For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

“You don’t want to stagnate. One of the worst feelings in retirement is stagnation… Know your why and create value that fits it.”

— John S. Rhodes, Rhodes Brothers

What if I told you that retirement isn’t the finish line—it’s the starting gate?

Retirement used to be the dream: no more deadlines, no more bosses, and endless days of freedom. But for many, reality doesn’t live up to the fantasy. Why? Because true fulfillment in retirement doesn’t come from doing less—it comes from doing more of what truly matters.

Many people discover too late that retirement without purpose leads to anxiety, stagnation, and regret. The good news? It doesn’t have to be that way. With the right mindset, strategies, and systems, you can create a fulfilling, financially secure, and meaningful retirement.

In this post, we’ll unpack the key strategies to retire with purpose, how to avoid the most common retirement mistakes, and how to test-drive your ideal retirement before you leave your job.

We’ll walk you through:

- How to shift your mindset from fear to freedom

- How to build a retirement budget that actually works

- The power of testing retirement before retiring

- Using systems and automation to build a life you love

- And most importantly: how to never fully retire from purpose

TL;DR

✅ Retirement is more mental than financial—prepare your mindset first.

✅ Track your actual spending, not just your budget.

✅ Run a “retirement test drive” before you leave your job.

✅ Know your “why”—your purpose must guide your post-career life.

✅ Avoid the stagnation trap—find ways to keep adding value.

✅ Use systems, routines, and automation to ease into retirement.

✅ Don’t just retire from something—retire to something.

Why Retirement is a Mental Game First

One of the most overlooked aspects of retirement is the emotional shift. Many retirees feel excited at first but soon encounter unexpected anxiety. Why?

Because work provides structure, identity, and social interaction. Without it, many feel lost.

John S. Rhodes puts it best: “You must lead yourself into retirement. It’s not just about leaving your job—it’s about stepping into something more meaningful.”

Emotional Pitfalls to Watch Out For:

- Fear of losing relevance

- Anxiety about money lasting

- Loss of daily structure

- Social isolation

Step-by-Step Guide to a Fulfilling Retirement

Retirement isn’t just about stopping work—it’s about starting a life you’ve always dreamed of. But that dream doesn’t happen by accident. It takes intention, preparation, and a few smart moves. Below is a simple, step-by-step guide to help you create a retirement that’s not only financially secure but also emotionally satisfying and purpose-driven.

Step 1: Track Your Real Spending (Not Just Your Budget)

“What gets measured gets managed.” — Peter Drucker

Most people think they know what they spend. But when they track it? Reality hits.

Use tools like:

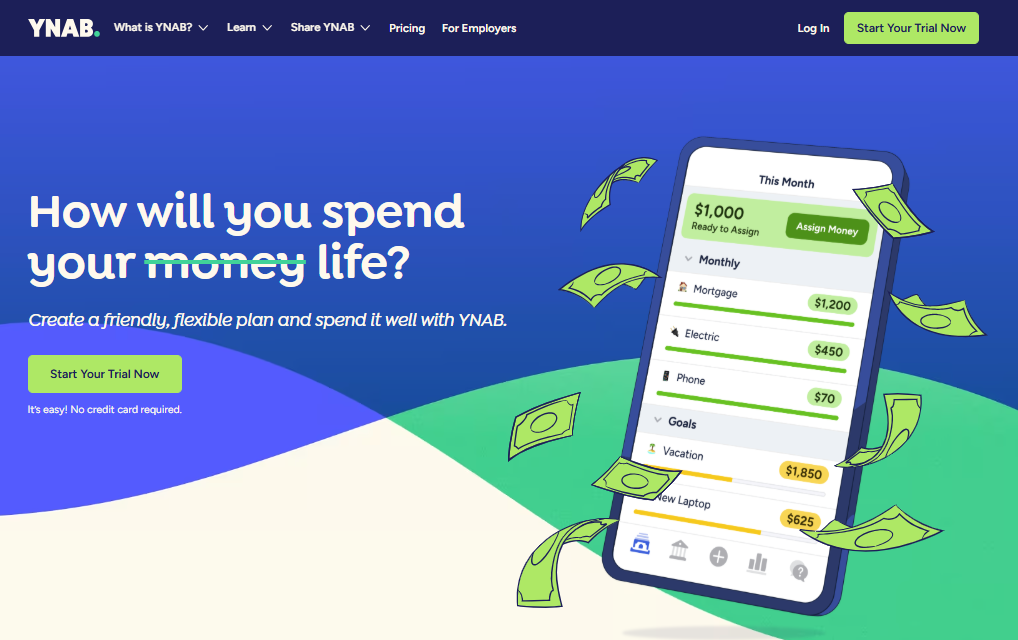

- You Need A Budget (YNAB)

- Mint

- Simple Excel/Google Sheets tracking

Pro Tip: Track for 3–6 months before retiring. Include credit card, cash, and loan expenditures. This will help you:

- Know your baseline costs

- Identify unnecessary spending

- Set a realistic retirement income goal

Step 2: Run a “Retirement Test Drive”

Why wait until retirement to find out if you like it?

Take a week or month off and live like you’re retired. No work. Just your “retirement routine.”

Ask yourself:

- How do I feel without work?

- Am I bored or energized?

- What routines am I naturally drawn to?

- What do I miss about working?

Track:

- Daily expenses

- Emotional highs/lows

- How you spend your time

John S. Rhodes calls this a “super tip” and says, “You can test and try things out… Try retirement before retiring.”

Step 3: Design a Purpose-Driven Routine

Retirement without a morning routine is like a boat without a rudder.

Build your system:

- Morning walk or exercise

- Journaling or gratitude practice

- Learning something new

- Gardening, volunteering, or mentoring

- Cooking or creative hobbies

Use tools like:

- Habit tracking apps (e.g., Habitica, Streaks)

- Journaling apps (Day One)

- YouTube learning channels (like Rhodes Brothers)

Step 4: Create Value—Even in Retirement

Adding value doesn’t mean working 40 hours a week. It means contributing.

Ideas:

- Freelance or consult part-time

- Teach locally or online

- Mentor younger professionals

- Start a hobby-based side hustle

- Volunteer with purpose

Platforms to explore:

Step 5: Know Your “Why”

If you don’t know why you’re retiring (besides “I’m tired”), you’ll carry dissatisfaction into retirement.

Ask yourself:

- Why do I want to retire?

- What impact do I still want to make?

- What brings me joy outside of work?

John S. Rhodes says, “Make sure you know your why… it pulls you forward into the future.”

Actionable Steps to Retire with Purpose and Peace

The path to a fulfilling retirement begins long before your final day at work. To make the most of this new chapter, you need more than just a financial plan—you need structure, purpose, and clarity. Below are detailed, practical steps you can take to ensure your retirement is joyful, meaningful, and sustainable.

The first step is to track your actual spending, not just what you think you spend. Many people set a retirement budget based on estimates, only to find themselves off by thousands of dollars. That’s why it’s crucial to monitor your real expenses for at least three to six months before retiring. Use tools like YNAB, Mint, or a simple Google Sheet. Track every dollar, from credit card charges to cash payments. Divide your expenses into “must-haves” like housing, food, and healthcare, and “wants” like dining out or travel. This provides a clear picture of your financial reality and helps you build a retirement budget based on facts, not guesses.

Next, test-drive your retirement while you’re still working. Take a week or two off and live as if you were already retired. Follow the daily routine you envision for your post-work life. Rely on your projected retirement income during that time, and pay close attention to how you feel. Are you bored? Energized? Anxious? Use this time as a mirror—it will reveal emotional readiness, lifestyle gaps, and whether your retirement plan aligns with your values.

Equally important is discovering your “why.” Retirement without purpose often leads to confusion, dissatisfaction, and even depression. Ask yourself what impact you still want to make in the world. What brings you joy? What causes or passions light you up? Write a personal mission statement for your retirement—a sentence or two that captures your reason for getting up every day. This becomes your compass when the initial thrill of “freedom” starts to fade.

Once your “why” is clear, start building a daily routine around it. Retirement without structure can feel like drifting. Design mornings that energize you—whether that’s walking, journaling, or meditating. Block time for hobbies, learning, and social interaction. Use tools like Streaks for habit tracking or Day One for journaling your thoughts and progress. This structure doesn’t have to be rigid, but it should give your days rhythm and purpose.

Retirement also doesn’t mean you stop contributing. In fact, continuing to create value—even in small, flexible ways—can be life-giving. Think about the skills you’ve developed over your career. Could you offer freelance services on Upwork or Fiverr? Start a blog, consult part-time, or mentor someone in your industry. You might also volunteer for causes that align with your values. Even a few hours a week of meaningful contribution can boost your mental health, self-worth, and possibly, your income.

To support this new lifestyle, start using automation and systems to simplify the mundane. Set your bills to auto-pay, schedule regular expense reviews, and use apps to keep your habits in check. For example, use Fitbit or an Apple Watch to track your steps and health, or set daily reminders to drink water, stretch, or meditate. These small systems reduce decision fatigue and free up mental space for the things that truly matter.

Don’t forget the importance of social connection. One of the biggest emotional shocks in retirement is the loss of your work-based social network. Be proactive: join local hobby groups on Meetup, schedule weekly coffee dates with friends, or volunteer regularly. Even casual connections can provide emotional nourishment and ward off loneliness.

Finally, make it a point to reassess your retirement life annually. Goals and desires evolve with time, and your retirement plan should too. Each year, review your spending, routines, health, and happiness. Ask yourself if you’re still aligned with your “why.” If not, don’t be afraid to pivot. Retirement isn’t one-size-fits-all—it’s a living, breathing journey.

By taking these steps, you’ll transform retirement from a vague dream into a vibrant, purpose-driven reality. Whether you’re a few years away or already easing into it, these strategies will help you build a lifestyle that’s financially grounded, emotionally fulfilling, and deeply meaningful.

Common Mistakes to Avoid (and What to Do Instead)

Retirement can be one of the most rewarding chapters of your life—but only if you plan for more than just your finances. Many people fall into common traps that lead to stress, boredom, or even regret. The good news? These mistakes are totally avoidable once you know what to look out for. Let’s break them down and explore what to do instead.

🚫 Mistake #1: Retiring Without Testing It First

✅ Solution: Run a Mini-Retirement to Experiment

Too many people wait until the day they retire to figure out what retirement actually feels like. The result? Disappointment, anxiety, or flat-out boredom. You wouldn’t buy a car without a test drive—so why would you “buy” your retirement lifestyle without trying it first?

Take a week or two off work and live as if you’re retired. Follow the routine you imagine for your retirement: wake up at your usual retired time, do the activities you plan to enjoy, and don’t use your regular paycheck—stick to what your retirement income would be. Track your emotional state and expenses during this time. This “mini-retirement” will show you whether your plan feels good in real life—or needs some tweaking.

🚫 Mistake #2: Confusing a Budget with Actual Spending

✅ Solution: Track Real Expenses for 3–6 Months

It’s easy to say, “I can live on $4,000 a month in retirement,” but unless you’ve tracked your actual spending, it’s just a guess. Many retirees discover too late that their spending habits don’t align with their budget—and the gap can be thousands of dollars.

Instead, start tracking every expense for at least three to six months before retirement. Use tools like Mint, YNAB, or a basic spreadsheet. Be honest. Include hidden categories like subscriptions, takeout, gifts, and medical co-pays. This habit will give you a clear view of your financial reality and help you build a retirement lifestyle that’s sustainable—not stressful.

🚫 Mistake #3: Thinking Freedom = Happiness

✅ Solution: Build Structure Into Your Days

One of the biggest myths about retirement is that freedom will automatically make you happy. Sure, it’s exciting at first—no alarm clock, no meetings, no deadlines. But after a few weeks or months, many retirees feel lost. Why? Because humans thrive on purpose and routine.

Freedom without structure often leads to boredom, lack of direction, and even depression. The cure? Design a flexible daily routine that includes health habits, meaningful activities, and time for relationships. Whether it’s a morning walk, journaling, or volunteering, structure adds rhythm and meaning to your days.

🚫 Mistake #4: Not Having a Social Plan

✅ Solution: Build Community Through Hobbies, Clubs, or Volunteering

Work doesn’t just give us a paycheck—it gives us a social network. When you leave your job, you also leave behind daily interactions, shared goals, and casual connections that boost your emotional well-being. Without a plan, this can lead to isolation and loneliness.

To avoid this, build a retirement social plan. Join hobby groups, take a class, or volunteer for a cause you care about. Use platforms like Meetup, Facebook Groups, or your local community center to find events and activities. Make it a goal to connect with others at least a few times a week. Retirement should be rich in relationships—not just rest.

🚫 Mistake #5: Overestimating Passive Income

✅ Solution: Recalculate Income vs. Spending Annually

It’s tempting to believe that your investments, rental properties, or side hustles will keep pumping out cash forever. But markets shift, expenses rise, and health costs sneak up. Overestimating passive income is one of the most financially dangerous mistakes retirees make.

The fix is to review your income and spending annually. Project conservatively. Factor in inflation, medical costs, and unexpected expenses. Work with a financial advisor if needed. Also, consider keeping some part-time income streams active—consulting, teaching, or freelancing a few hours a week can provide both cash flow and purpose.

Avoiding these common pitfalls can make the difference between a retirement that’s stressful and one that’s deeply satisfying. Think of this list as your early warning system—when you know what to look for, you’re far more likely to build the kind of life you’ve truly earned.

Frequently Asked Questions

How do I get started planning for retirement emotionally?

Start by journaling about your purpose, goals, and fears. Then test your routine with a retirement trial week.

What’s the biggest financial mistake people make before retiring?

Not tracking their actual spending. Budgeting is not the same as tracking.

How can I avoid boredom in retirement?

Create systems, routines, and value-driven activities. Keep learning and contributing.

Should I still work in retirement?

If it fulfills you—yes. Even 5 hours/week of meaningful work can bring joy and added income.

How do I know if I’m emotionally ready to retire?

If you know your “why,” have tested your routine, and feel excited—not fearful—about change.

What if I don’t have enough saved?

Consider part-time income, downsizing, or shared living. Also rework your retirement lifestyle.

How do I involve my spouse or partner in retirement planning?

Test retirement together. Discuss dreams, fears, and financial realities openly.

Is retiring early a good idea?

Only if your financial and emotional plans are solid. Otherwise, test first.

What tools help with retirement tracking?

YNAB, Mint, Personal Capital, and Google Sheets are excellent tools.

Can I change my mind after retiring?

Absolutely. You can return to work, start a business, or pivot your lifestyle anytime.

The Retirement You Deserve Starts Now

Retirement isn’t about escaping work—it’s about embracing impact. By knowing your why, testing your plan, and building systems that support your life, you can create a retirement that’s not only peaceful—but profitable and purposeful too.

You owe it to yourself to live fully, not just coast through the years.

Get started today by tracking your spending, planning your test drive, and journaling your “why.”

Thanks for joining us on this journey! For more insights, advice, and retirement strategies, be sure to subscribe to the Rhodes Brothers YouTube Channel and stay ahead of the curve.

Resource List

Books

- “The Psychology of Money” by Morgan Housel

- “Your Money or Your Life” by Vicki Robin

- “Die With Zero” by Bill Perkins

- “Retire Inspired” by Chris Hogan

- “How to Retire Happy, Wild, and Free” by Ernie Zelinski

Courses/Podcasts

- The Retirement Answer Man Show (Podcast)

- Smart Passive Income by Pat Flynn (Podcast)

- Coursera: Financial Planning for Retirement

- Udemy: Retirement Planning – Build Your Plan

Tools

- YNAB – Budgeting software

- Personal Capital – Net worth and investment tracking

- Habitica – Habit tracking

- Mint – Expense tracking

- Fiverr – Freelance work

- Upwork – Side gigs and consulting

Communities

- r/retirementplanning (Reddit)

- ChooseFI Facebook Group

- Meetup.com for local hobby and retirement groups