“Is Bitcoin a safe haven or a rollercoaster ride?” This question has been on the lips of investors, tech enthusiasts, and financial gurus alike. As the crypto market continues to make headlines, understanding Bitcoin’s true nature as an investment vehicle has never been more crucial. Whether you’re a seasoned trader or a curious newcomer, the world of digital currencies offers both thrilling opportunities and nail-biting risks.

In this deep dive, we’ll explore the multifaceted nature of Bitcoin as an investment, drawing insights from experts like John S. Rhodes of the Rhodes Brothers. As John points out, “Bitcoin isn’t meant to be money or cash at least not yet… it’s more akin to Gold.” This perspective challenges conventional wisdom and opens up a new way of thinking about cryptocurrency investments.

From short-term volatility to long-term potential, we’ll unpack the complexities of Bitcoin’s role in a diversified portfolio. By the end of this article, you’ll have a clearer understanding of whether Bitcoin truly qualifies as a “safe” investment and how it might fit into your financial strategy.

TL;DR

- Bitcoin exhibits high short-term volatility, making it unsuitable as a traditional “flight to safety” asset

- Over 4+ year periods, Bitcoin has consistently shown strong performance against other assets and fiat currencies

- The fixed supply of 21 million Bitcoin creates scarcity, potentially enhancing long-term value

- Bitcoin should be viewed as a store of value similar to gold, rather than as everyday currency

- Proper understanding of Bitcoin’s nature and investment timeframe is crucial for success

Understanding Bitcoin’s True Nature

When we talk about Bitcoin as an investment, it’s crucial to understand its fundamental nature. As John S. Rhodes eloquently puts it, “Bitcoin isn’t meant to be money or cash at least not yet in the future it might be something more like a currency but it’s not that way right now it’s more akin to Gold.”

This comparison to gold is pivotal in reshaping our perspective on Bitcoin investments. Like gold, Bitcoin isn’t something you’d use for daily transactions or to pay bills. Instead, it serves as a store of value – a digital asset that can potentially preserve and grow wealth over time.

The Volatility Factor: Short-Term Turbulence vs. Long-Term Stability

Bitcoin’s reputation as a volatile asset is well-earned, but this characteristic is often misunderstood. While short-term price swings can be dramatic, Bitcoin’s long-term trajectory tells a different story. Understanding this dichotomy is crucial for anyone considering Bitcoin as an investment.

Navigating Bitcoin’s Volatile Waters

One of the most talked-about aspects of Bitcoin is its volatility. The price swings can be dramatic, often causing newcomers to question its viability as an investment. However, it’s essential to view this volatility in the right context.

Short-Term Fluctuations: Not for the Faint-Hearted

In the short term, Bitcoin’s price can fluctuate wildly. This makes it unsuitable as a traditional “flight to safety” asset – the kind of investment you’d turn to during economic turmoil for immediate stability. As Rhodes notes, “Bitcoin is not a flight to safety at least in the short term.”

The Long Game: Where Bitcoin Shines

The real magic happens when you zoom out and look at Bitcoin’s performance over longer periods. Rhodes emphasizes, “If you look at four-year cycles really um more than four year cycles if you go to five years or more for sure four is probably enough… Bitcoin is absolutely just a champion.”

This long-term perspective is crucial. Over periods of four years or more, Bitcoin has consistently outperformed many traditional assets, including fiat currencies like the US dollar.

The Scarcity Factor: Bitcoin’s 21 Million Cap

One of Bitcoin’s most distinctive and powerful features is its fixed supply cap of 21 million coins. This predetermined scarcity is a fundamental aspect of Bitcoin’s design and plays a crucial role in its value proposition as a potential store of wealth. Understanding the implications of this scarcity is essential for anyone considering Bitcoin as an investment.

Understanding Bitcoin’s Limited Supply

One of Bitcoin’s most compelling features as an investment is its fixed supply. There will only ever be 21 million Bitcoin in existence. This scarcity is a fundamental driver of its potential long-term value.

The Anti-Inflation Hedge

In a world where central banks can print unlimited fiat currency, leading to inflation, Bitcoin’s fixed supply stands out as a potential hedge. Rhodes points out, “The US dollar is being inflated away at a crazy crazy rate even if it’s 5% a year that is insane.”

This contrast between Bitcoin’s scarcity and the inflationary nature of fiat currencies is a key factor for many long-term investors.

Strategies for Bitcoin Investment

Investing in Bitcoin can be an exciting yet daunting prospect. Given its unique characteristics and volatile nature, it’s crucial to approach Bitcoin investment with a well-thought-out strategy. This section will explore various approaches to investing in Bitcoin, with a focus on adopting a long-term mindset.

Adopting a Long-Term Mindset

Given Bitcoin’s nature, successful investment strategies often revolve around a long-term approach. Here are some key strategies to consider:

- Dollar-Cost Averaging: Instead of trying to time the market, consider investing a fixed amount regularly over time.

- HODL (Hold On for Dear Life): This popular crypto strategy involves holding onto your Bitcoin through market ups and downs.

- Diversification: While Bitcoin can be a powerful addition to a portfolio, it shouldn’t be the only asset you hold.

Tools for Bitcoin Investors

Several tools can help you navigate the Bitcoin investment landscape:

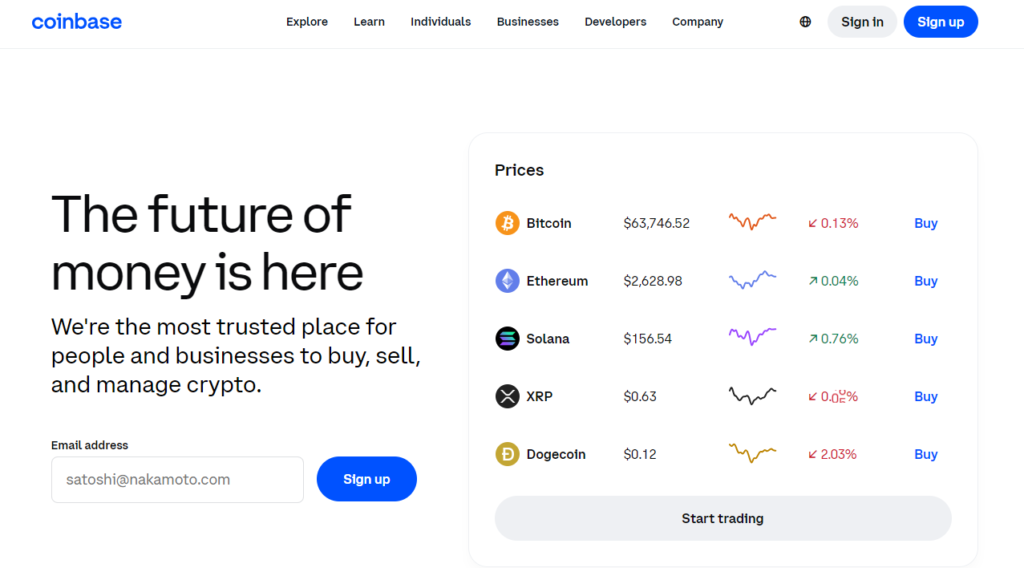

- Cryptocurrency exchanges like Coinbase or Binance for buying and selling Bitcoin

- Hardware wallets like Ledger or Trezor for secure storage

- Portfolio tracking apps like Delta or Blockfolio to monitor your investments

The Importance of Education and Research

In the rapidly evolving world of cryptocurrencies, education and research are not just beneficial—they’re essential. The cryptocurrency market, particularly Bitcoin, is known for its complexity, volatility, and constant innovation. To navigate this landscape successfully, investors must commit to ongoing learning and stay informed about market trends, technological developments, and regulatory changes.

Staying Informed in a Fast-Moving Market

The cryptocurrency market evolves rapidly, making continuous education crucial. Stay updated with reputable news sources, follow thought leaders in the space, and consider joining online communities to share insights.

As the famous investor Warren Buffett once said, “Risk comes from not knowing what you’re doing.” This rings especially true in the world of Bitcoin investment.

Actionable Steps for Bitcoin Investment Strategies

For Beginners:

- Educate Yourself

- Read “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto

- Take a free online course on Bitcoin basics from platforms like Coursera or edX

- Follow reputable crypto news sites like CoinDesk or Cointelegraph

- Start Small

- Determine an amount you’re comfortable potentially losing (e.g., 1-5% of your investment portfolio)

- Open an account on a beginner-friendly exchange like Coinbase or Gemini

- Make your first small purchase of Bitcoin

- Secure Your Investment

- Set up two-factor authentication on your exchange account

- Consider transferring your Bitcoin to a hardware wallet for long-term storage

- Write down and securely store your wallet’s recovery phrase

- Implement Dollar-Cost Averaging (DCA)

- Set up automatic weekly or monthly purchases of a fixed dollar amount

- Start with a small amount, like $10 or $20 per week

- Stick to this plan regardless of price fluctuations

- Learn and Adjust

- Monitor your investment without obsessing over daily price changes

- Continue your education by joining Bitcoin forums or local meetups

- Reassess your strategy every 3-6 months

For Intermediate Investors:

- Diversify Your Bitcoin Investment Methods

- Explore Bitcoin ETFs or trusts like Grayscale’s GBTC

- Consider Bitcoin mining stocks as an indirect investment

- Look into Bitcoin futures contracts (with caution)

- Enhance Your Security

- Set up a multi-signature wallet for added protection

- Use a password manager for your various crypto-related accounts

- Consider setting up a separate device solely for cryptocurrency transactions

- Implement Advanced DCA Strategies

- Use a value averaging strategy, adjusting your investment based on performance

- Set up automatic buys during typical market dip days (e.g., “Red Sundays”)

- Consider increasing your DCA amount after significant market drops

- Explore Lending and Yield Opportunities

- Research platforms that offer interest on Bitcoin holdings

- Understand the risks involved with lending your Bitcoin

- Start with a small portion of your holdings to test the waters

- Engage in Technical Analysis

- Learn to read Bitcoin price charts and understand basic indicators

- Use tools like TradingView to analyze market trends

- Practice making predictions based on your analysis, but avoid over-trading

For Advanced Investors:

- Implement Complex Trading Strategies

- Explore arbitrage opportunities between different exchanges

- Consider setting up automated trading bots (with extreme caution)

- Use options strategies to hedge your Bitcoin position

- Participate in the Lightning Network

- Set up a Lightning Network node to support the Bitcoin ecosystem

- Explore opportunities for earning through routing payments

- Use Lightning for micro-transactions and experience Bitcoin’s scaling solution

- Contribute to the Bitcoin Ecosystem

- Contribute to open-source Bitcoin projects on GitHub

- Consider running a full Bitcoin node to support the network

- Explore opportunities to accept Bitcoin in your business

- Sophisticated Portfolio Management

- Use advanced portfolio management tools to track your crypto investments

- Implement a dynamic asset allocation strategy, rebalancing between Bitcoin and other assets

- Explore tax-loss harvesting strategies (consult with a tax professional)

- Stay Ahead of Regulatory Changes

- Engage with local politicians about cryptocurrency regulations

- Consider joining or supporting cryptocurrency advocacy groups

- Stay informed about global regulatory trends and adjust your strategy accordingly

Remember, regardless of your experience level, never invest more than you can afford to lose, and always prioritize security and long-term thinking in your Bitcoin investment strategy.

Common Mistakes to Avoid in Bitcoin Investment

Mistake: Investing More Than You Can Afford to Lose

Bitcoin’s volatility can lead to significant losses, and some investors get caught up in the hype, risking more than they should.

Solution:

- Set a strict budget for Bitcoin investment, typically no more than 1-5% of your total investment portfolio

- Use only disposable income for Bitcoin investments

- Regularly reassess your financial situation and adjust your investment accordingly

Mistake: Neglecting Security Measures

Many investors underestimate the importance of security in the cryptocurrency world, leading to potential theft or loss of funds.

Solution:

- Use hardware wallets for long-term storage of significant amounts

- Enable two-factor authentication on all exchange accounts

- Never share your private keys or recovery phrases with anyone

- Use unique, strong passwords for each crypto-related account

- Be wary of phishing attempts and only use official websites

Mistake: Falling for Scams and Get-Rich-Quick Schemes

The cryptocurrency space is rife with scams that promise unrealistic returns or insider information.

Solution:

- Be extremely skeptical of any investment opportunity that promises guaranteed returns

- Research thoroughly before investing in any new project or ICO

- Avoid responding to unsolicited investment advice, especially on social media

- Remember: If it sounds too good to be true, it probably is

Mistake: Trying to Time the Market

Many novice investors try to buy low and sell high, often leading to poor decisions based on emotion rather than strategy.

Solution:

- Implement a dollar-cost averaging strategy to reduce the impact of volatility

- Set clear, long-term investment goals and stick to them

- Avoid making impulsive decisions based on short-term price movements

- If you must trade, only do so with a small portion of your overall Bitcoin holdings

Mistake: Lack of Diversification

Some investors put all their funds into Bitcoin, ignoring the benefits of a diversified portfolio.

Solution:

- Maintain a balanced investment portfolio that includes traditional assets

- Consider diversifying within the crypto space (but only after thorough research)

- Regularly rebalance your portfolio to maintain your desired asset allocation

Mistake: Not Understanding the Technology

Investing without understanding the underlying technology can lead to poor decision-making and vulnerability to misinformation.

Solution:

- Take time to learn about blockchain technology and how Bitcoin works

- Read the Bitcoin whitepaper and other educational resources

- Join reputable online communities to engage in discussions and learn from others

- Stay updated on technological developments in the Bitcoin network

Mistake: Ignoring Tax Implications

Many investors forget that Bitcoin transactions can be taxable events, leading to potential legal issues.

Solution:

- Keep detailed records of all your Bitcoin transactions

- Use crypto tax software to help track your transactions and calculate tax obligations

- Consult with a tax professional familiar with cryptocurrency regulations

- Stay informed about changes in cryptocurrency tax laws in your jurisdiction

Mistake: Overtrading

Frequent trading can lead to increased fees, taxable events, and often lower returns due to emotional decision-making.

Solution:

- Adopt a long-term investment strategy (e.g., HODL)

- If you must trade, set clear rules for entry and exit points

- Use a small portion of your holdings for trading and keep the majority for long-term holding

- Track your trading performance to understand if your strategy is actually profitable

Mistake: Relying on a Single Exchange

Using only one exchange exposes you to the risk of that exchange being hacked or becoming insolvent.

Solution:

- Research and use multiple reputable exchanges

- Don’t store large amounts of Bitcoin on exchanges; transfer to personal wallets

- Understand the insurance policies and security measures of the exchanges you use

Mistake: Panicking During Market Downturns

Many investors sell in panic during sharp price declines, realizing losses instead of holding through the volatility.

Solution:

- Develop a strong understanding of Bitcoin’s historical volatility

- Set realistic expectations for price movements

- Create an investment plan that accounts for potential market downturns

- Consider setting price alerts instead of constantly checking prices

By avoiding these common mistakes and implementing the suggested solutions, you can significantly improve your Bitcoin investment strategy and potentially achieve better long-term results. Remember, successful Bitcoin investing requires patience, education, and a disciplined approach.

Frequently Asked Questions

Is Bitcoin really a safe investment?

Bitcoin can be considered a relatively safe investment over the long term (4+ years), but it comes with significant short-term volatility. It’s important to understand that “safe” doesn’t mean risk-free. Bitcoin’s safety as an investment depends on your risk tolerance, investment timeline, and overall financial strategy.

How much should I invest in Bitcoin?

The amount you invest in Bitcoin should be based on your personal financial situation and risk tolerance. A common rule of thumb is to invest only what you can afford to lose. For many investors, this might mean allocating 1-5% of their investment portfolio to Bitcoin.

What’s the best way to buy Bitcoin?

The best way to buy Bitcoin is through a reputable cryptocurrency exchange. Popular options include Coinbase, Binance, and Kraken. Make sure to research and choose an exchange that’s licensed to operate in your country and has a good security track record.

How do I store my Bitcoin safely?

For maximum security, store your Bitcoin in a hardware wallet like Ledger or Trezor. These devices keep your cryptocurrencies offline, making them less vulnerable to hacking. For smaller amounts, you can use software wallets on your computer or smartphone, but be sure to enable all security features.

Can Bitcoin protect against inflation?

Bitcoin’s fixed supply of 21 million coins makes it potentially effective against inflation. Unlike fiat currencies that can be printed at will, Bitcoin’s scarcity could help it maintain or increase in value over time as the purchasing power of traditional currencies decreases.

What are the tax implications of investing in Bitcoin?

Tax laws for cryptocurrencies vary by country. In many jurisdictions, including the US, Bitcoin is treated as property for tax purposes. This means you may owe capital gains tax when you sell Bitcoin for a profit. Always consult with a tax professional for advice specific to your situation.

How does Bitcoin compare to traditional investments like stocks or gold?

Bitcoin is generally more volatile than traditional investments like stocks or gold. However, it has shown the potential for higher returns over longer periods. Unlike stocks, Bitcoin doesn’t represent ownership in a company, and unlike gold, it’s entirely digital. It’s often seen as a new asset class altogether.

Is it too late to invest in Bitcoin?

Many experts believe it’s not too late to invest in Bitcoin, as adoption is still in its early stages. However, the potential for high returns comes with increased risk. It’s important to do your own research and consider your long-term investment goals.

How does the halving event affect Bitcoin’s value?

The Bitcoin halving, which occurs approximately every four years, reduces the rate at which new Bitcoins are created. This event has historically been associated with price increases in the long term, as it reduces the supply of new Bitcoins entering the market.

What factors influence Bitcoin’s price?

Bitcoin’s price is influenced by various factors, including supply and demand, regulatory news, technological developments, macroeconomic factors, and market sentiment. Its relatively small market size compared to traditional assets can make it more susceptible to large price swings based on news events or large trades.

Navigating the Bitcoin Investment Landscape

As we’ve explored throughout this article, the question “Is Bitcoin a safe investment?” doesn’t have a simple yes or no answer. Bitcoin’s nature as a long-term store of value, its potential as an inflation hedge, and its impressive performance over 4+ year periods make it an intriguing investment option. However, its short-term volatility and the evolving regulatory landscape present risks that cannot be ignored.

The key takeaway is that Bitcoin can be a powerful addition to a diversified investment portfolio when approached with the right mindset and strategy. As John S. Rhodes emphasizes, viewing Bitcoin through a long-term lens is crucial. By understanding its unique characteristics, staying informed about market trends, and implementing sound investment practices, you can navigate the Bitcoin investment landscape more effectively.

The world of cryptocurrency is still relatively young and evolving. What remains constant is the need for thorough research, careful consideration of your financial goals, and a balanced approach to risk management.

We encourage you to take the first step in your Bitcoin investment journey by educating yourself further. Start by exploring reputable sources, joining cryptocurrency communities, and perhaps experimenting with a small investment to get hands-on experience.

For the latest videos and information to help you succeed in the world of cryptocurrency and beyond, we invite you to view and subscribe to the Rhodes Brothers YouTube Channel . Your financial future is in your hands – make it count!

Resource List

Books

- “The Bitcoin Standard” by Saifedean Ammous

- “Mastering Bitcoin” by Andreas M. Antonopoulos

- “The Internet of Money” by Andreas M. Antonopoulos

- “Cryptoassets” by Chris Burniske and Jack Tatar

Podcasts

- “What Bitcoin Did” with Peter McCormack

- “Unchained” with Laura Shin

- “The Pomp Podcast” with Anthony Pompliano

- “The Investor’s Podcast Network – Bitcoin Fundamentals” with Preston Pysh

Online Courses

- Coursera: “Bitcoin and Cryptocurrency Technologies” by Princeton University

- edX: “Blockchain and FinTech: Basics, Applications, and Limitations” by University of Hong Kong

Tools and Apps

- CoinGecko – for real-time price tracking and market data

- TradingView – for advanced charting and technical analysis

- Blockfolio – for portfolio tracking

- CoinTracker – for tax reporting and portfolio management

- Ledger Live – companion app for Ledger hardware wallets

Websites and Blogs

- CoinDesk – for cryptocurrency news and analysis

- Cointelegraph – for blockchain and crypto news

- Bitcoin.org – the official Bitcoin website

- Messari – for crypto research and market intelligence

- Glassnode – for on-chain analytics and market insights

Research Platforms

- Delphi Digital – for institutional-grade crypto research

- The Block – for news and research on digital assets

- Coin Metrics – for crypto financial analytics

- CryptoCompare – for real-time cryptocurrency data and research

- Chainalysis – for blockchain analysis and market intelligence

Community Forums

- Reddit r/Bitcoin – for discussions and news about Bitcoin

- BitcoinTalk – the original Bitcoin forum

- Stack Exchange Bitcoin – for technical Q&A about Bitcoin

These resources should provide a comprehensive starting point for anyone looking to deepen their understanding of Bitcoin as an investment. Remember to always cross-reference information and approach all investment decisions with careful consideration.