For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

Have you ever found yourself cutting costs so aggressively that it starts to feel overwhelming—almost like a second job? Perhaps you’ve questioned whether some extreme frugal living tips are even worth the effort, or worse, the discomfort they bring. While being frugal is a great way to take control of your finances, there’s a delicate balance between making smart savings choices and going to extremes that could negatively impact your health, relationships, or long-term financial goals.

As John S. Rhodes of the Rhodes Brothers channel wisely says:

“Being frugal is awesome, but extreme frugality sometimes costs more than it saves. Focus on creating value, not just cutting corners.”

In this blog, we’ll dive into the five worst extreme frugal living tips that are often touted as “money-saving hacks” but can actually do more harm than good. We’ll also explore smarter alternatives to these questionable practices, so you can save money without sacrificing your well-being or time. Let’s figure out how to embrace frugality the right way—by focusing on abundance, practicality, and long-term value.

TL;DR

- Reusing toilet paper: A dangerous and unhygienic practice. Instead, invest in cost-effective alternatives like bidets or bulk-purchased toilet paper.

- Dumpster diving for groceries: While resourceful, it’s risky and unhygienic. Look for grocery store discount programs or food-sharing apps.

- Unplugging everything: It’s tedious and barely saves money. Use smart power strips for better energy savings without the hassle.

- Showering only once a week: Poor hygiene can cost you more in medical bills and social opportunities. Opt for quick, water-saving showers instead.

- Avoiding medical care: Skipping doctor visits can lead to serious health issues. Preventive care is the real money-saver in the long run.

Why Extreme Frugality Can Backfire

Saving money is important, but extreme frugality often comes with hidden costs—both financial and emotional.

Instead of focusing on extreme measures, it’s better to think about the bigger picture. As Benjamin Franklin once said, “An investment in knowledge pays the best interest.” Learning smarter ways to save money and build wealth is far more effective than simply cutting costs to the bone.

Let’s break down why these five extreme frugal tips are bad ideas—and what you can do instead.

Reusing Toilet Paper: The Gross Reality

Yes, you read that right. Some extreme frugality advocates suggest using washable cloths or even repurposing other materials instead of toilet paper. While this might save a few bucks, the risks far outweigh the rewards.

Why It’s a Bad Idea:

- Hygiene Issues: Washing used clothes requires careful handling to avoid contamination. Mishandling can lead to serious health problems.

- Hidden Costs: You’ll end up spending money on detergents, disinfectants, and water. Plus, the time spent washing these clothes isn’t worth the pennies saved.

Smarter Alternative:

Invest in a bidet. These devices are affordable, eco-friendly, and drastically reduce your need for toilet paper. If you’re on a budget, you can find quality bidet attachments for as low as $30 online. Bulk-buying toilet paper during sales is another practical option.

Dumpster Diving for Groceries: A Risky Gamble

The idea of getting free food from dumpsters might sound appealing at first—especially considering that grocery stores throw away tons of “expired” but still edible food every day. However, dumpster diving comes with significant risks.

Why It’s a Bad Idea:

- Health Hazards: You never know what’s lurking in a dumpster—bacteria, mold, or even sharp objects.

- Safety Risks: Broken glass, needles, or aggressive animals could make this a dangerous endeavor.

- Legal Issues: Dumpster diving is illegal in some areas and could result in fines or trespassing charges.

Smarter Alternative:

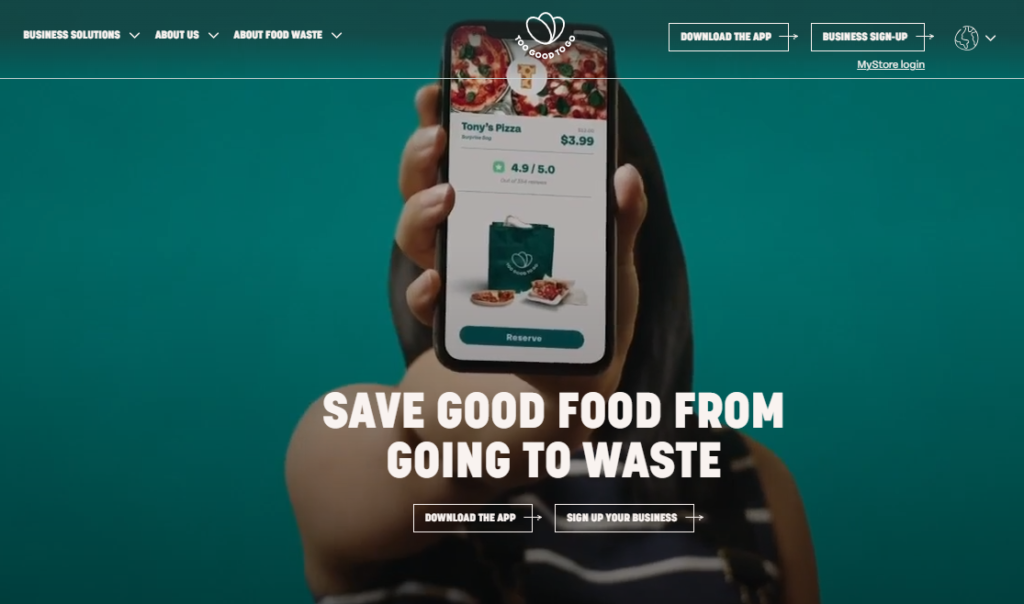

Take advantage of grocery store markdowns for items nearing their expiration dates. Many stores have dedicated sections for discounted produce, bread, and other items. Apps like Too Good To Go and Flashfood also help you score cheap, surplus food from local businesses.

Unplugging Everything: A Time-Wasting Habit

The logic behind unplugging all your electronics is sound—devices still draw a small amount of power even when turned off. But in reality, this practice saves you only a few cents per day while costing you precious time.

Why It’s a Bad Idea:

- Minimal Savings: Phantom energy use accounts for only about $100 per year for the average household, according to the U.S. Department of Energy.

- Time-Consuming: Constantly plugging and unplugging devices is tedious and impractical, especially if you have multiple gadgets.

Smarter Alternative:

Use smart power strips. These devices automatically cut power to electronics that are not in use, saving energy without requiring constant effort. They’re affordable and easy to set up, making them a far better solution than manually unplugging everything.

Showering Once a Week: The Social and Health Costs

Skipping showers to save water and energy might seem like a small sacrifice, but it can have serious repercussions. Poor hygiene doesn’t just affect your health—it can also harm your relationships and professional opportunities.

Why It’s a Bad Idea:

- Health Risks: Infrequent showers can lead to skin infections, body odor, and other hygiene-related issues.

- Social Consequences: Let’s face it—people notice when you don’t shower. This could hurt your chances of landing a job or maintaining relationships.

Smarter Alternative:

Take shorter, water-efficient showers. Installing a low-flow showerhead can reduce water usage by up to 60%, according to the EPA. You’ll save money without sacrificing cleanliness or professionalism.

Avoiding Medical Care to Save Money: A Dangerous Gamble

Medical bills are a major concern for many people, but avoiding care altogether is not the solution. Ignoring health issues can lead to more severe (and expensive) problems down the line.

Why It’s a Bad Idea:

- Delayed Diagnosis: Skipping routine check-ups can allow treatable conditions to worsen.

- Higher Costs Later: Emergency room visits and advanced treatments are far more expensive than preventive care.

Smarter Alternative:

Invest in preventive healthcare. Regular check-ups and screenings can catch health problems early, saving you money in the long run. If you’re uninsured, look for community health clinics or telehealth services that offer affordable care.

Actionable Steps for Smarter, Sustainable Savings

No matter where you’re at in life—whether you’re a young professional, a student on a tight budget, a working parent, or nearing retirement—there are smarter ways to save money without resorting to extreme frugality. These strategies will not only help you cut costs but also improve your quality of life and set you up for long-term financial success. Let’s break it down by demographic:

For Young Professionals: Automate and Optimize

- Automate Your Savings

If you’re in the early stages of building wealth, automating your savings is a no-brainer. Set up automatic transfers to your savings account as soon as you receive your paycheck. Apps like Acorns and Digit make it effortless to save by rounding up your purchases and stashing away the extra change. Pro Tip: Aim to save at least 20% of your income if possible. Start small and increase the percentage as you get raises or promotions.

- Learn a High-Income Skill

As a young professional, your biggest asset is your ability to learn and grow. Invest in yourself by developing a high-income skill, such as coding, data analysis, or digital marketing. Platforms like Coursera, Udemy, or LinkedIn Learning offer affordable courses to upgrade your career potential. Higher income equals more opportunities to save and invest.

For Students: Budget-Friendly Hacks

- Cook at Home

If you’re juggling school and part-time work, dining out can drain your wallet fast. Instead, meal prep during the weekends to save money and time. Use apps like Mealime or Budget Bytes for affordable recipes designed for students. Pro Tip: Cooking in bulk and freezing meals can save you both money and effort during busy school weeks.

- Negotiate Your Bills

Many students overlook this, but you can often negotiate discounts on your internet and phone bills by simply asking. Some providers even offer student rates. A quick call could save you $10–$30 a month—money that could go toward textbooks or savings. Tool to Try: Apps like Billshark or Trim can negotiate bills on your behalf.

For Working Parents: Save Time and Money

- Automate Your Savings

As a busy parent, you don’t have time to micromanage your budget daily. Automating your savings ensures you’re building a financial cushion without any extra effort. Use tools like Qapital to set savings goals, whether it’s for a family vacation, emergency fund, or college savings.

- Cook at Home (Family Style)

Feeding a family can get expensive, but cooking at home doesn’t have to be a chore. Use meal-planning apps like Plan to Eat to organize grocery lists and recipes. Make it fun by involving your kids in simple cooking tasks—they’ll love the experience, and you’ll save on takeout. Pro Tip: Look for local farmers’ markets or bulk-buying memberships like Costco to stretch your grocery budget further.

For Retirees and Seniors: Practical and Stress-Free

- Negotiate Your Bills

If you’re living on a fixed income, cutting unnecessary expenses is key. Call your phone, internet, and insurance providers to request discounts or senior citizen rates. You can often qualify for lower rates simply by asking.

- Cook at Home (Health-Focused)

Eating healthy doesn’t have to be expensive. Focus on simple, nutritious meals like soups, stews, or stir-fries that use affordable ingredients. Apps like SuperCook can help you create recipes based on what you already have in your pantry to reduce food waste. Pro Tip: Gardening is a great way to save on fresh produce while staying active and engaged.

For All Demographics: Invest in Your Future

- Learn a High-Income Skill (At Any Age)

Whether you’re just starting out or looking for a second career, learning new skills can open up opportunities for earning more. Skills like graphic design, writing, or online business management are in demand across industries. Online platforms make it easy to learn at your own pace, no matter your age or experience level.

- Focus on Long-Term Investments

Saving money is important, but investing it wisely is how you grow wealth over time. Consider opening a retirement account like a 401(k) or Roth IRA if you haven’t already. Apps like Betterment or Wealthfront make investing accessible and affordable for beginners.

By tailoring these actionable steps to your stage of life, you can maximize savings without sacrificing your well-being or time. Start small, stay consistent, and focus on strategies that align with your lifestyle and goals. Saving smarter isn’t about cutting corners—it’s about creating a system that works for you.

Common Mistakes to Avoid (And How to Do Better)

When it comes to saving money, it’s easy to fall into traps that feel productive in the short term but end up costing more in the long run. Extreme frugality often pushes people to make decisions that prioritize small savings over larger, more impactful financial strategies. Let’s explore some of the most common mistakes people make when trying to save money, why they’re problematic, and how you can avoid them by focusing on smarter, more sustainable approaches.

One of the most common pitfalls is over-obsessing over small savings. For example, spending hours clipping coupons, unplugging every appliance in your home, or driving across town to save a couple of dollars on groceries might feel like you’re being financially responsible, but these efforts rarely make a significant impact. In reality, the time spent on these small tasks could be better used on activities that lead to larger financial wins. For instance, instead of spending hours trying to save $10 here and there, you could use that time to negotiate your rent or mortgage, refinance a loan, or work on developing a high-income skill. Housing costs, for most people, are the largest monthly expense, so reducing those expenses or increasing your income will yield far greater results than obsessing over minor daily savings. As a rule of thumb, focus on the big wins that leave a lasting impact on your budget.

Another mistake many people make is neglecting quality in favor of price. While it might seem like buying the cheapest option is the best way to save money, this mindset often backfires. Cheap items are usually poorly made, which means they break or wear out faster, leading to repeated purchases and higher long-term costs. For example, buying a $20 pair of shoes that lasts only two months is far less cost-effective than spending $100 on a pair that lasts for years. This logic applies to everything from clothing to appliances to furniture. Additionally, low-quality items often lack warranties or energy efficiency, which can lead to hidden costs over time. To avoid this mistake, focus on value instead of price. High-quality items may cost more upfront, but they save money in the long run by lasting longer and performing better. Use the “cost-per-use” rule to guide your purchases—divide the item’s cost by how many times you’ll use it to determine its real value. This way, you can make smarter financial decisions that prioritize durability and efficiency.

A less obvious but equally harmful mistake is ignoring opportunity costs. Opportunity cost refers to the value of what you give up when you choose one option over another. For example, spending hours on extreme frugal hacks, like repairing a $5 item or driving to three different stores to save a few dollars, might save you a small amount of money, but it costs you valuable time—time that could be spent far more productively. Imagine how much more you could earn by using that time to work on a freelance project, build a side hustle, or learn a skill that increases your earning potential. Time is your most valuable resource, and every hour you spend chasing negligible savings is an hour you could invest in activities that yield far greater returns. To avoid this mistake, think critically about how you’re spending your time. Delegate low-value tasks, batch your efforts (e.g., meal prepping or shopping in bulk), and prioritize activities that align with your long-term financial goals.

Overlooking the importance of health is another dangerous misstep that often accompanies extreme frugality. Skipping doctor visits or foregoing preventive care to save money might seem like a good idea at the moment, but it can lead to far more expensive health problems down the road. Delayed diagnoses, untreated conditions, and poor nutrition can result in higher medical bills, lost productivity, and a reduced quality of life. For example, an untreated toothache might lead to a costly root canal, or neglecting regular check-ups could allow a small issue to develop into a serious (and expensive) condition. Instead of cutting corners on health-related expenses, focus on preventive care. Regular check-ups, a healthy diet, and consistent exercise are all investments in your well-being that pay off in the long term. Eating nutritious meals doesn’t have to be expensive—look for affordable, nutrient-rich staples like beans, lentils, whole grains, and frozen vegetables. Apps like Yummly can help you find budget-friendly recipes that are both healthy and satisfying.

Finally, one of the biggest mistakes is failing to plan for the future. Extreme frugality often prioritizes short-term savings at the expense of long-term financial health. For example, skipping contributions to your retirement account or leaving money in a low-interest savings account might feel like a way to save, but it means you’re missing out on opportunities for your money to grow. Without an emergency fund, a single unexpected expense—like a car repair or medical bill—could derail your finances. And without investing, you’re letting inflation erode the value of your savings over time. To avoid this, prioritize long-term financial strategies. Build an emergency fund with 3–6 months of living expenses in a high-yield savings account, and start investing in retirement accounts like a 401(k) or Roth IRA. Even small contributions can grow significantly over time, thanks to compound interest. If you’re new to investing, platforms like Betterment or Vanguard offer beginner-friendly tools to help you get started.

The key to avoiding these mistakes is to focus on balance and long-term value. Saving money is important, but it shouldn’t come at the expense of your health, time, or future financial security. Instead of chasing extreme frugal hacks, prioritize strategies that save you time, protect your well-being, and set you up for lasting financial success. It’s not about saving every penny—it’s about making every penny work harder for you.

Frequently Asked Questions

How do I balance frugality with enjoying life?

Balancing frugality with enjoying life is all about intentional spending. Identify what truly brings you joy or adds value to your life, and cut back on areas that don’t matter to you as much. For example, if you love traveling, consider reducing your spending on dining out or subscriptions you rarely use, so you can splurge on a memorable trip. Frugality doesn’t mean deprivation—it means aligning your spending with your priorities.

Are extreme frugal tips ever worth it?

Some extreme frugal tips can be worth trying in moderation, as long as they don’t compromise your health, safety, or quality of life. DIY projects, couponing, or growing your own vegetables can save significant money without being harmful. However, tips like skipping medical care, showering infrequently, or dumpster diving often come with risks that outweigh the benefits. Use common sense and focus on strategies that are sustainable.

How can I save money without sacrificing quality?

Saving money without sacrificing quality is possible by being strategic. Look for sales, shop off-season, and buy in bulk when it makes sense. When purchasing items like appliances, clothing, or furniture, invest in high-quality products that last longer, even if they cost more upfront. Use price comparison tools like Honey or CamelCamelCamel to ensure you’re getting the best deal without compromising on quality.

What are the best ways to cut utility bills without extreme measures?

There are plenty of manageable ways to reduce utility bills without resorting to extreme frugality. Start by installing energy-efficient appliances and LED light bulbs. Use a programmable thermostat to optimize heating and cooling. Seal windows and doors to prevent drafts, and consider using smart power strips to reduce phantom energy use. These small, practical changes can lead to noticeable savings over time.

How can I practice frugality without feeling deprived?

The key to avoiding deprivation is to focus on value-based spending. Identify what’s truly important to you and allocate your budget accordingly. For example, if you love good coffee, keep that indulgence but cut back on something less meaningful, like unused subscriptions. Also, look for free or low-cost alternatives for entertainment, like community events, library resources, or nature outings, so you can still enjoy life without spending excessively.

What are the top frugal habits that actually work?

Some of the best frugal habits include meal planning, automating savings, and avoiding impulse purchases. Meal planning helps you avoid food waste and save on dining out, while automating savings ensures you’re consistently building a financial cushion. Additionally, waiting 24 hours before making a purchase can help you avoid spending on items you don’t really need. These habits are simple to implement and can lead to significant savings.

How do I avoid burnout when trying to save money?

Frugality burnout happens when you focus too much on cutting costs and not enough on maintaining balance. To avoid this, give yourself room for small indulgences and celebrate financial milestones. For instance, if you’ve saved $500 this month, treat yourself to a small reward like a nice dinner or a movie night. Balance your saving goals with moments of enjoyment to stay motivated.

How can I teach my kids to be frugal without making them feel deprived?

Teaching kids about frugality is all about showing them the value of money in a positive way. Involve them in budgeting by letting them help plan meals or shop for groceries. Encourage saving by giving them a piggy bank or opening a savings account for them. Show them that frugality isn’t about saying “no” to everything—it’s about making smart choices that align with their goals and values.

What’s the difference between frugality and being cheap?

Frugality is about maximizing value and making thoughtful spending decisions, while being cheap often prioritizes the lowest cost at the expense of quality or relationships. For example, a frugal person might spend more on a durable pair of shoes that will last for years, while a cheap person might buy the lowest-cost pair, even if it falls apart quickly. Frugality focuses on the long-term, whereas being cheap is often short-sighted.

How can I build wealth while being frugal?

Being frugal is just one part of building wealth—it’s also important to focus on earning more and investing wisely. Use the money you save through frugality to invest in assets like stocks, mutual funds, or real estate that grow over time. Set clear financial goals, such as saving for retirement or building an emergency fund, and automate contributions to those goals. Frugality creates the foundation, but wealth-building comes from making your money work for you.

Smarter Savings Without Sacrifices

Saving money doesn’t have to mean sacrificing your health, happiness, or long-term goals. As we’ve explored, some extreme frugal living tips—like reusing toilet paper, skipping showers, and avoiding medical care—can end up costing you more than they save. Instead, the key is to focus on practical, sustainable strategies that enhance your quality of life while helping you build financial security.

Let’s recap some of the actionable steps you can start implementing today:

- Automate your savings with tools like Acorns or Digit, so you’re steadily building wealth in the background.

- Cook at home using meal-planning apps like Mealime to reduce food costs while maintaining a healthy diet.

- Negotiate your bills, from internet to insurance, to free up extra cash for your savings or investment goals.

- Invest in quality products that last longer and save you money over time, following the “cost-per-use” mindset.

- Most importantly, focus on big wins—like reducing housing costs or increasing your income—rather than obsessing over small, insignificant savings.

As John S. Rhodes of the Rhodes Brothers channel wisely said, “The better way forward is to increase your income, improve your skills, and provide value to others.” This abundance mindset is the foundation for achieving financial freedom. Saving money is important, but creating value and long-term wealth is the real key to success.

Ready to start your journey toward smarter savings and financial security? Begin by picking just one actionable tip from this article and implementing it today. Whether it’s automating your savings, negotiating a bill, or learning a new skill, each step brings you closer to your goals.

For even more insights on practical savings, wealth-building strategies, and how to cultivate an abundance mindset, check out the Rhodes Brothers YouTube Channel . Their videos are packed with actionable advice to help you achieve greater wealth and financial mastery.

Resource List

Books to Read

- Your Money or Your Life by Vicki Robin – A classic guide on transforming your relationship with money and achieving financial independence.

- The Total Money Makeover by Dave Ramsey – A step-by-step plan to eliminate debt and build wealth.

- Atomic Habits by James Clear – Learn how small, consistent changes can lead to massive improvements in every area of your life, including your finances.

Courses and Podcasts

- Coursera’s Personal Finance Specialization – A comprehensive course on budgeting, saving, and investing.

- The Ramsey Show Podcast – Practical advice on money management and debt elimination.

- Afford Anything Podcast by Paula Pant – A podcast about mastering money while living with intentionality.

Tools and Apps

- Acorns – A micro-investing app that rounds up your purchases and invests the spare change.

- Mealime – A meal-planning app that helps you save money and reduce food waste.

- Betterment – A beginner-friendly app for investing and building wealth over time.

Blogs and Websites

- Mr. Money Mustache – A blog focused on frugal living and financial independence.

- NerdWallet – A website offering tools and guides for comparing financial products, from credit cards to mortgages.

YouTube Channels

- The Financial Diet – A channel dedicated to making finances approachable and relatable.

- Graham Stephan – Straightforward advice on saving, investing, and creating wealth.

Additional Tools for Success

- YNAB (You Need A Budget) – A budgeting tool that helps you take control of your money.

- Personal Capital – A free app for tracking your net worth and managing your investments.

- Mint – A budgeting app that syncs with your bank accounts to help you monitor spending.

By leveraging these resources, you’ll be well-equipped to save smarter, live better, and build a brighter financial future. Remember, the journey to wealth is not about deprivation—it’s about making intentional choices and creating opportunities for abundance. Start today!