For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

Have you ever wondered how much of your portfolio should be allocated to Bitcoin? You’re not alone. This question plagues both newcomers and seasoned investors alike. In this comprehensive guide, we’ll dive deep into the world of Bitcoin investment, offering you practical advice and strategies to help you make informed decisions.

John S. Rhodes of the Rhodes Brothers, a respected voice in the cryptocurrency space, says, “You want to invest as much Bitcoin as you can to the point of where it starts to worry you or cause you pain.” This intriguing perspective sets the stage for our exploration of Bitcoin investment strategies.

Have you ever wondered how much of your portfolio should be allocated to Bitcoin? This question plagues both newcomers and seasoned investors alike. In this comprehensive guide, we’ll dive deep into the world of Bitcoin investment, offering you practical advice and strategies to help you make informed decisions.

TL;DR

- Decide if Bitcoin investment is right for you before determining how much to invest

- Use the “pain threshold” and “FOMO” concepts to find your ideal investment range

- Consider your time horizon – longer is generally better for Bitcoin investments

- Understand the psychological impact of gains and losses in Bitcoin

- Start with a small percentage and gradually increase your allocation

- Always prioritize your ability to sleep well at night over potential gains

Understanding Bitcoin Investment: The Basics

Before delving into how much to invest in Bitcoin, it’s crucial to understand that this decision comes after you’ve already decided Bitcoin is a worthwhile investment. As John Rhodes notes, “If someone has not yet made the decision to invest in Bitcoin, there’s no point and you’ll be barking up the wrong tree.”

This initial decision requires a deep understanding of what Bitcoin is, how it works, and its potential impact on the global financial system. It’s not just about jumping on a trendy investment bandwagon; it’s about comprehending the fundamental value proposition of Bitcoin as a decentralized, borderless, and censorship-resistant form of money.

Handling Objections

Many people have reservations about Bitcoin. Common objections include:

- It’s a Ponzi scheme

- It’s fake internet money

- Gold is better

- Concerns about quantum computing

- Government intervention

Let’s address these concerns one by one:

- Ponzi Scheme: Unlike a Ponzi scheme, Bitcoin doesn’t rely on new investors to pay returns to earlier investors. It’s a decentralized network with a predetermined supply schedule.

- Fake Internet Money: While Bitcoin is digital, it has real-world value and can be used for transactions. Its scarcity and security make it a viable form of digital value.

- Gold Comparison: Gold has historically been a store of value, but Bitcoin offers advantages like easy divisibility, portability, and verifiability.

- Quantum Computing: While quantum computers could theoretically break Bitcoin’s cryptography, the network can be upgraded to quantum-resistant algorithms if needed.

- Government Intervention: While governments can regulate Bitcoin, its decentralized nature makes it resistant to complete shutdown.

If you’re still grappling with these concerns, it’s essential to address them before moving forward. Research, listen to podcasts, and engage with knowledgeable sources to make an informed decision.

Determining Your Bitcoin Investment Amount

Once you’ve decided to invest in Bitcoin, the next crucial step is determining how much to invest. This decision should balance potential gains with your risk tolerance and financial situation.

The Pain Threshold Approach

John Rhodes suggests an interesting approach to determining your Bitcoin investment amount. He advises increasing your allocation until you reach a point where you feel uncomfortable, then dialing it back slightly. This method helps you find your personal “pain threshold” – the maximum amount you can invest while still sleeping well at night.

For example, let’s say you start by investing $1,000 in Bitcoin. You feel comfortable with this amount, so you increase it to $2,000. Still comfortable? Try $5,000. If at this point you start feeling uneasy about the amount, you’ve found your pain threshold. You might then dial it back to $4,000 to ensure you’re in your comfort zone.

The FOMO Factor

On the flip side, you don’t want to invest so little that you experience FOMO (Fear of Missing Out) if Bitcoin’s price skyrockets. Find a balance between these two extremes to determine your ideal investment range.

Consider this scenario: You invest $100 in Bitcoin. The price doubles, and you’ve made $100. While that’s a great return percentage-wise, the actual dollar amount might not feel significant. If you find yourself wishing you had invested more, you might be experiencing FOMO. In this case, you might want to consider increasing your investment to an amount that would feel meaningful if it doubled.

Portfolio Allocation

Start by looking at your overall portfolio. What percentage feels right for Bitcoin? Here’s a step-by-step approach:

- Assess your current portfolio: List all your assets and their current values.

- Start with a small percentage allocation to Bitcoin (e.g., 1-2%): For a $100,000 portfolio, this would mean $1,000 to $2,000 in Bitcoin.

- Gradually increase this percentage: Maybe move to 3%, then 5%, etc.

- Stop when you hit your “pain threshold”: This might be 10% for some, 20% for others.

- Dial back slightly to ensure you can sleep well at night: If 10% feels uncomfortable, try 8%.

- Ensure you’re not at risk of FOMO with this allocation: Make sure the amount is meaningful enough to you.

This allocation should be part of a well-diversified portfolio that includes traditional assets like stocks, bonds, and real estate.

Time Horizon Matters

Rhodes emphasizes the importance of your investment time horizon. “The amount of time that you’re going to hold on to it should be as high as possible,” he says. Bitcoin’s volatility makes it less suitable for short-term investments, so consider your timeline carefully.

Here’s why the time horizon is crucial:

- Short-term (less than 1 year): Bitcoin’s price can be highly volatile in the short term. If you might need the money within a year, Bitcoin might not be the best choice.

- Medium-term (1-5 years): This timeframe can help smooth out some of the short-term volatility, but still carries significant risk.

- Long-term (5+ years): Historically, Bitcoin has performed well over longer time horizons. This allows time for the technology to develop and adoption to increase.

Consider the following example:

If you had invested $1,000 in Bitcoin in 2015 and held until 2020, your investment would have grown significantly despite several periods of high volatility in between. However, if you had invested in late 2017 and sold in early 2018, you might have experienced a substantial loss.

The Psychology of Bitcoin Investment

Investing in Bitcoin isn’t just about numbers and market trends; it’s also deeply psychological. Understanding the emotional aspects of investing can help you make more rational decisions and stick to your investment strategy.

Understanding Gains and Losses

One of the most crucial insights Rhodes offers is about the psychological impact of gains and losses. He states, “The pain of losing is three to five times worse than the pleasure that you get from the gains.” This asymmetry in how we perceive gains and losses is crucial to understand when determining your Bitcoin investment amount.

For example, if you invest $10,000 in Bitcoin:

- A $1,000 gain might feel good

- A $1,000 loss might feel psychologically equivalent to a $3,000-$5,000 loss

This psychological factor is why it’s so important to invest an amount that doesn’t cause you undue stress or anxiety.

Let’s delve deeper into this concept:

- Loss Aversion: This psychological principle suggests that people prefer avoiding losses to acquiring equivalent gains. In other words, it’s better not to lose $5 than to find $5.

- Emotional Impact: Losses can lead to stress, anxiety, and even depression. These emotional states can cloud judgment and lead to poor investment decisions.

- Risk Tolerance: Understanding your emotional response to gains and losses can help you gauge your true risk tolerance. If a 10% drop in Bitcoin’s price keeps you up at night, you might be investing too much.

- Decision Making: The fear of losses can sometimes lead to premature selling during market dips, potentially missing out on long-term gains.

To mitigate these psychological effects:

- Start with a smaller investment and gradually increase it as you become more comfortable.

- Set clear investment goals and stick to them, regardless of short-term price movements.

- Educate yourself about Bitcoin’s historical price movements to put current volatility in perspective.

- Consider using dollar-cost averaging to reduce the impact of price volatility on your emotions.

The key is to find an investment amount that allows you to participate in Bitcoin’s potential upside without causing undue stress or anxiety. As the famous investor Warren Buffett once said, “Risk comes from not knowing what you’re doing.” The more you understand about Bitcoin and your own risk tolerance, the better equipped you’ll be to make sound investment decisions.

By considering these factors – your decision to invest, handling objections, determining your investment amount, considering your time horizon, and understanding the psychology of investing – you’ll be well-prepared to approach Bitcoin investment in a thoughtful and strategic manner.

Every investor’s situation is unique, so what works for others may not be the best approach for you. Always consider your personal financial situation, risk tolerance, and investment goals when making decisions about Bitcoin or any other investment.

Tools for Smarter Bitcoin Investing

To help you implement the solutions we’ve discussed and make more informed decisions about your Bitcoin investments, consider using these tools:

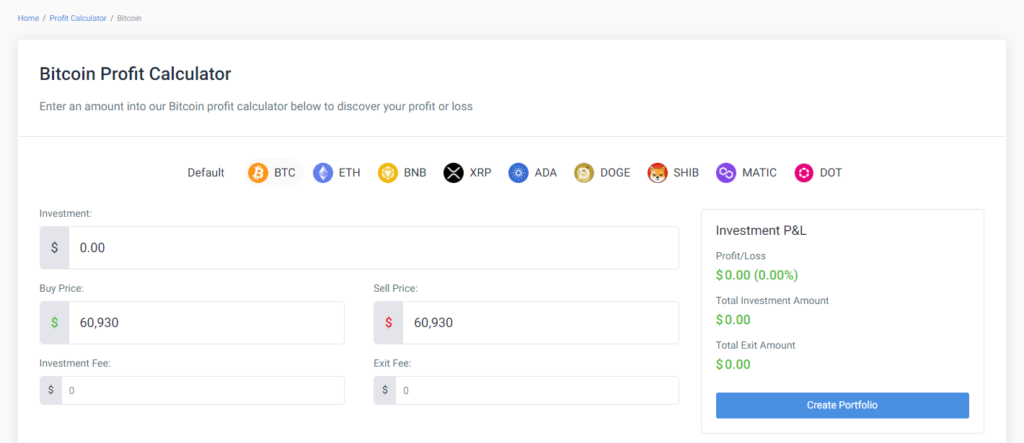

Bitcoin Investment Calculator

Use this tool to estimate potential returns and visualize the impact of different investment strategies. A Bitcoin Investment Calculator typically allows you to input your initial investment amount, investment date, and frequency (one-time or recurring). It then calculates potential returns based on historical Bitcoin price data.

Key features of a Bitcoin Investment Calculator:

- Input for initial investment amount

- Selection of investment date

- Choice of investment frequency (one-time or recurring)

- Calculation of total invested amount

- Estimation of current value

- Calculation of profit/loss

- Display of Return on Investment (ROI)

Investment Allocation Visualizer

This tool helps you visualize your investment allocation and ensure proper diversification. An Investment Allocation Visualizer typically allows you to input percentage allocations for different asset classes, including Bitcoin, stocks, bonds, and other investments. It then generates a visual representation, often in the form of a pie chart, to help you see your portfolio distribution at a glance.

Key features of an Investment Allocation Visualizer:

- Input fields for percentage allocation of different assets

- Visual representation of allocation (e.g., pie chart)

- Ability to adjust allocations and see immediate changes in the visualization

- Option to save or export your allocation plan

Risk Tolerance Assessment

This tool helps you gauge your risk tolerance for Bitcoin investment. A Risk Tolerance Assessment typically consists of a series of questions about your investment preferences, financial situation, and attitude towards risk. Based on your answers, it provides an assessment of your risk tolerance level.

Key components of a Risk Tolerance Assessment:

- Questions about comfort with high-risk investments

- Scenarios involving potential investment losses

- Queries about investment time horizon

- Assessment of financial knowledge and experience

- Calculation of overall risk tolerance score

- Recommendation for Bitcoin allocation based on risk tolerance (e.g., low risk: 1-2% allocation, moderate risk: 3-5% allocation, high risk: 5-10% allocation)

These tools can help you make more informed decisions about your Bitcoin investments, visualize your overall portfolio allocation, and assess your risk tolerance. Remember, while these tools provide valuable insights, they should be used in conjunction with thorough research and, if necessary, professional financial advice.

When using these tools, it’s important to:

- Input accurate and up-to-date information

- Regularly reassess your investment strategy and risk tolerance

- Use the tools as guides rather than definitive answers

- Consider how Bitcoin fits into your overall investment strategy and financial goals

By leveraging these tools, you can develop a more structured and informed approach to Bitcoin investing, helping you avoid common pitfalls and make decisions aligned with your financial objectives and risk tolerance.

Actionable Steps for Bitcoin Investment

Beginners:

- Start small: Invest only what you can afford to lose, typically 1-2% of your investable assets.

- Use dollar-cost averaging: Set up recurring small purchases (e.g., $50-$100 monthly) to reduce the impact of volatility.

- Educate yourself: Spend time learning about Bitcoin before increasing your investment.

- Set a cap: Decide on a maximum amount you’re willing to invest and stick to it.

Intermediate Investors:

- Assess your risk tolerance: Use the risk assessment tool provided earlier to gauge your comfort level.

- Diversify: Ensure Bitcoin is part of a balanced portfolio, typically not exceeding 5-10% of your total investments.

- Increase gradually: Slowly raise your Bitcoin allocation as you become more comfortable and knowledgeable.

- Rebalance regularly: Adjust your Bitcoin holdings periodically to maintain your target allocation.

Advanced Investors:

- Consider the “Pain Threshold” approach: Gradually increase your investment until you reach discomfort, then dial back slightly.

- Analyze opportunity cost: Compare potential Bitcoin returns with other investment options.

- Factor in your time horizon: Allocate more if you’re investing for the long term (5+ years).

- Stay informed: Keep up with Bitcoin developments and adjust your strategy accordingly.

General Advice for All Levels:

- Never invest more than you can afford to lose.

- Understand that Bitcoin is highly volatile; be prepared for significant price swings.

- Secure your investment: Learn about proper storage and security measures for your Bitcoin.

- Keep records: Track your purchases and sales for tax purposes.

- Reassess regularly: Review your Bitcoin investment strategy at least annually or when your financial situation changes.

Common Mistakes to Avoid for Bitcoin Investment

Investing more than you can afford to lose

Solution:

- Set a strict budget: Determine a fixed percentage of your income or savings for Bitcoin investment.

- Use the “Sleep Test”: Only invest an amount that allows you to sleep comfortably at night.

- Create an emergency fund first: Ensure you have 3-6 months of living expenses saved before investing in Bitcoin.

Neglecting to diversify your overall portfolio

Solution:

- Follow the 5% rule: Limit Bitcoin to no more than 5% of your total investment portfolio.

- Rebalance regularly: Adjust your holdings periodically to maintain your target allocation.

- Invest in other asset classes: Include stocks, bonds, real estate, and other cryptocurrencies in your portfolio.

Failing to secure your Bitcoin properly

Solution:

- Invest in a hardware wallet: Store large amounts of Bitcoin offline on a secure device.

- Use two-factor authentication: Enable this extra security step on all your cryptocurrency accounts.

- Practice safe key management: Store your recovery phrases securely, consider using a metal backup.

- Educate yourself: Learn about best practices for cryptocurrency security.

Trying to time the market instead of adopting a long-term strategy

Solution:

- Adopt a “HODL” mentality: Commit to holding your Bitcoin for a set period (e.g., 5+ years).

- Set it and forget it: Use automated tools to make regular purchases and avoid constantly checking prices.

- Focus on fundamentals: Base your investment decisions on Bitcoin’s long-term potential rather than short-term price movements.

- Keep a investment journal: Record your reasons for buying Bitcoin to refer back to during market downturns.

By implementing these solutions, you can avoid common pitfalls and develop a more robust, disciplined approach to Bitcoin investing. The key is to have a clear strategy and stick to it, regardless of market volatility.

Frequently Asked Questions

Is Bitcoin a good investment for beginners?

Bitcoin can be a good investment for beginners, but it’s crucial to start small and educate yourself thoroughly before investing significant amounts.

How often should I review my Bitcoin investment?

While it’s important to stay informed, checking too frequently can lead to emotional decision-making. Consider reviewing your investment monthly or quarterly.

Should I invest in Bitcoin if I’m close to retirement?

Due to its volatility, Bitcoin might not be suitable for those near retirement unless it’s a very small portion of a well-diversified portfolio.

Is it better to buy Bitcoin all at once or over time?

Many experts recommend dollar-cost averaging (buying small amounts regularly) to mitigate the impact of Bitcoin’s price volatility.

How do I protect my Bitcoin investment from hacks or theft?

Use reputable exchanges, enable two-factor authentication, and consider moving your Bitcoin to a hardware wallet for long-term storage.

Can I invest in Bitcoin through my retirement account?

Some retirement accounts offer Bitcoin exposure through trusts or ETFs, but direct Bitcoin investment in traditional IRAs or 401(k)s is generally not possible.

How does Bitcoin’s halving event affect its price?

Historically, Bitcoin’s price has increased in the months following a halving event, but past performance doesn’t guarantee future results.

Should I invest in other cryptocurrencies besides Bitcoin?

While Bitcoin is the most established cryptocurrency, diversifying into other reputable projects can be part of a balanced crypto portfolio strategy.

How do taxes work with Bitcoin investments?

In many countries, including the U.S., Bitcoin is treated as property for tax purposes. Consult with a tax professional for specific advice.

What’s the minimum amount I can invest in Bitcoin?

You can buy fractions of a Bitcoin, so you can start with as little as a few dollars on most exchanges.

Your Bitcoin Investment Journey

Investing in Bitcoin is a personal journey that requires careful consideration, education, and self-awareness. By understanding your risk tolerance, setting clear investment goals, and following the strategies outlined in this guide, you can approach Bitcoin investment with confidence.

The key is to find a balance that allows you to participate in the potential upside of Bitcoin without causing undue stress or financial strain. Start small, increase gradually, and always prioritize your financial wellbeing.

Thank you for joining us on this exploration of Bitcoin investment strategies. For the latest videos and information to help you succeed in your cryptocurrency journey, be sure to check out and subscribe to the Rhodes Brothers YouTube Channel .

Resource List

Books

- “The Bitcoin Standard” by Saifedean Ammous

- “Mastering Bitcoin” by Andreas M. Antonopoulos

- “The Internet of Money” by Andreas M. Antonopoulos

- “Inventing Bitcoin” by Yan Pritzker

- “The Bullish Case for Bitcoin” by Vijay Boyapati

Podcasts

- “What Bitcoin Did” with Peter McCormack

- “The Investor’s Podcast Network – We Study Billionaires” (Bitcoin episodes)

- “Unchained” with Laura Shin

- “The Pomp Podcast” with Anthony Pompliano

- “Tales from the Crypt” with Marty Bent

Courses

- Coursera: “Bitcoin and Cryptocurrency Technologies” by Princeton University

Tools

- CoinGecko or CoinMarketCap for price tracking

- Blockfolio or Delta for portfolio management

- TradingView for technical analysis

- Ledger or Trezor hardware wallets for secure storage

- Coinbase Pro or Kraken for trading

- Bitcoin.org for general Bitcoin information

- Glassnode or CryptoQuant for on-chain analysis

Websites

- Bitcoin.org

- Lopp.net (Bitcoin Information & Resources)

- Bitcointalk.org (Forum)

- r/Bitcoin (Reddit community)

Newsletters

- “The Pomp Letter” by Anthony Pompliano

- “Bitcoin Optech Newsletter” for technical updates

YouTube Channels

These resources should provide a comprehensive starting point for anyone looking to deepen their understanding of Bitcoin and cryptocurrency investments.

Leave a Reply