For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

The path to financial freedom begins with embracing your struggles, taking ownership of your failures, and transforming them into opportunities. It’s a powerful shift that can completely change the way you approach wealth and success. Bold, but true.

But according to John S. Rhodes, this is not only possible but essential, particularly for men over 40. As he states, “Every problem is a chance to level up.” This philosophy is the backbone of the Fast Money Meditation—a transformative approach to wealth-building that’s about mindset, action, and resilience.

In this blog, we’ll dive deep into the strategies outlined by John S. Rhodes in his powerful meditation. These techniques aren’t about passive reflection; they’re about taking active, calculated steps to overcome obstacles, redefine your relationship with money, and create opportunities for yourself and others. Whether you’re looking to boost your income, grow your business, or simply take control of your financial future, this guide will show you how to do it.

But before we dive in, here’s a quick snapshot of what you’ll learn:

TL;DR

- Mindset is everything: Shift from seeing problems as barriers to viewing them as opportunities to grow and profit.

- Understand money at its core: Dive into what money really is and how to leverage it effectively.

- Quit whining and take action: Stop describing obstacles—start solving them.

- Failure is your ally: Every failure clears the path for your next success.

- Life happens for you, not to you: Flip the script and embrace life’s challenges as gifts.

The Fast Money Framework: Turning Obstacles into Opportunities

Every challenge you face has the potential to become a stepping stone for success. When you shift your perspective and learn to see obstacles as opportunities, you unlock a new level of resilience and creativity. This is the foundation of the Fast Money Framework—a mindset and action plan designed to help you turn struggles into profit and setbacks into growth. Let’s break it down, starting with the most critical step: rewiring your mindset.

-

Rewire Your Mindset: Problems Are Profit Pathways

Let’s face it—life after 40 comes with its unique set of challenges. You’ve likely faced setbacks, responsibilities, and even failures. But here’s the thing: every problem is a hidden opportunity. As Rhodes explains, the obstacle is the way. This isn’t just stoic philosophy; it’s a proven strategy for success.

Practical Steps to Shift Your Perspective

- Describe the problem clearly: Don’t just say, “I need more money.” Be specific. Are you struggling with debt? Is your business stagnant? Do you lack clarity on how to grow your wealth?

- Reframe the issue: Instead of thinking, “Why is this happening to me?” ask, “How can I grow stronger from this?”

- Find the opportunity: For example, if you’re struggling with debt, could you create a course or product teaching others how to manage their finances better based on your experience?

Example: Jeff Bezos famously said, “I knew that if I failed, I wouldn’t regret that. But I knew the one thing I might regret is not trying.” Use failure as a springboard for action.

-

Understand Money: It’s Not Just Paper—It’s Potential

One of the most profound questions Rhodes asks is: What is money? Is it the cash in your wallet? The numbers in your bank account? Or something more? By understanding the true nature of money, you can unlock its potential in your life.

Breaking Down Money and Wealth

- Money vs. Wealth: Money is a medium of exchange, but wealth is the accumulation of value. Wealth can be skills, relationships, or assets—things that generate income over time.

- Assets vs. Liabilities: Focus on acquiring assets (things that put money in your pocket, like investments or businesses) rather than liabilities (things that drain your resources, like unnecessary expenses).

- Leverage your skills: What can you teach, build, or create that others will pay for?

Tools to Help You Manage Money Better

-

- Budgeting Apps: Tools like YNAB (You Need A Budget) or Mint can help you track your spending and allocate resources effectively.

- Investment Platforms: Explore platforms like Robinhood or Vanguard to grow your wealth through stocks, ETFs, or mutual funds.

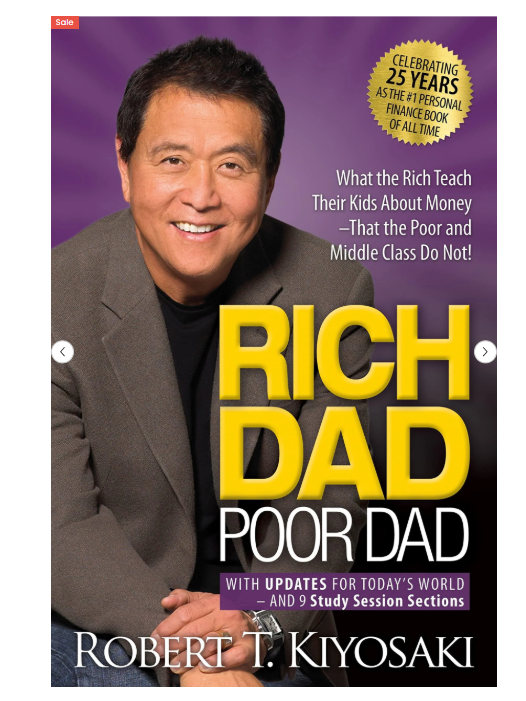

- Books to Read: “Rich Dad Poor Dad” by Robert Kiyosaki is a must-read for understanding the difference between assets and liabilities.

-

Quit Whining: Action Beats Excuses Every Time

Rhodes doesn’t mince words: “Quit whining. Just shut up and do the work.” This tough-love approach is crucial for men over 40 who may feel stuck or defeated. Complaining won’t solve your problems—only action will.

How to Take Action Today

- Step 1: Identify one area to improve. Whether it’s paying off a credit card, starting a side hustle, or improving your health, pick ONE thing.

- Step 2: Break it into steps. For example, if you want to start a side hustle, your steps might be:

- Identify your skills.

- Research demand for those skills.

- Create a simple product or service.

- Step 3: Execute consistently. Commit to taking small, daily actions.

Pro Tip: Use the Pomodoro Technique to stay focused—work for 25 minutes, take a 5-minute break, and repeat.

-

Failure Is the Way Forward

Here’s the truth: failure isn’t the enemy. It’s your greatest teacher. According to Rhodes, “Progress is not success after success—it’s overcoming failure after failure.”

Why Failure Is a Gift

- It builds resilience: Each failure makes you stronger and more prepared for future challenges.

- It provides feedback: Every setback teaches you what doesn’t work, so you can refine your approach.

- It clears the path for success: Overcoming obstacles sets you apart and creates opportunities to help others.

Common Mistakes to Avoid

-

- Fear of starting: Many men over 40 hesitate to take risks, fearing failure. Remember, the only real failure is not trying.

- Lack of focus: Trying to do too much at once leads to burnout. Focus on one goal at a time.

- Giving up too soon: Success often comes just after the point where most people quit.

-

Flip the Script: Life Happens FOR You, Not TO You

One of the most transformative lessons from Rhodes is that life isn’t out to get you. Instead, it’s for you—every challenge, every obstacle, every failure is a gift meant to help you grow.

How to Adopt This Mindset

- Practice gratitude: Focus on what’s going right in your life, even when things feel tough.

- Seek the lesson: Ask yourself, “What can I learn from this experience?”

- Surround yourself with positivity: Find mentors, books, or communities that inspire and uplift you.

Example: Start your day by writing down three things you’re grateful for.

-

Build Recurring Income Streams

One of the fastest ways to create financial stability and grow wealth is by building recurring income streams—income that flows in regularly without constant effort. This could be through investments, businesses, or even digital products. As a man over 40, you have the advantage of experience and skills that can be monetized effectively.

Examples of Recurring Income Streams

- Rental Income: If you own property (or can invest in one), renting it out can generate consistent monthly cash flow.

- Dividend Stocks: Invest in companies with a track record of paying dividends for passive income. Tools like Robinhood or Fidelity can help you start.

- Online Courses or Ebooks: Package your expertise into a course or ebook and sell it on platforms like Teachable or Amazon Kindle Direct Publishing.

- Subscription Services: Offer a subscription for exclusive content, services, or products (e.g., a paid newsletter or coaching program).

How to Start Your First Recurring Income Stream

- Identify your skills or interests: What knowledge or assets do you have that others might find valuable?

- Find your audience: Use social media, forums, or communities to identify people who could benefit from your product or service.

- Create and launch: Start small—your first product doesn’t have to be perfect. Get feedback and improve over time.

Pro Tip: Platforms like Patreon or Substack are excellent for creators looking to monetize their audience through subscriptions.

-

Master the Art of Problem-Solving

As Rhodes emphasizes, people will pay for solutions to their problems—especially if those solutions resonate with them personally. The key to building wealth is to become a problem-solver in your niche.

How to Identify Problems You Can Solve

- Reflect on your struggles: What challenges have you faced and overcome? Others are likely dealing with the same issues.

- Listen to others: Engage in conversations, read comments online, or join forums to uncover common pain points.

- Research trends: Use tools like Google Trends or AnswerThePublic to see what people are searching for in your area of expertise.

Developing a Solution

Once you’ve identified a problem, create a product, service, or piece of content that addresses it. For example:

- If you’ve overcome financial struggles, create a budgeting guide or coaching service.

- If you’ve transformed your health, share your workout regimen or meal plans.

Example: Rhodes mentions that by solving your own obstacles and documenting the journey, you create a blueprint others will pay for. This is how you turn your struggles into profits.

Actionable Steps: Turning Obstacles into Opportunities for Financial Freedom

For beginners, the focus should be on building a strong foundation by tackling small, manageable goals. Start by assessing your financial situation—write down specific challenges like debt, lack of savings, or low income. From there, aim for small wins, such as saving $20 a week, paying off the smallest debt first using the snowball method, or dedicating 30 minutes a day to learning new skills through free platforms like Coursera or YouTube. Budgeting tools like Mint or YNAB can help you track your spending and stay on course. By focusing on incremental progress, you can build momentum and set yourself up for long-term success.

For professionals or mid-career individuals, the goal is to build on your existing skills and scale your income. Start by identifying market gaps in your industry and leveraging your expertise to solve problems. For example, if you’re a finance professional, consider offering consulting services, creating a digital product like an online course, or starting a side hustle. Automating your finances is essential—set up automatic savings and investments through tools like Acorns or Betterment to ensure consistent progress. Networking and collaboration are also key at this stage; connect with peers at industry events or through professional groups to uncover opportunities for partnerships or growth. With the right focus, you can transform your career into a wealth-building engine.

For men over 40 or those approaching retirement, the focus shifts to leveraging your experience and creating sustainable wealth. Turn your knowledge into revenue by offering consulting services, mentorship, or even writing a book. At this stage, it’s crucial to prioritize passive income streams like dividend-paying stocks, rental properties, or REITs (Real Estate Investment Trusts), which can generate consistent cash flow. Reevaluate your financial priorities by paying off high-interest debt, maximizing retirement account contributions, and considering estate planning to protect your wealth. Additionally, think about building a legacy—mentoring younger professionals or family members allows you to leave a lasting impact while sharing the lessons you’ve learned. Your decades of experience are valuable; use them to create financial stability and a meaningful future.

Common Mistakes to Avoid

Building wealth isn’t just about taking the right actions—it’s also about steering clear of common pitfalls that can derail your progress. Many men over 40, in particular, fall into traps that can slow their financial growth or keep them stuck in unproductive cycles. Recognizing and addressing these mistakes is critical to staying on track toward financial freedom. Below are some of the most common missteps to avoid and practical solutions to help you maintain momentum.

- Procrastination: Waiting for the “perfect time” to start saving, investing, or pursuing a financial goal is one of the biggest barriers to wealth-building. Life rarely offers the ideal circumstances, and delaying action often results in missed opportunities. The best time to start was yesterday; the second-best time is now. Even small, consistent actions taken today can compound into significant results over time.

- Overcomplicating Things: Many people get bogged down by trying to find the “perfect” tools, strategies, or systems for building wealth. However, wealth-building doesn’t require overly complex plans or expensive tools. Simplicity is often the key to success. Focus on the fundamentals—spend less than you earn, invest wisely, and consistently work toward your goals. Avoid analysis paralysis and prioritize taking action.

- Chasing Shortcuts: The allure of get-rich-quick schemes can be tempting, especially when you’re eager to make progress. However, these schemes often lead to financial losses and wasted time. Sustainable, long-term strategies like investing in diversified assets, building passive income streams, and developing valuable skills are far more reliable paths to financial freedom. Remember, wealth is built over time, not overnight.

- Neglecting Health: Wealth means little if your health prevents you from enjoying it. Many men over 40 find themselves so focused on financial goals that they neglect their physical and mental well-being. Poor health can lead to decreased productivity, higher medical expenses, and reduced quality of life. Prioritizing exercise, proper nutrition, and stress management ensures you have the energy and focus needed to achieve your financial aspirations.

Solutions to Stay on Track

- Set Realistic, Measurable Goals: Break your long-term financial goals into smaller, actionable steps with clear deadlines. For example, instead of vaguely aiming to “save for retirement,” set a goal to contribute a specific amount to your retirement account each month. Defined goals provide direction and make progress easier to track.

- Partner with an Accountability Buddy or Join a Mastermind Group: Having someone to hold you accountable can significantly improve your chances of success. Partner with a friend, family member, or mentor to regularly check in on your progress. Alternatively, join a mastermind group or financial community where you can exchange ideas, share challenges, and stay motivated.

- Regularly Review Your Progress: Periodically reviewing your financial plan is essential to ensure you’re on track. Set aside time each quarter to evaluate your investments, savings, and spending habits. Adjust your strategies as needed to account for changes in circumstances, such as unexpected expenses, market fluctuations, or shifts in your personal goals. Consistent reflection helps you stay aligned with your long-term vision.

- Prioritize Your Health: Incorporate healthy habits into your daily routine to maintain the physical and mental energy required for wealth-building. This could include scheduling regular exercise, eating a balanced diet, and practicing mindfulness or relaxation techniques to manage stress. Health and wealth are interconnected—investing in one supports progress in the other.

By avoiding these common mistakes and implementing practical solutions, you can stay focused on your financial journey and build sustainable wealth. Remember, the key to success lies in consistent, intentional actions combined with the discipline to avoid distractions and pitfalls. Wealth-building is a marathon, not a sprint—stay the course, and the results will follow.

Frequently Asked Questions

How do I start saving money if I’m already in debt?

Focus on creating a budget that prioritizes debt repayment while setting aside a small emergency fund. Use the snowball or avalanche method for tackling debt.

What’s the best investment for beginners?

Start with low-cost index funds through platforms like Vanguard. They offer diversification and steady growth over time.

How do I stay motivated when progress is slow?

Break your goals into smaller milestones and celebrate each win, no matter how small. Consistency is key.

Is it too late to start a side hustle at 40?

Not at all! Many successful entrepreneurs started later in life. Leverage your experience and network to hit the ground running.

What’s the difference between good debt and bad debt?

Good debt (e.g., a mortgage or student loan) can help you build assets, while bad debt (e.g., credit card debt) drains your resources without adding value.

How can I balance wealth-building with family responsibilities?

Involve your family in your goals and create a plan that works for everyone. Communication is key.

What’s the most common reason people fail to build wealth?

A lack of clear goals and consistent action. Clarity and discipline are essential.

How do I overcome the fear of taking risks?

Start small. Take calculated risks and learn from the outcomes. Each step will build your confidence.

What’s the best way to grow my network?

Attend events, join online communities, and actively participate in discussions related to your field of interest.

How do I teach my kids about money?

Lead by example. Discuss budgeting, saving, and investing openly. Consider tools like Greenlight, a debit card designed for kids to learn financial responsibility.

Your Journey Starts Now

Building wealth as a man over 40 doesn’t require magic or luck—it requires action, consistency, and a willingness to embrace the right mindset. As John S. Rhodes wisely says, “Level up by finding the opportunity in every problem.” This simple yet profound perspective is the foundation of financial success. No matter where you’re starting, the key is to take the first step today. Start by identifying one challenge you’re facing, reframing it as an opportunity, and committing to a small, actionable step forward. Whether it’s setting up a savings plan, launching a side hustle, or finally tackling that overdue debt, progress begins with action.

The journey won’t always be easy. There will be moments of doubt, frustration, and even failure. But remember, failure is a gift—it teaches, strengthens, and prepares you for future success. Every obstacle you encounter is an opportunity in disguise, pushing you to grow and innovate. Shift your mindset to see life as happening for you, not to you. This perspective will help you face challenges with confidence, resilience, and determination. You have the power to rewrite your financial story, no matter your past mistakes or current circumstances.

For ongoing inspiration, strategies, and tough-love motivation, subscribe to the Rhodes Brothers YouTube Channel here. Their direct, no-nonsense approach will show you how to rise above your struggles, grow into your full potential, and turn your efforts into tangible wealth. The journey starts now—take that first step, and remember, the life you’ve always wanted is within reach. You just have to claim it.

Resource List

To continue your journey, here are some highly recommended tools and resources:

Books

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Obstacle Is the Way” by Ryan Holiday

- “Atomic Habits” by James Clear

Courses and Podcasts

- The Side Hustle School Podcast by Chris Guillebeau

- Financial Peace University by Dave Ramsey

- MindValley Courses for personal growth and productivity

Tools and Apps