For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

“Your network is your net worth.” These wise words from John S. Rhodes of the Rhodes Brothers encapsulate the essence of smart investing: it’s not always about money, but about where you focus your time, energy, and resources to create sustainable wealth. If you’ve been wondering how to make the best investments right now, this guide will walk you through actionable strategies that go beyond traditional financial advice. Whether it’s growing your financial assets, nurturing relationships, or investing in yourself, the key is to leverage what truly matters.

In this blog post, we’ll explore the top three investments that can transform your life, including financial assets, relationships, and self-growth. Backed by expert insights, tools, and examples, this comprehensive guide will empower you to take control of your wealth journey.

TL;DR

Here’s a quick breakdown of the best investments you can make right now:

- Invest in Financial Assets: Build wealth through stocks, real estate, and other income-generating assets that grow in value over time.

- Invest in Relationships: Strengthen personal and professional networks to unlock opportunities and create long-term value.

- Invest in Yourself: Focus on developing your skills, health, and mindset to maximize your potential.

These strategies are designed to help you create lasting wealth while aligning with what matters most in your life.

Investing in Financial Assets: Building Your Wealth Foundation

When it comes to wealth creation, financial assets are often the first thing that comes to mind. From dividend-paying stocks to real estate, the right financial investments can provide a steady stream of income while growing in value over time.

Key Strategies for Smart Financial Investments

Building wealth through financial assets requires a strategic approach. While many focus on chasing trends or the “next big thing,” the most sustainable investments are often those that offer steady growth, predictable income, and long-term value. Below, we delve into one of the most reliable financial strategies: dividend-paying stocks.

Dividend-Paying Stocks

Dividend-paying stocks are an excellent choice for generating passive income. Companies that consistently pay dividends—like the “Dividend Kings” or “Dividend Aristocrats”—are often financially stable, making them a low-risk option for long-term growth.

Example:

Coca-Cola has been paying dividends for over 60 years, making it a reliable investment. By reinvesting dividends, you can harness the power of compound interest to grow your portfolio.

Pro Tip: Start small with dividend ETFs like Vanguard Dividend Appreciation ETF (VIG) to diversify your exposure to multiple companies.

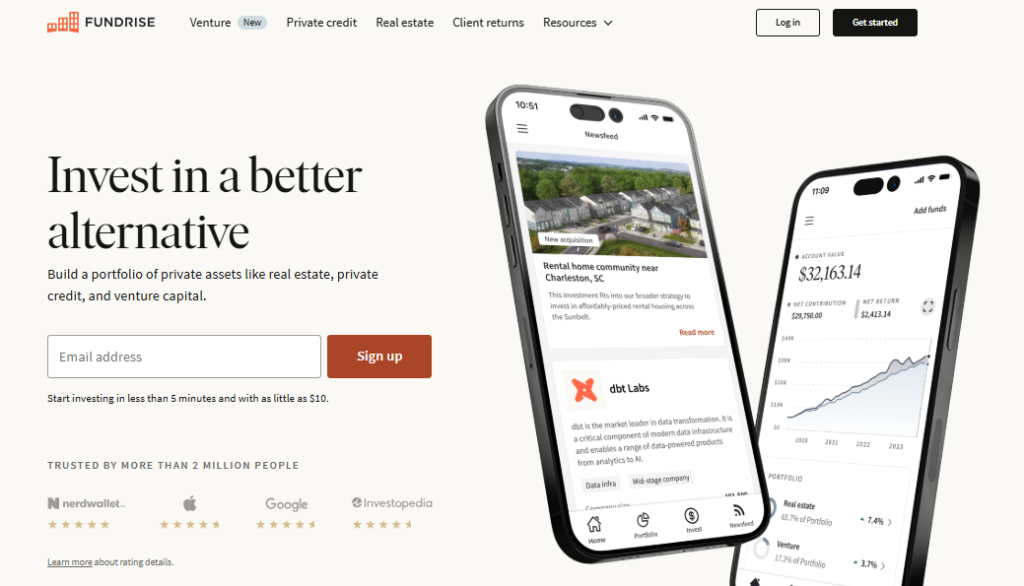

Real Estate and REITs

Real estate offers a unique advantage: it appreciates over time while providing cash flow through rent. If direct property ownership feels overwhelming, Real Estate Investment Trusts (REITs) are a more accessible option.

Tool to Use:

Platforms like Fundrise or Roofstock allow you to invest in REITs or individual properties with minimal upfront capital.

Diversification Across Asset Classes

Relying on one type of investment increases your financial risk. Diversify your portfolio by allocating funds across stocks, bonds, real estate, and alternative assets like farmland or commodities.

Actionable Tip: Use tools like Betterment or Wealthfront to create diversified portfolios tailored to your financial goals and risk tolerance.

Investing in Relationships: Building a Network That Pays Dividends

While financial assets are essential, relationships are equally powerful when it comes to wealth creation. Your network has the potential to open doors to opportunities, collaborations, mentorships, and even financial support during tough times.

How to Strengthen Your Network

Your network is one of the most valuable assets you can invest in. A strong network not only opens doors to opportunities but also provides a support system that can help you thrive personally and professionally. Strengthening your network is not about collecting as many contacts as possible—it’s about building meaningful relationships that create mutual value. Below, we’ll explore one of the most essential strategies: building genuine connections.

Build Genuine Connections

Building meaningful relationships starts with giving value. Help others solve problems, share opportunities, and offer support. When you lead with value, people naturally want to help you in return.

Real-Life Example:

John S. Rhodes shared in one of his talks that a strong email list or subscriber base is like having a goldmine of opportunities. By maintaining connections, he’s been able to consistently create value for his audience while growing his business.

Utilize Social Media and Networking Tools

Online platforms like LinkedIn, Twitter, and even Meetup can help you connect with like-minded individuals. Actively engage with posts, join industry-specific groups, and attend virtual events to expand your circle.

Tool to Use:

- LinkedIn Sales Navigator for professional connections.

- Canva for creating engaging content to share with your network.

Maintain Close Personal Relationships

Beyond professional networks, nurture personal relationships. Close family and friends can provide emotional support and encouragement, which is crucial for long-term success.

Pro Tip: Dedicate time each week to check in with friends and family. A simple phone call, text, or coffee meeting can go a long way in maintaining strong bonds.

Investing in Yourself: The Most Powerful Asset You Own

The most effective way to create wealth and success is by investing in yourself. Your knowledge, health, and mindset are the foundation for every other investment you make.

Areas to Focus On

When it comes to investing in yourself, prioritizing key areas that enhance your personal and professional growth is essential. By focusing on aspects that improve your knowledge, skills, and overall well-being, you can set the foundation for success. One of the most impactful areas to concentrate on is education and skills development. Lifelong learning not only increases your earning potential but also ensures you stay competitive and adaptable in a rapidly changing world.

Education and Skills Development

Continuing education is one of the most rewarding investments. Whether it’s learning a new skill, attending workshops, or earning certifications, self-improvement directly enhances your earning potential and career prospects.

Tools for Learning:

- Coursera: Offers affordable courses from top universities.

- Skillshare: Ideal for creative and business skills.

- Udemy: Great for niche skills like coding, marketing, or design.

Prioritize Health

Your health is your most important asset. Good physical and mental health increases productivity, energy levels, and overall happiness.

Actionable Steps:

- Exercise for at least 30 minutes daily.

- Practice mindfulness or meditation using apps like Headspace or Calm.

- Track your nutrition with tools like MyFitnessPal.

Develop a Growth Mindset

Your mindset determines your success. Adopting a growth mindset means believing in your ability to learn, adapt, and overcome challenges. Use tools like journaling and affirmations to reinforce positive beliefs.

Quote to Live By:

As Henry Ford famously said, “Whether you think you can or you think you can’t, you’re right.”

Actionable Steps to Profit from These Investments

To turn these investments into tangible results, it’s important to take consistent, practical steps. Below, we’ll break down how to effectively take action in three key areas: financial assets, relationships, and personal growth. Each section includes detailed steps and examples to help you get started today.

For Financial Assets

Investing your money wisely is one of the most straightforward paths to building wealth. Even if you’re starting small, consistency and smart planning can yield significant results over time.

Start Small: Begin with as little as $100 in ETFs or REITs.

You don’t need a large sum of money to begin investing. With $100 or less, you can start building your portfolio through low-cost ETFs (Exchange-Traded Funds) or REITs (Real Estate Investment Trusts).

Why ETFs?

- ETFs allow you to invest in a diversified portfolio of stocks or bonds without the need to pick individual companies. For example, the Vanguard S&P 500 ETF (VOO) tracks the performance of the S&P 500, providing exposure to the largest companies in the U.S.

- Example: If you invest $100 in VOO and consistently add $100 each month, you could see significant growth over time due to compounding returns.

Why REITs?

- REITs let you invest in real estate without owning physical property. For example, Fundrise and Public REITs allow you to earn income from real estate investments with minimal upfront capital.

- Example: Using Fundrise, you can start with as little as $10 and earn passive income from dividends paid by real estate projects.

Actionable Tip:

- Research platforms like Robinhood, Fidelity, or Charles Schwab to find beginner-friendly options for investing in ETFs or REITs. Commit to investing a small amount monthly to grow your portfolio steadily.

Automate Savings: Use apps like Acorns or Stash to invest spare change.

Automating your savings takes the stress out of consistently setting aside money for investments. Apps that round up your purchases or automate investments can make a big difference without requiring active effort.

- Acorns: Acorns links to your debit or credit card and rounds up your purchases to the nearest dollar, investing the spare change into a diversified ETF portfolio. For example, if you spend $3.75 on coffee, Acorns will round up to $4.00 and invest the $0.25 difference.

- Stash: Stash offers personalized portfolios and allows you to start investing with as little as $5. It also includes educational tools to help you learn the basics of investing.

Actionable Tip:

- Set up an account with one of these apps, link your bank card, and let the app handle small, consistent investments. Over time, these small contributions can grow into a significant portfolio.

Reinvest Earnings: Reinvest dividends to maximize compound returns.

Reinvesting the dividends you earn from stocks, ETFs, or REITs allows you to buy more shares and take advantage of compounding. Over time, this strategy can significantly boost your returns.

Dividend Reinvestment Plans (DRIPs):

- Most brokerage accounts offer DRIP options that automatically reinvest your dividends into additional shares of the same stock or ETF.

- Example: If you own shares in Procter & Gamble (a Dividend Aristocrat), reinvesting quarterly dividends can help you grow your shareholding without additional out-of-pocket investments.

Actionable Tip:

- Log in to your brokerage account and enable the DRIP feature for all dividend-paying investments. Regularly monitor your portfolio to track how reinvested dividends are increasing your holdings.

For Relationships

Building and maintaining strong relationships is an investment in social capital, which can lead to valuable opportunities, collaborations, and support systems.

- Attend Networking Events: Look for industry-specific events to meet new people.

- Networking events are excellent opportunities to meet potential mentors, collaborators, or clients who can help advance your career or personal goals.

Where to Find Events:

- Check platforms like Meetup, Eventbrite, and LinkedIn for industry-specific events, virtual conferences, or local gatherings.

- For professionals, associations like Toastmasters International or industry-specific organizations often host networking meetups.

Actionable Tip:

Attend at least one networking event per month. Set a goal to meet and connect with at least 3-5 people during each event. Prepare an elevator pitch about yourself or your goals to confidently introduce yourself.

- Follow Up Consistently: Send thank-you emails or messages after meeting someone new.

The key to building strong relationships is staying in touch. After meeting someone, a thoughtful follow-up can help you stand out and strengthen the bond.

What to Include in a Follow-Up:

- Thank them for their time or insights.

- Mention something specific you discussed to show you were paying attention.

- Offer something of value, such as a helpful article or a relevant introduction.

- Example: “Hi [Name], It was great meeting you at [Event]. I really enjoyed our conversation about [Topic]. Here’s an article I thought you’d find interesting. Let’s stay in touch!”

Actionable Tip:

- Create a system to track your new connections. Use tools like HubSpot CRM or even a simple spreadsheet to log who you meet, when you followed up, and the nature of your conversation.

Offer Value First: Share articles, resources, or introductions that might help others.

Networking is not just about asking for help—it’s about providing value to others. By being helpful and generous, you build trust and strengthen your relationships.

How to Offer Value:

- Share industry-related articles or resources that might interest your connections.

- Introduce someone to a person in your network who can help them achieve their goals.

- Offer your expertise if you can assist with a project or solve a problem.

- Example: If a connection mentions they’re looking to hire, share a job posting or refer someone from your network.

Actionable Tip:

- Make a habit of sending one helpful resource or introduction to someone in your network every week. This consistent effort builds goodwill and keeps you top-of-mind.

For Personal Growth

Investing in yourself is the most important long-term investment you can make. By focusing on self-improvement, you unlock opportunities for success and fulfillment.

- Set Clear Goals: Write down your short-term and long-term self-development goals.

Goal-setting creates a roadmap for your personal growth and helps you stay focused on what truly matters.

Short-Term Goals:

- Example: “Complete one online course this month” or “Read one book on leadership in the next 30 days.”

Long-Term Goals:

- Example: “Earn a professional certification in my field within the next year” or “Build a daily exercise habit over the next 6 months.”

Actionable Tip:

Write your goals down and place them somewhere visible, like your desk or phone. Use tools like Trello or Notion to break them down into actionable steps and track your progress.

- Schedule Learning: Dedicate 30 minutes daily to reading or taking an online course.

Consistency is key when it comes to personal growth. Block out time in your day specifically for learning, just as you would for meetings or exercise.

What to Learn:

- Read books on self-improvement, productivity, or your industry.

- Take online courses on platforms like Coursera, Udemy, or LinkedIn Learning.

- Watch educational YouTube videos or listen to podcasts during your commute.

Actionable Tip:

Set a recurring calendar reminder for your “learning time.” For example, schedule 30 minutes every morning or evening to focus on a course or book.

- Track Progress: Use tools like Notion or Habitica to monitor your growth.

Tracking your progress keeps you accountable and motivated. By reviewing your achievements regularly, you can see how far you’ve come and make adjustments to your plan.

Tools to Use:

- Notion: Create a personal dashboard to track your goals, learning milestones, and completed tasks.

- Habitica: Turn your personal growth into a gamified experience by earning rewards for completing habits like “Read for 30 minutes daily” or “Exercise 3 times a week.”

Actionable Tip:

At the end of each week, spend 10 minutes reviewing what you’ve accomplished. Celebrate your wins and identify areas for improvement.

By taking these expanded steps, you can turn your investments in financial assets, relationships, and personal growth into actionable strategies that yield measurable results. Remember, consistent effort over time is the key to long-term success.

Common Mistakes to Avoid

Even with the best intentions, there are certain pitfalls that can hinder your progress when investing in financial assets, relationships, or personal growth. By understanding and avoiding these common mistakes, you can ensure your efforts are effective and lead to meaningful results. Below, we’ll break down these mistakes and how to overcome them.

1. Focusing Only on Money

One of the most common mistakes people make is concentrating solely on financial investments while neglecting other critical areas of their lives, such as relationships and personal growth. While building wealth through financial assets is important, it’s only one piece of the puzzle. Neglecting relationships or failing to invest in your personal development can create an unbalanced life, limiting your ability to achieve long-term success and happiness. Financial wealth alone cannot replace the value of a strong support network or the fulfillment that comes from personal growth. To avoid this mistake, take a holistic approach to investing by allocating time and energy to other areas that enrich your life. For example, while you focus on building your investment portfolio, also nurture your relationships and dedicate time to learning new skills or improving your health. This balance ensures that your financial success is supported by a strong foundation in other areas.

2. Procrastinating Self-Investment

Another common pitfall is delaying self-investment, often waiting for the “perfect moment” to start. Many people put off learning new skills, pursuing personal goals, or improving their health because they feel they’re too busy or believe they’ll have more time in the future. However, this procrastination can lead to missed opportunities, as every day you delay is a day you could have spent building your knowledge, improving your skills, or enhancing your well-being. The truth is that there is rarely a perfect time to start, and taking small, consistent steps toward self-investment is far better than waiting for ideal circumstances. For example, instead of waiting for a long vacation to enroll in a course, commit to learning for just 30 minutes a day. By starting now, even with small efforts, you’ll build momentum and see progress over time. Remember, the earlier you begin investing in yourself, the greater the returns you’ll see in the future.

3. Ignoring Risks in Financial Investments

Many new investors make the mistake of ignoring or underestimating the risks involved in financial investments. This often happens when people are overly eager to chase high returns or follow trends without fully understanding the underlying risks. For instance, investing in high-yield stocks or speculative assets without proper research can lead to significant losses, especially if these investments are not diversified. Similarly, putting all your money into a single asset class, like stocks or cryptocurrency, can expose you to unnecessary risk. To avoid this mistake, it’s crucial to educate yourself about the investments you’re making and to diversify your portfolio across different asset classes, such as stocks, bonds, real estate, and ETFs. Tools like robo-advisors or financial planners can help you create a balanced portfolio that aligns with your risk tolerance and financial goals. By taking a cautious and informed approach, you can reduce the likelihood of losses and build a more stable foundation for your wealth.

4. Burning Bridges

In relationships, one of the biggest mistakes is failing to nurture connections or allowing conflicts to destroy important bonds. Burning bridges—whether through neglect, miscommunication, or unresolved disagreements—can limit your opportunities and damage your social capital. For example, failing to follow up with a mentor, colleague, or friend after they’ve helped you can create the impression that you’re ungrateful or uninterested. Similarly, reacting emotionally in conflicts without seeking resolution can lead to irreparable damage in professional or personal relationships. To avoid this mistake, prioritize maintaining and strengthening your connections. After meeting someone new or receiving help, always follow up with a thank-you message or gesture of appreciation. When conflicts arise, approach them with empathy and a willingness to resolve differences constructively. Building and maintaining strong relationships requires effort, but the rewards—such as access to opportunities, emotional support, and collaboration—make it one of the most valuable investments you can make.

By recognizing these mistakes and taking steps to avoid them, you can ensure that your investments in financial assets, relationships, and personal growth are effective and sustainable. Success is not just about avoiding failure—it’s about learning from these common missteps and creating a balanced, intentional approach to building a thriving and fulfilling life.

Frequently Asked Questions

What are the safest investments for beginners?

Dividend-paying stocks, government bonds, and REITs are ideal for beginners due to their stability and predictable returns.

How can I build a strong professional network?

Focus on building genuine relationships by offering value first. Use tools like LinkedIn to connect with professionals in your field.

What’s the best way to invest in myself?

Prioritize education, health, and mindset development. Start with online courses or workshops in areas that align with your goals.

How much should I invest in financial assets?

A good rule of thumb is to invest at least 20% of your income. Adjust based on your financial goals and risk tolerance.

Can relationships really impact my wealth?

Yes, strong networks can lead to new opportunities, collaborations, and even financial support during tough times.

What tools can help with self-investment?

Platforms like Coursera, Skillshare, and fitness trackers (e.g., Fitbit) are great for personal development.

How do I avoid common investment mistakes?

Diversify your portfolio, research thoroughly before investing, and avoid chasing trends.

Are alternative investments worth exploring?

Yes, if you’ve already built a stable portfolio. Options like farmland or peer-to-peer lending can offer diversification.

How do I stay motivated to invest in myself?

Set clear goals and track your progress regularly. Celebrate small wins to stay motivated.

What’s the best way to balance financial and personal investments?

Allocate time and money to both areas. For example, dedicate weekends to personal development and automate financial investments monthly.

Take the First Step Today

The best investments you can make right now aren’t limited to financial assets—they also include relationships and self-growth. By diversifying your financial portfolio, building strong networks, and continuously investing in yourself, you create a foundation for sustainable wealth and success.

John S. Rhodes reminds us to focus on what truly matters: “When you invest in yourself, you are the number one asset. Everything else flows from there.” Whether it’s learning new skills, strengthening your health, or cultivating relationships, these investments provide exponential returns over time.

Your Next Steps:

- Start small by automating a portion of your income toward financial investments.

- Reach out to a friend, colleague, or family member to reconnect and strengthen your network.

- Dedicate 30 minutes today to self-improvement, whether it’s reading, exercising, or learning a new skill.

For more actionable insights and strategies, subscribe to the Rhodes Brothers YouTube Channel. Their videos are packed with valuable advice to help you succeed in your wealth-building journey.

Resource List

Books

- The Intelligent Investor by Benjamin Graham

- Atomic Habits by James Clear

- How to Win Friends and Influence People by Dale Carnegie

Courses

Tools

- Fundrise for real estate investments.

- HubSpot CRM for relationship management.

Podcasts