“Bitcoin has climbed roughly 50% this year,” declares John S. Rhodes of the Rhodes Brothers, highlighting the explosive potential of cryptocurrency investments.

This staggering growth has caught the attention of major financial institutions, with Morgan Stanley leading the charge in offering Bitcoin ETFs to select clients. But what does this mean for the average investor? Can you capitalize on this trend without millions in the bank? The answer might surprise you.

In this guide, we’ll dive deep into the world of Bitcoin ETFs, exploring how Morgan Stanley’s groundbreaking move is reshaping the investment landscape. We’ll uncover strategies for both high-net-worth individuals and everyday investors to potentially profit from this digital gold rush. Whether you’re a seasoned crypto enthusiast or a curious newcomer, this article will equip you with the knowledge to navigate the exciting, yet complex, world of Bitcoin investments.

As John S. Rhodes aptly puts it, “Access to bitcoin is getting easier and easier.” Let’s explore how you can position yourself to potentially benefit from this financial revolution, regardless of your net worth.

TL;DR

- Morgan Stanley is the first major Wall Street bank to offer Bitcoin ETFs to clients

- Two ETFs available: BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC)

- Clients need $15 million net worth and high risk tolerance to qualify through Morgan Stanley

- Alternative options exist for smaller investors to access these ETFs

- Bitcoin’s 50% climb this year is attracting significant attention from financial institutions

- Understanding the pros and cons of ETFs vs. self-custody is crucial for investors

- The move signals growing mainstream acceptance of cryptocurrency investments

Understanding the Bitcoin ETF Landscape

The cryptocurrency world is buzzing with excitement as Morgan Stanley takes a bold step into the Bitcoin ETF arena. This move marks a significant milestone in the journey of digital assets towards mainstream acceptance. Let’s break down what this means for investors and the broader financial landscape.

What Are Bitcoin ETFs?

Bitcoin ETFs, or Exchange-Traded Funds, are investment vehicles that track the price of Bitcoin without requiring investors to directly own or manage the cryptocurrency. They offer a way to gain exposure to Bitcoin’s price movements through traditional brokerage accounts.

Key Benefits of Bitcoin ETFs:

- Easier access for traditional investors

- Reduced technical barriers to entry

- Potential for inclusion in retirement accounts

- Professional management and security

The Morgan Stanley Move: A Game-Changer

Morgan Stanley’s decision to offer Bitcoin ETFs is groundbreaking for several reasons:

- Wall Street Validation: As the first major Wall Street bank to take this step, Morgan Stanley lends significant credibility to Bitcoin as an investment asset.

- Advisor Network: With 15,000 wealth advisors now able to recommend Bitcoin ETFs, the potential for widespread adoption increases dramatically.

- Institutional Interest: This move signals growing institutional acceptance of cryptocurrency, potentially paving the way for other banks to follow suit.

As John S. Rhodes notes, “This really sets a precedent because they are the first Wall Street Bank to do this.”

The Two Chosen ETFs

Morgan Stanley has selected two specific ETFs for their clients:

- BlackRock’s iShares Bitcoin Trust (IBIT)

- Fidelity’s Wise Origin Bitcoin Fund (FBTC)

Both funds have seen impressive gains, with Rhodes mentioning, “The two Bitcoin tracking ETF funds have gained about 35%.”

Navigating the Eligibility Criteria

While Morgan Stanley’s move is exciting, it’s important to note the stringent eligibility requirements:

- Minimum net worth of $15 million

- High risk tolerance

- Interest in speculative assets

These criteria significantly limit direct access through Morgan Stanley. However, don’t be discouraged! There are alternative routes for smaller investors to participate in the Bitcoin ETF market.

Alternative Access for Everyday Investors

If you don’t meet Morgan Stanley’s criteria, consider these options:

- Traditional Brokerages: Many online brokers like Charles Schwab offer access to Bitcoin ETFs with much lower entry barriers.

- Robo-Advisors: Some digital investment platforms are incorporating crypto-based ETFs into their portfolios.

- Self-Directed IRAs: Explore the possibility of including Bitcoin ETFs in your retirement strategy through specialized IRA providers.

Remember, as Rhodes points out, “You don’t need to be at this point in time you don’t need to be a Morgan Stanley client in order to access these ETFs.”

The Bigger Picture: Why Bitcoin ETFs Matter

The introduction of Bitcoin ETFs by a major bank like Morgan Stanley has far-reaching implications:

- Mainstream Adoption: It signals growing acceptance of cryptocurrency as a legitimate asset class.

- Regulatory Progress: The approval of these ETFs suggests a maturing regulatory environment for digital assets.

- Potential Market Impact: Increased institutional involvement could lead to greater price stability and liquidity in the Bitcoin market.

- Diversification Opportunities: Bitcoin ETFs offer a new avenue for portfolio diversification, potentially reducing overall investment risk.

As the famous investor Ray Dalio once said, “Bitcoin is one hell of an invention.” The introduction of ETFs makes this invention more accessible than ever before.

ETFs vs. Self-Custody

While ETFs offer convenience, it’s crucial to understand the trade-offs:

Pros of ETFs:

- Simplicity and familiarity

- Potential tax advantages

- Professional management

Cons of ETFs:

- Higher fees compared to direct ownership

- Less control over your assets

- Potential tracking errors

Self-custody, on the other hand, offers maximum control but requires more technical knowledge and personal responsibility for security.

John S. Rhodes advises, “While it is generally a wiser thing to do for certain people to acquire Bitcoin and then self-custody it, if you don’t want to have to worry about the technology and the tactics for self-custodianing Bitcoin, well these are the ways to do it.”

Steps to Get Started with Bitcoin ETFs

- Educate Yourself: Understand the basics of Bitcoin and blockchain technology.

- Assess Your Risk Tolerance: Be honest about your ability to withstand volatility.

- Choose a Brokerage: Select a platform that offers the Bitcoin ETFs you’re interested in.

- Start Small: Begin with a modest investment to get comfortable with the process.

- Monitor Performance: Keep an eye on your investment and the broader crypto market.

- Diversify: Don’t put all your eggs in one basket – consider Bitcoin ETFs as part of a broader investment strategy.

Tools for Bitcoin ETF Investors:

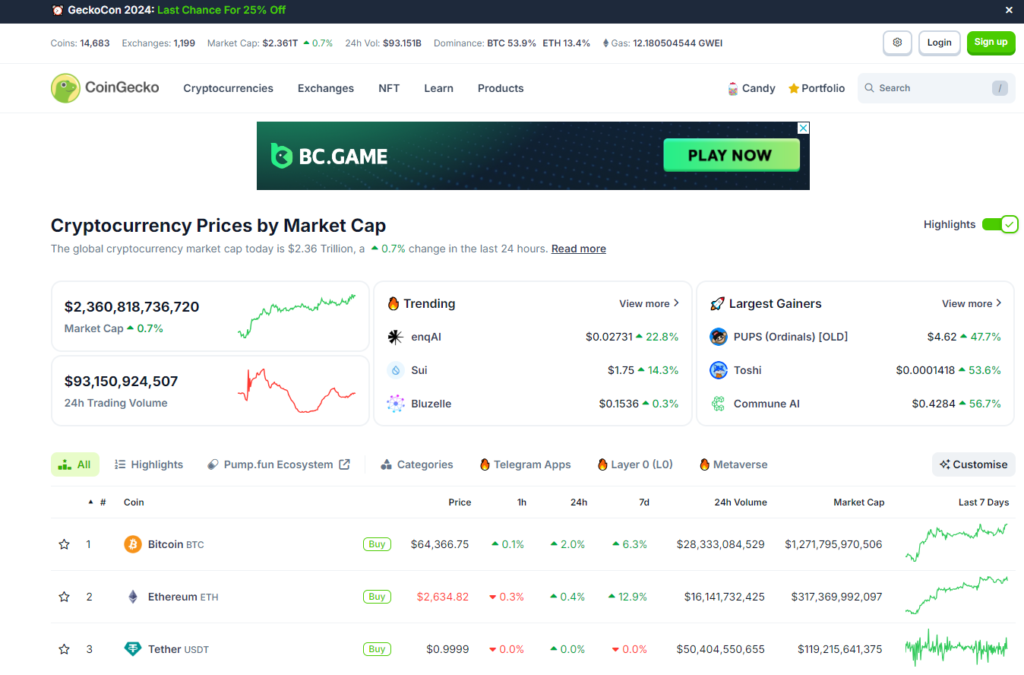

- CoinGecko or CoinMarketCap for price tracking

- TradingView for technical analysis

- CryptoCompare for ETF comparisons

- Blockfolio or Delta for portfolio management

Actionable Steps for Investing in Bitcoin ETFs

For Beginners:

- Educate yourself: Start by learning the basics of Bitcoin and blockchain technology.

- Open a brokerage account: Choose a reputable online broker that offers Bitcoin ETFs.

- Start small: Invest a small amount you’re comfortable with to get familiar with the process.

- Monitor performance: Regularly check your investment and stay informed about market trends.

- Diversify: Don’t put all your money into Bitcoin ETFs; maintain a balanced portfolio.

For Intermediate Investors:

- Compare ETFs: Research different Bitcoin ETFs to find the one that best suits your goals.

- Analyze fees: Look closely at expense ratios and management fees.

- Consider tax implications: Consult with a tax professional about the impact on your portfolio.

- Set up automatic investments: Use dollar-cost averaging to potentially reduce risk.

- Learn technical analysis: Use tools like TradingView to make more informed decisions.

For Advanced Investors:

- Explore options strategies: Consider using options on Bitcoin ETFs for more sophisticated trading.

- Implement hedging strategies: Use inverse ETFs or short-selling to protect against downside risk.

- Participate in securities lending: If your brokerage allows, lend your ETF shares for additional income.

- Conduct in-depth market analysis: Use on-chain analytics tools to inform your investment decisions.

- Consider international Bitcoin ETFs: Explore opportunities in other markets for diversification.

For Institutional Investors:

- Perform due diligence: Thoroughly review the ETF’s prospectus and management team.

- Assess liquidity needs: Ensure the ETF’s trading volume aligns with your investment size.

- Evaluate custody solutions: Understand how the ETF secures its Bitcoin holdings.

- Consider regulatory implications: Stay informed about evolving cryptocurrency regulations.

- Integrate with existing portfolio: Analyze how Bitcoin ETFs fit into your overall investment strategy.

Common Mistakes to Avoid

- Overinvesting

- Mistake: Allocating too much of your portfolio to Bitcoin ETFs.

- Solution: Limit your cryptocurrency exposure to a small percentage (e.g., 1-5%) of your total portfolio.

- Ignoring Volatility

- Mistake: Underestimating Bitcoin’s price swings.

- Solution: Set realistic expectations and be prepared for significant fluctuations.

- Neglecting Research

- Mistake: Investing based on hype or FOMO (Fear of Missing Out).

- Solution: Conduct thorough research and understand the underlying technology before investing.

- Misunderstanding ETF Structure

- Mistake: Assuming Bitcoin ETFs are the same as owning Bitcoin directly.

- Solution: Educate yourself on how ETFs work, including potential tracking errors and fees.

- Forgetting Security

- Mistake: Not securing your brokerage account properly.

- Solution: Use strong passwords, enable two-factor authentication, and be cautious of phishing attempts.

- Emotional Trading

- Mistake: Making impulsive decisions based on short-term market movements.

- Solution: Develop a long-term investment strategy and stick to it, avoiding panic selling or buying.

- Ignoring Tax Implications

- Mistake: Failing to consider the tax consequences of trading Bitcoin ETFs.

- Solution: Keep detailed records of all transactions and consult with a tax professional.

- Chasing Performance

- Mistake: Investing in an ETF solely based on its recent performance.

- Solution: Look at long-term trends and understand that past performance doesn’t guarantee future results.

- Overlooking Fees

- Mistake: Not comparing expense ratios between different Bitcoin ETFs.

- Solution: Factor in all costs when choosing an ETF, as high fees can significantly impact returns over time.

- Lack of Diversification

- Mistake: Concentrating all cryptocurrency investments in a single Bitcoin ETF.

- Solution: Consider diversifying across multiple crypto-related investments or different Bitcoin ETFs.

Statistics and Research

- According to a 2023 Fidelity Digital Assets survey, 74% of institutional investors plan to buy or invest in digital assets in the future.

- A 2024 report by Ark Invest predicts Bitcoin could reach $1.48 million per coin by 2030 in a bull case scenario.

Frequently Asked Questions

How do Bitcoin ETFs differ from buying Bitcoin directly?

Bitcoin ETFs allow you to gain exposure to Bitcoin’s price movements without the need to manage digital wallets or deal with cryptocurrency exchanges. They trade on traditional stock exchanges and can be bought and sold like regular stocks.

Are Bitcoin ETFs safer than holding Bitcoin directly?

While ETFs offer some protections, such as professional management and regulatory oversight, they still carry risks associated with Bitcoin’s volatility. They may be considered “safer” in terms of custody and ease of use, but the underlying asset remains highly speculative.

Can I include Bitcoin ETFs in my retirement account?

Yes, many retirement accounts allow for the inclusion of Bitcoin ETFs. However, it’s important to check with your specific retirement account provider and consider the long-term implications and risks.

What are the tax implications of investing in Bitcoin ETFs?

Bitcoin ETFs are typically treated like other ETFs for tax purposes. This means you may be subject to capital gains taxes when you sell. However, tax laws can be complex and vary by jurisdiction, so it’s advisable to consult with a tax professional.

How much should I invest in Bitcoin ETFs?

The amount you invest should depend on your overall financial situation, risk tolerance, and investment goals. Many financial advisors suggest limiting cryptocurrency exposure to 1-5% of your total portfolio.

Can Bitcoin ETFs be shorted?

Yes, like other ETFs, Bitcoin ETFs can typically be shorted. This allows investors to potentially profit from downward price movements, but it carries significant risks.

How do Bitcoin ETF fees compare to traditional ETFs?

Bitcoin ETFs generally have higher expense ratios compared to traditional stock or bond ETFs. This is due to the complexities involved in managing and securing Bitcoin assets.

What happens to my Bitcoin ETF investment if the fund closes?

If an ETF closes, the fund typically liquidates its assets and distributes the proceeds to shareholders. However, the specific process can vary, so it’s important to read the fund’s prospectus.

Can international investors buy U.S.-listed Bitcoin ETFs?

This depends on your country’s regulations and the policies of your brokerage. Some international investors may be able to access U.S.-listed ETFs, while others may be restricted.

How closely do Bitcoin ETFs track the actual price of Bitcoin?

Bitcoin ETFs aim to track the price of Bitcoin closely, but there can be some tracking error due to factors like fees, trading costs, and market liquidity. It’s important to monitor the ETF’s performance against the actual Bitcoin price.

Embracing the Future of Finance

As we’ve explored in this comprehensive guide, the introduction of Bitcoin ETFs by Morgan Stanley marks a pivotal moment in the evolution of cryptocurrency investments. While access through this particular channel may be limited to high-net-worth individuals, the broader implications are clear: Bitcoin and other digital assets are increasingly becoming a part of the mainstream financial landscape.

Whether you choose to invest through ETFs, explore self-custody options, or simply watch from the sidelines, staying informed about these developments is crucial in today’s rapidly changing financial world. As with any investment, it’s essential to do your own research, understand the risks, and never invest more than you can afford to lose.

The world of Bitcoin and cryptocurrency is dynamic and full of potential. As John S. Rhodes aptly puts it, “These ETFs are incredible.” They represent a new frontier in investment opportunities, bridging the gap between traditional finance and the digital asset revolution.

We encourage you to take the first step in your cryptocurrency journey, whether that’s educating yourself further, consulting with a financial advisor, or making your first small investment in a Bitcoin ETF. The future of finance is here, and it’s more accessible than ever before.

For the latest videos and information to help you succeed in the world of cryptocurrency and beyond, we invite you to view and subscribe to the Rhodes Brothers YouTube Channel . Stay informed, stay curious, and embrace the opportunities that lie ahead in this exciting financial landscape.

Resource List

Books

- “The Bitcoin Standard” by Saifedean Ammous

- “Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond” by Chris Burniske and Jack Tatar

- “Mastering Bitcoin: Programming the Open Blockchain” by Andreas M. Antonopoulos

- “The Age of Cryptocurrency” by Paul Vigna and Michael J. Casey

- “Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher

Podcasts

- “What Bitcoin Did” by Peter McCormack

- “Unchained” by Laura Shin

- “The Pomp Podcast” by Anthony Pompliano

- “The Investor’s Podcast Network – We Study Billionaires”

- “Bankless” by Ryan Sean Adams and David Hoffman

Courses

- Coursera: “Bitcoin and Cryptocurrency Technologies” by Princeton University

- LinkedIn Learning: “Blockchain Basics”

Tools

- CoinMarketCap – for tracking cryptocurrency prices and market data

- TradingView – for technical analysis and charting

- Blockfolio – for portfolio tracking

- CryptoCompare – for comparing different cryptocurrencies and exchanges

- Ledger or Trezor – hardware wallets for secure storage of cryptocurrencies

- MetaMask – a browser extension for interacting with Ethereum-based applications

- CoinTracker – for tax reporting and portfolio management

- Glassnode – for on-chain analytics and market intelligence

- Crypto.com DeFi Wallet – for exploring decentralized finance

- Binance Academy – for educational resources on blockchain and cryptocurrency

Websites and Blogs

- CoinDesk – for cryptocurrency news and analysis

- Cointelegraph – for blockchain news and features

- Bitcoin Magazine – for in-depth Bitcoin coverage

- Decrypt – for cryptocurrency and blockchain news

- The Block – for institutional-grade crypto insights

Research and Analytics Platforms

- Messari – for crypto asset transparency

- DeFi Pulse – for decentralized finance metrics

- Santiment – for on-chain, social & development information on 1000+ cryptocurrencies

- Glassnode Studio – for on-chain market intelligence

These resources should provide a comprehensive starting point for anyone looking to deepen their understanding of Bitcoin, cryptocurrencies, and blockchain technology. Remember to always approach investment decisions with caution and seek professional advice when needed.