For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

Feeling like investing is a complex puzzle reserved only for the Wall Street pros? Think again. Building wealth through investing isn’t some exclusive club; it’s absolutely achievable for anyone ready to understand a few key principles. The most crucial starting point? Getting crystal clear on your personal risk tolerance. This isn’t just jargon; it’s the compass that guides your investment decisions, ensuring you choose strategies that let you sleep soundly at night while still growing your money. Forget guesswork – we’re diving into how you can accurately assess your comfort level with risk and match it with smart investment choices, setting you up for long-term success.

This post will guide you through understanding how to assess your risk tolerance before investing, exploring why it matters, and connecting it directly to beginner-friendly investment options like those discussed by financial commentators. We’ll break down practical steps, highlight common pitfalls, and give you the tools you need to start your investment journey with confidence.

Think about it: many people jump into investing based on a hot tip or fear of missing out, only to panic sell when things get bumpy. Why? Often, it’s because the investment didn’t align with their inherent tolerance for risk. Statistics consistently show that investors who understand their risk profile tend to stick with their strategy and achieve better long-term results. As John S. Rhodes of the Rhodes Brothers aptly puts it, when discussing the power of long-term investing, “time is really truly your friend.” Understanding your risk tolerance helps you leverage that time effectively by choosing investments you can comfortably hold onto, through thick and thin.

TL;DR

- Know Thyself: Understanding your risk tolerance (how much potential loss you can stomach emotionally and financially) is foundational to successful investing.

- Why It Matters: It dictates the types of investments suitable for you, preventing panic decisions and aligning your portfolio with your goals and timeline.

- Key Factors: Assess your financial situation (income, debt, savings), investment timeline (short-term vs. long-term), investment knowledge, and emotional response to market swings.

- Beginner-Friendly Options: Low-cost index funds/ETFs and target-date funds often align well with lower-to-moderate risk tolerances due to diversification and automatic adjustments.

- Time is Key: Longer investment horizons generally allow for taking on more risk, as there’s more time to recover from downturns.

- Avoid Pitfalls: Don’t overestimate your tolerance, chase hot stocks emotionally, or ignore the impact of fees.

- Tools Help: Use risk tolerance questionnaires and calculators as starting points, but combine them with self-reflection.

Decoding Your Investment Comfort Zone: Assessing Risk Tolerance

Alright, let’s get down to brass tacks. What is risk tolerance, really? In simple terms, it’s your ability and willingness to handle potential declines in the value of your investments. It’s a mix of your financial capacity to withstand losses and your emotional gut reaction when markets get turbulent. Figuring this out before you invest a single dollar is like checking the weather before a long hike – it helps you prepare and choose the right gear (or in this case, investments).

Why Bother Assessing Risk? Isn’t Investing Always Risky?

Yes, all investing involves some level of risk. But the amount and type of risk vary wildly. Putting all your money in one speculative stock is vastly different from investing in a diversified index fund. Knowing your tolerance helps you:

- Choose Suitable Investments: Aligning investments with your comfort level prevents sleepless nights and panic selling. If you’re highly risk-averse, volatile assets might cause too much stress, leading to poor decisions.

- Set Realistic Expectations: Understanding potential downsides helps you stay grounded and avoid disappointment if returns aren’t sky-high immediately.

- Stick to Your Plan: When you know why you chose certain investments based on your risk profile, you’re more likely to stay the course during market dips – which, as the transcript highlights, is crucial for long-term growth.

As the legendary investor Warren Buffett said, “Risk comes from not knowing what you’re doing.” Assessing your tolerance is a fundamental part of knowing what you’re doing.

Factors Influencing Your Risk Tolerance

Assessing risk isn’t a one-size-fits-all calculation. It involves looking at several personal factors:

- Financial Situation:

- Income Stability: Is your job secure? Do you have multiple income streams? Higher stability might allow for more risk.

- Savings Cushion: Do you have an emergency fund covering 3-6 months of expenses? If not, taking significant investment risk is unwise.

- Debt Levels: High-interest debt often takes priority over investing, especially risky investing.

- Investment Timeline (Time Horizon):

- How long until you need the money? If you’re investing for retirement 30 years away, you can generally afford to take on more risk than someone needing the funds in 3 years for a house down payment. Longer timelines provide more opportunity to recover from market downturns. This connects directly to John S. Rhodes’ point about time being your greatest asset.

- Investment Goals:

- What are you investing for? Aggressive growth goals might necessitate higher risk, while capital preservation goals suggest lower risk.

- Investment Knowledge & Experience:

- How familiar are you with different investment types? Beginners might start with simpler, more diversified options. As your knowledge grows, your comfort with different risks might change.

- Emotional Temperament:

- How do you react to volatility? Be honest. Would a 20% drop in your portfolio value cause you to panic and sell? Or can you view it as a potential buying opportunity? This is perhaps the most crucial, yet hardest-to-quantify, factor.

Connecting Risk Tolerance to Beginner-Friendly Investments (Based on the Transcript)

The transcript mentions specific investment types great for beginners. Let’s see how they align with different risk levels:

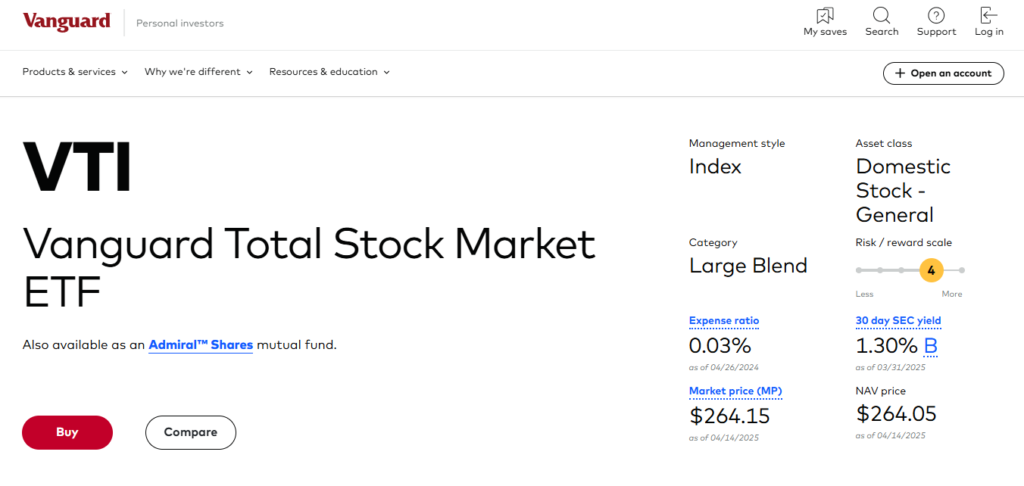

- Index Funds and ETFs (like S&P 500 funds):

- Risk Level: Generally Moderate. They offer broad diversification (investing in hundreds of companies at once), which significantly reduces single-stock risk compared to buying shares in just one company like Hershey (as mentioned in the transcript).

- Who are they good for? Investors with a low-to-moderate risk tolerance, those seeking market-average returns, beginners who want simplicity, and long-term investors. They are less risky than individual stocks but still subject to overall market fluctuations.

- Leverage/Profit: Profit comes from the overall growth of the market segment the fund tracks and potentially dividends paid by the underlying companies. Leverage comes from diversification – you benefit from the collective success of many companies.

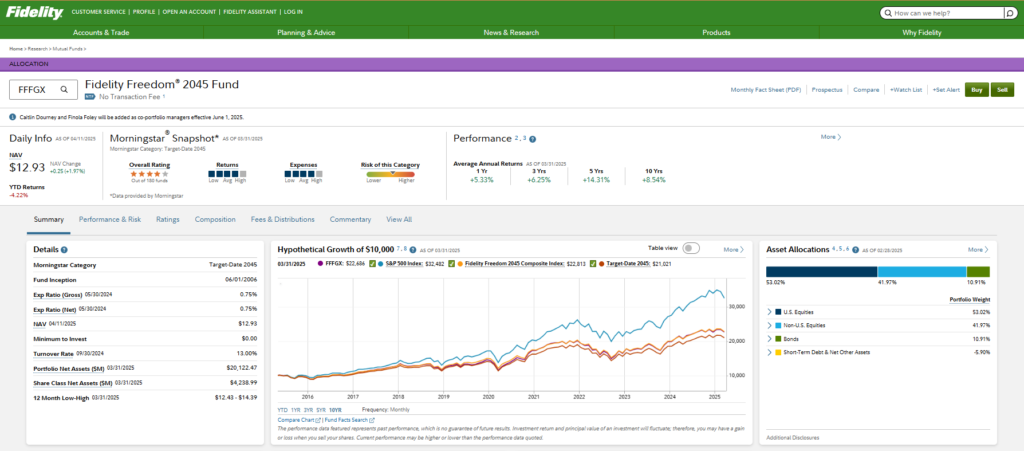

- Target-Date Funds (TDFs):

- Risk Level: Starts Moderate-to-High (when the target date is far off) and automatically becomes Lower Risk over time. They adjust the mix of stocks and bonds, becoming more conservative as the target year approaches.

- Who are they good for? Hands-off investors, particularly those saving for retirement, who want their risk level managed automatically based on their timeline. Suitable for various initial risk tolerances, as the fund handles the adjustments.

- Leverage/Profit: Profit potential is higher in the early years (more stocks) and shifts towards capital preservation later (more bonds). The leverage is the automatic rebalancing – it takes the guesswork out of adjusting risk over time.

- The “Leave it Alone” Strategy (Long-Term Investing):

- Risk Level: Depends on the underlying assets, but the strategy itself mitigates emotional risk. Holding diversified investments like index funds long-term aligns with moderate risk tolerance, allowing time to smooth out volatility.

- Who is it good for? Everyone! But especially those who understand their risk tolerance allows them to weather market storms without panicking. It requires discipline.

- Leverage/Profit: The power here is compounding. As John S. Rhodes noted, quoting Buffett, handling your portfolio too much makes it shrink due to fees and bad timing. Letting investments grow and reinvesting dividends over decades is how significant wealth is often built.

Tools for Assessment

While self-reflection is key, some tools can provide a starting point:

- Risk Tolerance Questionnaires: Many brokerage firms (like Vanguard, Charles Schwab, Fidelity) offer online questionnaires. They ask about your financial situation, timeline, and hypothetical reactions to market drops.

- Example Question: “If your investment portfolio lost 15% of its value in a month, what would you do? a) Sell everything, b) Sell some, c) Do nothing, d) Buy more.”

- Financial Calculators: Online tools can help model potential outcomes based on different risk/return scenarios and your timeline.

Important Note: These tools are guides, not definitive answers. Combine their output with your honest self-assessment.

Actionable Steps: Pinpointing Your Risk Profile

Okay, theory is great, but how do you actually figure this out based on where you are in life? Let’s break down the steps with specific considerations for different situations:

-

Honest Financial Check-up

-

- For Everyone: List your income, expenses, assets (savings, property), and debts. Calculate your true disposable income after essentials and emergency fund contributions (aim for 3-6 months of living expenses!). Knowing your safety net is non-negotiable. If losing a portion of your investment would mean you can’t pay rent or cover an emergency, your financial capacity for risk is low, regardless of how brave you feel.

- Young Professionals/Millennials (20s-30s): Factor in student loans or other debts. Is your income stable or variable? Prioritize building that emergency fund first. Your capacity might be lower initially, even if your willingness feels high.

- Mid-Career (40s-50s): You might have more assets (like home equity) but also bigger obligations (mortgage, kids’ college funds). How secure is your income? How much is already earmarked for specific future goals? This impacts how much is truly available for riskier, long-term growth.

- Pre-Retirees (Late 50s+): Assess your nest egg size relative to retirement needs. How much income will you need from investments? Protecting your capital becomes paramount. Your capacity for loss is likely much lower now.

-

Define Your Timeline & Goals

-

- For Everyone: When will you need this specific pool of money? Be honest and write it down. Is it for retirement decades away, a house deposit in 5 years, or college tuition starting in 10? Also, what’s the goal? Just keeping pace with inflation? Modest growth? Building significant wealth?

- Young Professionals/Millennials: Your longest timeline is likely retirement (30+ years), which allows for higher risk. But if you’re also saving for a medium-term goal like a house, that specific pot of money needs a shorter timeline and lower risk profile. Don’t mix them!

- Mid-Career: You still have a decent runway for retirement (15-25 years), allowing for growth-oriented risk. However, shorter-term goals (college funds starting soon?) require more conservative approaches for that money.

- Pre-Retirees: Your primary timeline is likely short (0-10 years until/into retirement). This drastically reduces how much risk is appropriate for the bulk of your savings. Focus shifts to capital preservation and generating income.

-

-

The “Sleep-at-Night” Test (Emotional Check)

-

- For Everyone: Imagine investing $10,000 (or an amount significant to you). Now, picture the news screaming about a market crash, and your investment is suddenly worth $8,000. How does that feel? Gut reaction? Annoyed but sticking to the plan? Slightly nauseous? Full-blown panic wanting to sell? Be brutally honest. Now imagine it’s $7,000, or even $5,000. Where’s your breaking point? This reveals your emotional tolerance.

- Beginners (Any Age): If you’ve never invested before, be extra conservative in your assessment. It’s easy to overestimate your bravery until you see real money fluctuate. Start small to experience volatility without high stakes.

- Experienced Investors: Reflect on past downturns. How did you actually react versus how you thought you would? Use past behavior as a guide.

-

Consider Your Knowledge & Comfort Level

-

- For Everyone: How much do you understand about different investment types (stocks, bonds, ETFs, mutual funds, crypto, real estate)?

- Beginners: Stick to simpler, broadly diversified options like index funds or target-date funds, as mentioned in the transcript. Complexity itself adds risk if you don’t understand what you own. Focus on learning the basics first.

- More Experienced: Your knowledge might make you comfortable with a wider range of investments (e.g., sector ETFs, individual stocks, alternatives). However, don’t let knowledge lead to overconfidence. Stick to your overall risk parameters.

-

Take a Questionnaire (or Two) – Use as Input

-

- For Everyone: Use online tools from reputable brokerages (Vanguard, Schwab, Fidelity, etc.) as a data point. Answer honestly. See how the suggested profile aligns with your self-assessment from the steps above.

Key Use: Notice where the questionnaire result differs from your gut feeling or financial reality. Why the difference? Does the questionnaire highlight a risk you hadn’t considered, or does it fail to capture your unique situation? Use it to refine, not dictate, your profile.

-

Match Tolerance & Capacity to Strategy

-

-

- For Everyone: Synthesize the above. Where do your financial capacity, timeline, emotional tolerance, and knowledge point? Categorize yourself (e.g., Conservative, Moderately Conservative, Moderate, Moderately Aggressive, Aggressive).

- Conservative: Focus on capital preservation. High allocation to bonds, fixed income, TDFs very close to their target date, maybe some broad market equity index funds for inflation protection. Suitable for very short timelines or very low emotional/financial tolerance.

- Moderate: A balanced approach. Mix of stock and bond index funds (e.g., 60% stocks/40% bonds), TDFs with medium-term horizons. Suitable for medium-to-long timelines with average risk tolerance. This is often a good starting point for many.

- Aggressive: Focus on long-term growth. High allocation to stock index funds (domestic and international), potentially some sector ETFs or individual stocks (if knowledge supports it). Only suitable for long timelines (15+ years) AND high emotional/financial tolerance for volatility.

- Crucial Link: Ensure your chosen strategy directly addresses your goals within your timeline and feels comfortable based on your sleep-at-night test. If there’s a mismatch, adjust the strategy – don’t try to force yourself to tolerate more risk than you can handle.

-

Common Mistakes to Avoid When Assessing Risk

Getting this wrong can be costly. Steer clear of these common pitfalls:

- Overestimating Your Tolerance (The Bull Market Trap): It’s easy to think you have a high risk tolerance when markets are soaring. The real test comes during a downturn. Be conservative in your estimation, especially if you haven’t experienced a significant market correction before.

- Ignoring Your Financial Capacity: Willingness to take risks means little if you lack the ability to withstand losses. Don’t invest money you might need for near-term obligations or emergencies.

- Confusing Speculation with Investing: Chasing meme stocks or crypto based on hype isn’t investing based on risk tolerance; it’s closer to gambling. True investing involves understanding the underlying asset and its associated risks.

- Forgetting About Time Horizon: Taking high risks with money needed in the short term is a recipe for disaster. Market timing is notoriously difficult; short-term needs require lower-risk vehicles.

- Analysis Paralysis: While assessment is crucial, don’t let it stop you from starting. For many beginners, starting small with a diversified, low-cost option like an S&P 500 index fund is a reasonable first step while you continue to learn and refine your understanding of risk.

- Not Reassessing Periodically: Your risk tolerance isn’t static. Life events (job change, marriage, inheritance, nearing retirement) can change your financial situation, timeline, and goals. Review your tolerance and portfolio alignment every year or two, or after major life changes.

Frequently Asked Questions

What’s the difference between risk tolerance and risk capacity?

Risk tolerance is your emotional comfort with risk and potential losses. Risk capacity is your financial ability to withstand losses without jeopardizing your essential financial goals. Both are important, but sometimes they differ (e.g., you might feel comfortable with risk but lack the financial cushion). Capacity should generally set the upper limit.

Can my risk tolerance change over time?

Absolutely! Major life events (new job, inheritance, marriage, kids, approaching retirement) or changes in market outlook or personal financial knowledge can all shift your tolerance. It’s wise to reassess periodically.

I’m young, should I automatically have a high risk tolerance?

While a longer time horizon generally allows for higher risk capacity, your emotional tolerance might still be lower. Don’t feel pressured to be overly aggressive if it makes you uncomfortable. A balanced, diversified approach is often suitable even for young investors.

Are risk tolerance questionnaires accurate?

They are useful starting points and provide objective input, but they aren’t perfect. They can’t fully capture individual emotional nuances or complex financial situations. Use them as one tool alongside honest self-reflection.

What if my spouse/partner has a different risk tolerance?

This is common! Open communication is key. You might consider segmenting investments (some managed according to one tolerance, some to the other) or finding a compromise portfolio allocation you can both live with. Consulting a financial advisor can help navigate this.

Does investing in index funds mean no risk?

No. Index funds eliminate single-stock risk through diversification, but they still carry market risk. If the overall market (e.g., the S&P 500) goes down, the value of your index fund will also decrease. They are generally less risky than individual stocks but not risk-free.

How do Target Date Funds fit my risk tolerance?

They are designed to align with a typical risk tolerance glide path based on your retirement year. They start more aggressive (higher stock allocation) when you’re young and automatically become more conservative (higher bond allocation) as the target date nears. They are convenient if you prefer a hands-off approach that manages risk over time for you.

What’s the single most important factor in assessing risk tolerance?

While all factors matter, your emotional reaction to potential losses (the “sleep-at-night” test) combined with your time horizon are often the most critical drivers for choosing appropriate investments.

Can I just copy what my successful friend is doing?

It’s generally not advisable. Your friend’s financial situation, goals, timeline, and emotional tolerance for risk could be vastly different from yours. What works for them might be entirely unsuitable for you.

Where can I get help assessing my risk tolerance?

Reputable online brokerage platforms often have tools. You can also read books on investing psychology, or consider talking to a fee-only financial planner who can provide personalized guidance based on your specific circumstances.

Taking Control: Your Next Steps in Investing

Understanding your risk tolerance isn’t just an academic exercise; it’s the bedrock of a sound investment strategy. By honestly evaluating your financial situation, time horizon, goals, and emotional fortitude, you can move beyond guesswork and choose investments that truly align with you. Whether it’s the broad diversification of low-cost index funds, the automated adjustments of target-date funds, or simply committing to the powerful strategy of long-term, hands-off investing, knowing your comfort zone empowers you to make smarter decisions. You’re equipped now to avoid common pitfalls like emotional selling or chasing unsuitable hot tips.

The journey to building wealth starts with this crucial first step of self-assessment. Don’t let uncertainty paralyze you. Your financial future is too important. Take action today by performing your own “sleep-at-night” test and outlining your investment timeline and goals. This simple act can provide immense clarity and set you on the path to confident investing.

Thank you for joining us and exploring how to assess your investment risk tolerance. We encourage you to continue learning and growing. For more insights on financials, savings, investing, and achieving greater wealth, be sure to check out and subscribe to the Rhodes Brothers YouTube Channel for latest videos and practical advice to help you succeed!

Resource List

Books

- The Intelligent Investor by Benjamin Graham (Classic on value investing and temperament)

- A Random Walk Down Wall Street by Burton Malkiel (Covers diversification, risk, and market efficiency)

- The Little Book of Common Sense Investing by John C. Bogle (Focuses on low-cost index fund investing)

- Thinking, Fast and Slow by Daniel Kahneman (Explores cognitive biases affecting financial decisions)

- Your Money and Your Brain by Jason Zweig (Connects neuroscience and investing behavior)

- The Psychology of Money by Morgan Housel (Timeless lessons on wealth, greed, and happiness)

Podcasts

- The Ramsey Show (Practical personal finance advice)

- ChooseFI (Focuses on financial independence)

- Afford Anything with Paula Pant (Challenges conventional financial advice)

- Motley Fool Money (Market news and stock analysis)

Online Tools & Calculators

- Vanguard Investor Questionnaire: – Example risk tolerance assessment tool.

- Charles Schwab Risk Profile Questionnaire: (Available through Schwab accounts or general financial planning tools) – Another example.

- Fidelity Financial Planning Tools: (Various calculators and tools available on their site)

- Personal Capital / Empower: Financial tracking and planning tools, including retirement simulators.

Blogs & Websites:

- Investopedia: Comprehensive financial dictionary and educational articles.

- NerdWallet: Personal finance advice, reviews, and comparisons.

- The Balance: Articles covering various aspects of money management and investing.

- Morningstar: Investment research and analysis (some content requires subscription).

Courses:

- Coursera / edX: Search for courses on personal finance, behavioral finance, or investment management from universities.

- Morningstar Investing Classroom: Free online courses covering investment basics.