitcoin for international remittances through services like Strike.

Deepen Your Technical Understanding

- Step 1: Read “Mastering Bitcoin” by Andreas Antonopoulos.

- Step 2: Experiment with running a Bitcoin Core full node on your computer.

- Step 3: Learn about and start using the Lightning Network for faster, cheaper transactions.

Engage with the Community

- Step 1: Attend a local Bitcoin meetup (find one on Meetup.com).

- Step 2: Participate in online discussions on platforms like Twitter or Telegram groups.

- Step 3: Consider attending a Bitcoin conference to network and learn from experts.

Advanced Level:

Implement Advanced Security Measures

- Step 1: Set up a multi-signature wallet using a service like Casa or Unchained Capital.

- Step 2: Create a comprehensive backup and inheritance plan for your Bitcoin holdings.

- Step 3: Regularly audit and update your security practices.

Explore Bitcoin Mining

- Step 1: Research mining profitability using tools like CryptoCompare’s Mining Calculator.

- Step 2: If viable, purchase an ASIC miner like the Antminer S19 Pro.

- Step 3: Join a mining pool like Slush Pool to increase your chances of earning rewards.

Contribute to the Ecosystem

- Step 1: Review the Bitcoin Core GitHub repository to understand ongoing development.

- Step 2: If you have programming skills, contribute to open-source Bitcoin projects.

- Step 3: Consider running a Lightning Network node to support the network’s growth.

Integrate Bitcoin into Your Business

- Step 1: Set up a BTCPay Server to accept Bitcoin payments for your products or services.

- Step 2: Develop a strategy for managing Bitcoin holdings (e.g., percentage to keep vs. convert to fiat).

- Step 3: Educate your team and customers about Bitcoin payments.

Optimize Your Bitcoin Strategy

- Step 1: Consult with a crypto-savvy financial advisor to align Bitcoin with your overall financial plan.

- Step 2: Explore advanced trading strategies if appropriate for your risk tolerance.

- Step 3: Stay informed about regulatory developments and adjust your strategy accordingly.

Leverage Bitcoin in Your Investment Portfolio

- Step 1: Research Bitcoin ETFs or trusts if you prefer traditional investment vehicles.

- Step 2: Consider allocating a portion of your retirement savings to Bitcoin through a Bitcoin IRA.

- Step 3: Regularly rebalance your portfolio to maintain your desired Bitcoin allocation.

Common Mistakes to Avoid When Leveraging Bitcoin’s Value Proposition

Here’s an outline of common pitfalls people face when dealing with Bitcoin, along with actionable solutions and workarounds to help readers avoid these mistakes:

- Lack of Understanding

- Mistake: Investing without fully grasping Bitcoin’s technology and economics.

- Solution: Dedicate time to educate yourself through reputable books, courses, and online resources.Start with “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. Engage in Bitcoin forums and communities to ask questions and learn from others.

- Poor Security Practices

- Mistake: Neglecting proper security measures, leading to potential loss or theft.

- Solution: Use hardware wallets for long-term storage of significant amounts. Enable two-factor authentication on all cryptocurrency-related accounts. Never share your private keys or seed phrases with anyone. Regularly update your wallet software and operating systems.

- Emotional Trading

- Mistake: Making impulsive buy or sell decisions based on market volatility or FOMO.

- Solution: Develop a clear investment strategy and stick to it. Use dollar-cost averaging to reduce the impact of volatility. Set clear profit-taking and stop-loss levels in advance. Avoid checking prices obsessively; set price alerts instead.

- Neglecting Tax Obligations

- Mistake: Failing to keep accurate records or understand tax implications.

- Solution: Consult with a crypto-savvy tax professional. Use cryptocurrency tax software to track transactions and generate reports. Keep detailed records of all transactions, including dates and amounts. Stay informed about changing regulations in your jurisdiction.

- Falling for Scams

- Mistake: Getting lured by promises of guaranteed returns or unrealistic profits.

- Solution: Remember: if it sounds too good to be true, it probably is. Verify the legitimacy of any Bitcoin-related service or investment opportunity. Be wary of unsolicited offers, especially through social media or email. Use only well-established, reputable exchanges and services.

- Overinvesting

- Mistake: Allocating more funds to Bitcoin than one can afford to lose.

- Solution: Only invest what you can afford to lose entirely. Diversify your investment portfolio beyond just Bitcoin. Regularly reassess your risk tolerance and adjust your Bitcoin allocation accordingly.

- Losing Access to Funds

- Mistake: Misplacing private keys or seed phrases, resulting in permanent loss of funds.

- Solution: Store seed phrases in multiple secure locations, including fireproof and waterproof storage. Consider using metal backups for seed phrases to protect against physical damage. Regularly test your backup and recovery processes. Consider multi-signature setups for added security and redundancy.

- Misunderstanding Network Fees

- Mistake: Overpaying on transaction fees or having transactions stuck due to low fees.

- Solution: Learn how Bitcoin transaction fees work and how to set them appropriately. Use fee estimation tools to determine optimal fees based on current network conditions. For non-urgent transactions, consider using replace-by-fee (RBF) to adjust fees if needed. Explore Layer 2 solutions like the Lightning Network for smaller, frequent transactions.

- Ignoring the Broader Ecosystem

- Mistake: Focusing solely on price and neglecting the technological and economic aspects.

- Solution: Stay informed about technological developments in Bitcoin, such as Taproot or Lightning Network. Understand Bitcoin’s role in the broader financial system and its potential impact. Explore ways to use Bitcoin beyond just holding, such as for payments or remittances.

- Neglecting Privacy

- Mistake: Overlooking the importance of financial privacy when using Bitcoin.

- Solution: Learn about Bitcoin’s privacy limitations and best practices for enhancing privacy. Consider using privacy-enhancing techniques like CoinJoin when appropriate. Be cautious about sharing your Bitcoin addresses or transaction details publicly. Use different addresses for different transactions to improve privacy.

- Relying on a Single Exchange

- Mistake: Keeping all funds on one exchange, risking loss if the exchange is compromised.

- Solution: Use exchanges primarily for trading, not long-term storage. Distribute funds across multiple reputable exchanges if needed. Regularly withdraw funds to your personal wallets for better control and security.

- Disregarding the Importance of Running a Full Node

- Mistake: Relying solely on third-party services for transaction validation.

- Solution: Consider running a full Bitcoin node to independently verify transactions and support the network. Use wallets that allow you to connect to your own full node for enhanced security and privacy.

By being aware of these common mistakes and implementing the suggested solutions, you can more effectively leverage Bitcoin’s value proposition while minimizing risks and potential losses. Remember, the key to success in the Bitcoin space is continuous learning, vigilance, and responsible management of your digital assets.

Statistics and Research

According to a 2023 study by Fidelity Digital Assets, 58% of institutional investors surveyed believe digital assets have a place in their investment portfolio. This growing institutional acceptance underscores Bitcoin’s evolving role in the financial landscape.

Frequently Asked Questions

What makes Bitcoin different from other cryptocurrencies?

Bitcoin is the first and most well-established cryptocurrency, with the largest network effect and highest level of security. Its fixed supply and decentralized nature set it apart from many other digital assets.

Is Bitcoin legal?

Bitcoin’s legal status varies by country. In many jurisdictions, it’s legal to buy, sell, and hold Bitcoin, but regulations are evolving. Always check your local laws.

How volatile is Bitcoin?

Bitcoin is known for its price volatility. While this can present opportunities for traders, it also carries significant risk. Long-term investors often focus on Bitcoin’s potential as a store of value.

Can Bitcoin be used for everyday transactions?

While Bitcoin can be used for transactions, its primary use case has evolved towards being a store of value, similar to digital gold. Layer 2 solutions like the Lightning Network aim to make Bitcoin more suitable for everyday transactions.

How does Bitcoin mining work?

Bitcoin mining involves using specialized computers to solve complex mathematical problems. Successful miners are rewarded with newly minted Bitcoin and transaction fees.

Is Bitcoin environmentally friendly?

Bitcoin’s energy consumption is a topic of debate. While it does require significant energy, many miners are increasingly using renewable sources. The environmental impact should be weighed against the potential benefits of a global, decentralized monetary system.

How can I buy Bitcoin?

You can buy Bitcoin through cryptocurrency exchanges, Bitcoin ATMs, or peer-to-peer platforms. Always do your research and choose a reputable platform.

What is a Bitcoin wallet?

A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. It can be software-based (on your computer or phone) or hardware-based (a physical device).

Can Bitcoin be hacked?

While the Bitcoin network itself has never been successfully hacked, individual wallets and exchanges can be vulnerable if proper security measures aren’t taken.

What is the future of Bitcoin?

While no one can predict the future with certainty, many believe Bitcoin has the potential to become a global, decentralized store of value and possibly a medium of exchange. Its adoption and use cases continue to evolve.

The Human Element in Digital Value

As we’ve explored, Bitcoin’s value stems from a unique combination of tangible inputs, mathematical scarcity, and human trust. It’s a digital asset grounded in real-world commodities, yet elevated by the collective belief in its potential.

The journey of understanding and potentially benefiting from Bitcoin starts with education and careful consideration. Whether you’re looking to invest, use Bitcoin for transactions, or simply understand this technological phenomenon, the key is to approach it with an open mind and a willingness to learn.

Remember, the world of cryptocurrencies is still young and evolving. As John S. Rhodes puts it, “The human aspects of Bitcoin are what make Bitcoin so valuable.” It’s this intersection of technology and human behavior that makes Bitcoin such a fascinating subject.

For more insights and the latest information on cryptocurrencies and technology, be sure to check out and subscribe to the Rhodes Brothers YouTube Channel. Your journey into the world of digital assets is just beginning!

Resource List

Books

• “The Bitcoin Standard” by Saifedean Ammous

• “Mastering Bitcoin” by Andreas M. Antonopoulos

• “The Internet of Money” by Andreas M. Antonopoulos

• “The Age of Cryptocurrency” by Paul Vigna and Michael J. Casey

Podcasts

• “What Bitcoin Did” by Peter McCormack

• “The Pomp Podcast” by Anthony Pompliano

• “The Investor’s Podcast Network – Bitcoin Fundamentals” by Preston Pysh

Courses

• Coursera: “Bitcoin and Cryptocurrency Technologies” by Princeton University

• edX: “Blockchain and FinTech: Basics, Applications, and Limitations” by University of Hong Kong

Tools

• Portfolio Tracking: Delta, Blockfolio

• Tax Reporting: CoinTracker, TokenTax

• Bitcoin Nodes: Bitcoin Core, BTCPay Server

• Lightning Network: Lightning Labs

Websites

• Bitcoin.org: Official Bitcoin website

• Lopp.net: Comprehensive Bitcoin information resource

• Glassnode: On-chain analytics and market intelligence

• BitcoinTalk.org: Original Bitcoin forum

Analytics Tools

• Glassnode Studio: Advanced on-chain metrics

• CryptoQuant: Institutional-grade crypto market data

• Coin Metrics: Open-source crypto asset analytics

These resources should provide a comprehensive starting point for anyone looking to deepen their understanding of Bitcoin and its underlying technology.

Leave a Reply