For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

It sounds weird, maybe even impossible, but it’s true: you can retire on $500,000—if you do it right.

The idea of needing millions to retire has been drilled into us by headlines, financial media, and even well-meaning advisors. But many people are proving that with strategy, clarity, and discipline, half a million dollars can go a long way.

In fact, John S. Rhodes of the Rhodes Brothers YouTube channel puts it perfectly when he says: “You can master the markets by mastering what your rules are, what your thinking is.”

This post is your roadmap to doing exactly that. You’ll learn how to stretch $500,000 into a retirement that works for you, not some average statistic. We’ll cover:

- Proven investment strategies that maximize long-term returns

- How lifestyle choices and location can 2x or even 3x your retirement power

- The tools, assets, and mindsets that make $500,000 go further

- Major mistakes to avoid that could ruin your plan

- A step-by-step guide for different ages and retirement stages

Whether you’re a millennial planning ahead, a Gen Xer nearing retirement, or someone already in it—you’ll find practical, real-world advice to make your goals happen.

TL;DR

- Yes, you can retire on $500,000—but it depends on strategy and lifestyle.

- Growth investments like index funds (e.g. QQQ or SPY) historically return 8–10% annually.

- Living in low-cost areas or overseas can supercharge your spending power.

- Diversification, inflation protection, and a “wealth battery” mindset are key.

- Avoid lifestyle creep, poor diversification, and ignoring healthcare costs.

- Supplement your income with part-time work, freelancing, or side hustles.

- Retirement is not all-or-nothing—it can be phased or flexible.

- A strong budget and emergency planning set the foundation.

How to Make $500,000 Work in Retirement

If you’re wondering whether $500,000 is enough to retire, you’re not alone—and the honest answer is: it depends on how you use it. The key isn’t just having the money, but knowing how to make it work for you. With smart strategies, a bit of flexibility, and intentional planning, you can turn this nest egg into a sustainable source of income for decades. Let’s break down how to stretch, grow, and protect your $500,000 for a secure and fulfilling retirement.

1. Think of Your Portfolio as a “Wealth Battery”

John Rhodes introduces a powerful idea: your investment portfolio isn’t just savings—it’s a “wealth battery.” You charge it during your working years, then discharge it strategically in retirement.

The core idea is to invest in assets that hold or grow value over time:

- Growth Stocks: Companies with long-term upside and strong fundamentals. Think Apple, Amazon, Microsoft

- Index Funds: Like SPY (S&P 500) or QQQ (NASDAQ 100). They give you instant diversification

- Dividend Stocks: Provide income without selling assets

- Real Estate Investment Trusts (REITs): Generate passive income

A well-balanced portfolio can return an average of 8–10% per year. That’s $40,000–$50,000 annually on a $500K investment.

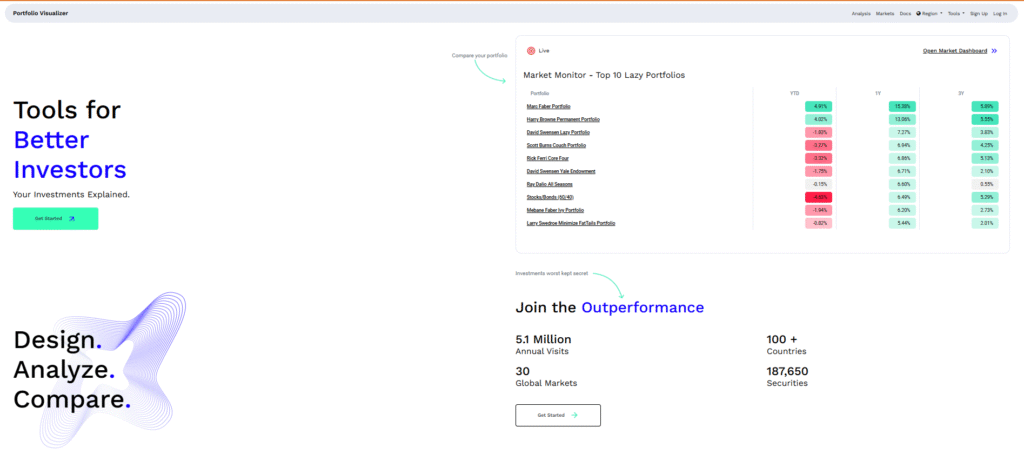

Example Tool: Use Portfolio Visualizer to backtest different asset allocations and simulate returns.

2. Choose Where You Live (Geoarbitrage is Powerful)

Where you live might be the biggest money move you make.

Let’s say you retire in New York City. That $500K may barely last 10 years. But if you move to a lower-cost area—like rural parts of the U.S., or even countries like Portugal, Mexico, or Vietnam—you could stretch your money much further.

This is called geoarbitrage: taking advantage of cost-of-living differences to maximize your lifestyle for less.

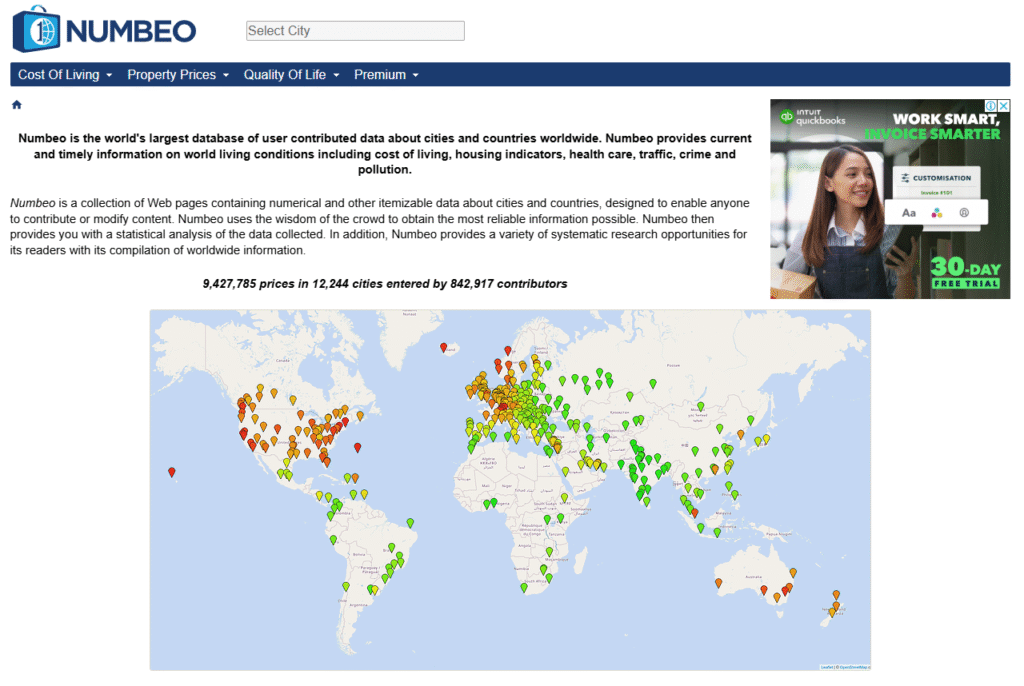

Tool Tip: Use Numbeo or Expatistan to compare global cost of living.

3. Build in Flexibility: Semi-Retirement Works

Retirement doesn’t have to be an on-off switch. Many people “retire” by simply working less:

- Freelance or consult part-time

- Drive for Uber or deliver with DoorDash

- Teach online or create a digital product

- Flip items on eBay or Etsy

- Seasonal work (tax prep, coaching, hospitality)

This part-time income can reduce your drawdown on investments, giving your portfolio more time to grow.

“Retirement is not all or nothing… You might just do seasonal work or start a side business.” — John S. Rhodes

4. Plan for Emergencies (Because They WILL Happen)

Unexpected costs hit hard in retirement:

- Medical bills

- Car or home repairs

- Family emergencies

Set aside a cash cushion of 6–12 months in a high-yield savings account or money market fund to avoid selling investments when the market is down.

Tool Tip: Use Ally Bank or Marcus by Goldman Sachs for flexible, FDIC-insured savings.

5. Know Your “Enough” Number

Everyone’s retirement number is different. Some can live well on $30K/year. Others need $100K.

Break your expenses into:

- Needs (housing, food, healthcare)

- Wants (travel, entertainment, hobbies)

Then ask: Can my portfolio cover my needs? If yes, great. If not, adjust lifestyle, location, or income approach.

“Know your wants and know your needs… Make sure you can cover your needs with whatever your portfolio is generating.” — John S. Rhodes

This mindset is essential. If you want to retire on $500,000, every dollar needs a purpose.

Actionable Steps for Retiring on $500,000

Planning for retirement on $500,000 looks different depending on your age and stage of life. Whether you’re just starting to build wealth, approaching retirement, or already there, the strategies you use can make all the difference. Here’s how to take actionable, age-specific steps to make $500,000 work for you—no matter where you are on your financial journey.

For Millennials (Ages 25–40), the most powerful tool you have is time. Start investing now to take full advantage of compound growth. Prioritize contributions to a Roth IRA and your employer-sponsored 401(k), especially if there’s a match. Focus on investing in broad market index funds, such as those tracking the S&P 500, which offer long-term growth with low fees. If flexibility allows, explore remote work opportunities and consider living in lower-cost areas or countries to reduce expenses and boost your savings rate. Use this phase of life to build multiple income streams—through freelancing, YouTube, investing, or creating digital products. These early moves can drastically increase the chances of reaching or exceeding the $500K mark and retiring earlier than expected.

For Gen X (Ages 41–55), it’s crucial to get serious about your financial foundation. Start by auditing your monthly expenses and cutting out lifestyle inflation—those creeping costs that add up without adding real value. Shift your portfolio toward a mix of growth and dividend income to balance upside with stability. If your current home or city is expensive, consider downsizing or relocating to reduce overhead and free up capital. This is also a great time to begin experimenting with part-time retirement options, like building a side hustle, consulting, or freelance work that can continue into your retirement years.

For Boomers (Ages 56+), the focus shifts from growth to preservation and income. Use a “bucket strategy” to manage your money—keep short-term cash needs in liquid accounts, mid-term needs in bonds or conservative funds, and long-term growth in equities. If you can delay Social Security, you’ll receive larger monthly checks, which can significantly improve your financial stability in later years. Also, consider options like annuities to provide guaranteed income or part-time consulting work to reduce the need to draw from your savings immediately. Every dollar you don’t spend now helps preserve your portfolio for the long haul.

Common Mistakes to Avoid

Even with a solid $500,000 nest egg, the wrong moves can put your retirement at risk. Avoiding these common pitfalls is just as important as choosing the right investments. Here’s a deeper look at the mistakes that can quietly sabotage your retirement—and how to sidestep them with confidence.

Putting Everything in Cash

While it might feel “safe” to keep your money in cash, especially during volatile markets, this is a dangerous long-term strategy. Cash and traditional savings accounts typically earn less than the rate of inflation, meaning your purchasing power erodes over time. If inflation runs at 3% annually and your cash earns 1%, your real wealth is shrinking every year. Instead, reserve cash for emergencies (6–12 months of expenses), and keep the rest invested in a diversified portfolio that grows over time.

Lack of Diversification

Too many retirees make the mistake of putting all their eggs in one basket—whether it’s a single stock, a single sector, or even just one type of asset class. Diversification spreads your risk across multiple investments, helping protect your portfolio from a downturn in any one area. A smart mix might include U.S. and international stocks, bonds, real estate investment trusts (REITs), and dividend-paying ETFs. Using broad-based index funds like VTI or SPY can give you exposure to hundreds of companies with a single investment.

Ignoring Healthcare Costs

Healthcare is often the silent killer of retirement budgets. Many people mistakenly believe that Medicare covers everything, but it doesn’t. You’ll still have to pay for premiums, deductibles, co-pays, and services like dental, vision, and long-term care. Without proper planning, these costs can drain your savings faster than expected. Consider opening a Health Savings Account (HSA) early on if eligible—it offers triple tax advantages and can be used for qualified medical expenses in retirement. Also, look into supplemental Medicare insurance to reduce out-of-pocket costs.

Withdrawing Too Much Too Soon

One of the biggest risks to your portfolio is drawing down your savings too aggressively in the early years of retirement. This mistake, known as sequence of returns risk, can cause your portfolio to deplete much faster, especially if markets are down when you start withdrawing. The widely accepted 4% rule offers a general guideline: withdraw no more than 4% of your portfolio annually, adjusted for inflation, to make your money last 25–30 years. In uncertain times, consider starting with 3–3.5% and adjusting based on market performance and your needs.

Not Planning for Taxes

Taxes don’t stop when you retire—they just change. Failing to account for how your withdrawals will be taxed can leave you with a lot less than you expected. For example, traditional 401(k) and IRA distributions are taxed as ordinary income, while capital gains and qualified dividends may be taxed at lower rates. Smart strategies like Roth IRA conversions, tax-loss harvesting, and strategic withdrawal planning can help minimize your tax burden. It’s also wise to coordinate withdrawals between taxable, tax-deferred, and tax-free accounts to maximize after-tax income.

Pro Tip: Working with a fee-only financial advisor or using advanced planning software like NewRetirement or SmartAsset’s retirement planner can help you project tax impacts and optimize withdrawal strategies.

Avoiding these mistakes doesn’t just protect your savings—it empowers you to enjoy retirement with less stress and more freedom. Being proactive about these risks will help you make smarter, more sustainable decisions with your $500,000.

Frequently Asked Questions

Can I retire at 60 with $500,000?

Yes, but it depends on your expenses, location, and investment returns. If you can live on $40–50K/year and invest wisely, it’s doable.

What’s the safest way to invest $500,000 for retirement?

A mix of index funds, dividend ETFs, and bonds (like a 60/40 portfolio) is a good start. Use tools like Fidelity or Vanguard to get started.

Should I downsize my home to free up cash?

If your home is a big chunk of your net worth and housing costs are high, downsizing can dramatically improve your retirement plan.

What’s geoarbitrage, and how can I use it?

Geoarbitrage is living in a lower-cost area to stretch your money. Popular retiree spots include Mexico, Portugal, and Thailand.

How much should I keep in cash?

Keep 6–12 months’ worth of expenses in cash or a money market fund for emergencies.

What if I still have debt?

Pay off high-interest debt ASAP. You don’t want liabilities draining your retirement income.

Can I get by with part-time work in retirement?

Absolutely. Even $1,000/month from part-time work can significantly reduce your portfolio withdrawals.

Is Social Security enough to retire on?

For many, it’s not. But combined with a $500K portfolio, it can help cover basic needs.

What’s the 4% rule?

Withdraw 4% of your portfolio annually to make it last 25–30 years. For $500,000, that’s $20,000/year.

Where can I learn more?

Follow the Rhodes Brothers YouTube Channel for detailed breakdowns and strategies.

How to Retire on $500,000 Without Regret

Retiring on half a million dollars isn’t just possible—it’s practical with the right mindset and strategies. You don’t need to be rich. You need to be resourceful.

Here’s your action plan:

- Invest in diversified, growth-oriented portfolios

- Lower your cost of living

- Build in flexibility

- Plan for emergencies

- Know your numbers

- Keep learning and adjusting

Get started today by reviewing your budget, setting your investment strategy, and exploring low-cost living options.

Thanks for joining us in this guide. For more deep dives, actionable advice, and encouragement from real experts, subscribe to the Rhodes Brothers YouTube Channel.

Resource List

Books

- The Simple Path to Wealth by JL Collins

- Your Money or Your Life by Vicki Robin

- Die With Zero by Bill Perkins

- How Much Money Do I Need to Retire? by Todd Tresidder

Podcasts & YouTube

Tools

- Personal Capital – Track net worth and investments

- Portfolio Visualizer – Backtest investment strategies

- Fidelity / Vanguard – Low-cost retirement accounts

- Numbeo – Compare cost of living worldwide

- Social Security Quick Calculator – Estimate your benefits

- FireCalc – Retirement withdrawal simulator