For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

Most people think investing is only for the wealthy or the ultra-savvy. But the truth is, anyone — yes, anyone — can start building wealth with the right strategies. You don’t need a finance degree, a six-figure income, or a Wall Street mentor. All you need is a clear plan, a bit of patience, and the willingness to get started.

If you’ve ever asked yourself, “Where do I even begin with investing?” — you’re not alone. In this post, we’re breaking down the best investment options for beginners in a way that’s simple, practical, and proven. Backed by insights from John S. Rhodes of the Rhodes Brothers Channel, we’ll walk you through the best beginner-friendly options, tools, and tactics to grow your money with confidence.

As John says:

“One of the best things you could do is lose your password to your account… so that all that happens is that your money compounds and compounds.”

That’s the beauty of smart investing: you set it up once, and let time do the heavy lifting.

In this guide, we’ll cover:

- Index Funds & ETFs: The safest way to dip your toes into investing

- Target Date Funds: Set-it-and-forget-it investing

- Smart habits and mindsets that make the biggest difference

- The most common mistakes beginners make — and how to avoid them

- Real-world tools and steps to start investing today

TL;DR – Quick Wins for Beginner Investors

- Start with Index Funds and ETFs for low-cost, diversified exposure

- Target Date Funds are ideal for hands-off investors with long-term goals

- Time is your best friend — the longer you leave your money in, the better

- Avoid emotional investing — don’t sell when the market drops

- Use platforms like Vanguard, Fidelity, and Schwab to get started

- Leave your portfolio alone — seriously, stop checking it every day

- Reinvest dividends and watch compounding work its magic

The Best Investment Options for Beginners

Getting started with investing doesn’t have to be overwhelming — in fact, your first investment could be the simplest decision you make for your financial future. With the right tools and knowledge, anyone can begin building wealth, no matter their age or income. If you’re new to investing and unsure where to start, you’re in the right place. This guide will break down the best investment options for beginners in a way that’s easy to understand, low-risk, and built for long-term success.

Why Simplicity Wins for Beginners

Investing can feel overwhelming — stocks, bonds, crypto, mutual funds… where do you even start? The answer? Start simple.

John S. Rhodes emphasizes using “broad market exposure with low fees”, and that’s where Index Funds and ETFs come in.

Index Funds & ETFs: Your Investing Starter Pack

What are they?

- Index Funds track a market index (like the S&P 500), giving you exposure to hundreds of companies in one fund.

- ETFs (Exchange-Traded Funds) are similar but trade like stocks on the market.

Why they’re perfect for beginners:

- Diversification: You’re not betting on just one company — you get a slice of many.

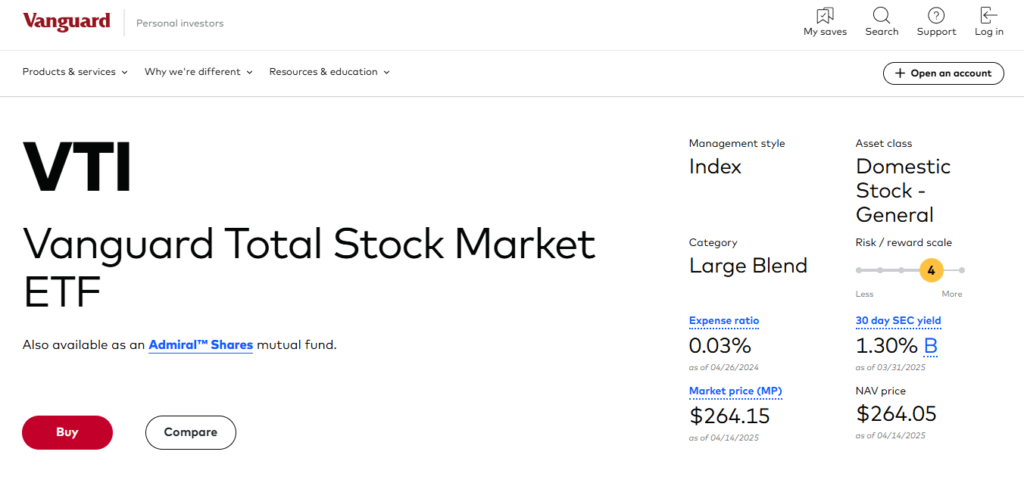

- Low cost: Fees are minimal. Vanguard’s S&P 500 ETF (VOO) has an expense ratio of just 0.03%.

- Passive investing: No need to constantly monitor the market.

Warren Buffett once said, “By periodically investing in an index fund… the know-nothing investor can actually outperform most investment professionals.”

Tools You Can Use:

- Vanguard VTI – Total US stock market

- Fidelity ZERO Total Market Index Fund (FZROX) – No fees

- Schwab S&P 500 Index Fund (SWPPX) – Low-cost and beginner-friendly

Target Date Funds: Set It and Forget It

If you want to invest without constantly thinking about it, Target Date Funds (TDFs) might be your new best friend. They’re designed for people who want to grow their money over time — without obsessing over market trends, asset allocation, or rebalancing. As John S. Rhodes says, these funds are “ideal for someone who just wants to automate their investing and not worry about it.”

They’re especially great for beginners who plan to invest for the long haul — like retirement — and want a hands-off, worry-free approach.

What are Target Date Funds?

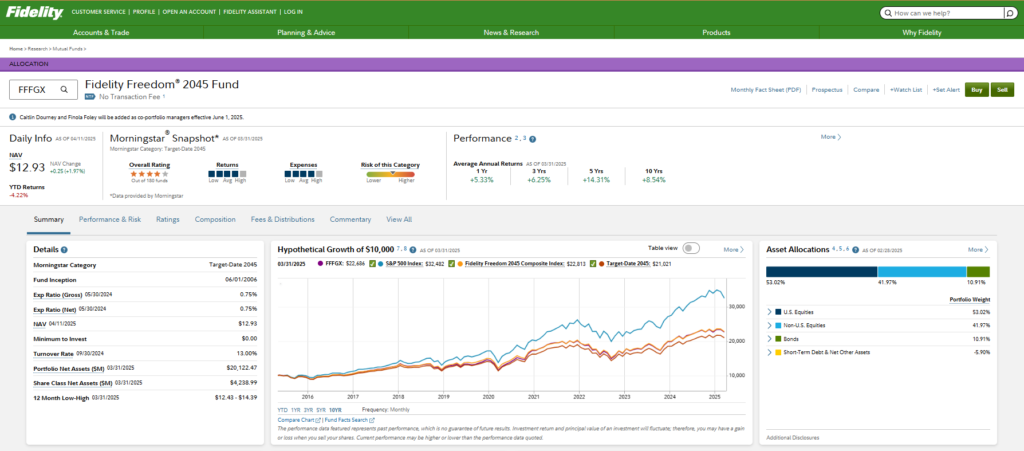

They’re mutual funds that automatically adjust your investment mix based on your retirement year. For example, a 2045 Target Date Fund starts aggressive with more stocks and gradually shifts to bonds as the target year approaches.

Why beginners love them:

- Automatic rebalancing

- Built-in diversification

- Zero effort after setup

John points out that while they may lean too heavily on bonds later in life, they’re still excellent for hands-off investors.

Popular Providers:

- Vanguard Target Retirement 2045 Fund (VTIVX)

- Fidelity Freedom 2045 Fund (FFFGX)

- T. Rowe Price Retirement 2045 Fund (TRRKX)

Play the Long Game: Time Is Your Best Ally

The longer you stay invested, the more you benefit from compound growth. This is where your money earns money — and then those earnings earn money.

John’s advice? “Don’t touch it. Time is your friend.”

Actionable Steps and Direct Advice for the Best Investment Options for Beginners

Whether you’re fresh out of college, in your 30s juggling work and family, or nearing retirement and finally ready to invest — there’s a practical path forward for everyone. Here’s how to tailor your investing journey based on where you are in life:

Beginners Just Getting Started (All Ages)

If you’re completely new to investing, start small but start now. Open a low-fee brokerage account with a trusted provider like Fidelity, Vanguard, or Schwab. From there:

- Choose a broad-based index fund or ETF like VTI (Total Stock Market) or VOO (S&P 500). These funds give you exposure to hundreds of companies with a single investment.

- Set up automatic monthly contributions, even if it’s just $25 or $50. This is called dollar-cost averaging, and it smooths out market volatility over time.

- Turn on dividend reinvestment, so your earnings go right back into growing your investment.

- Avoid checking your account too often — once a quarter is enough. Consistency beats timing.

Millennials in Their 20s and 30s

You’ve got one major asset on your side — time. The earlier you start, the more powerful compound interest becomes. Here’s what to do:

- Open a Roth IRA if you qualify — your investments grow tax-free, and withdrawals in retirement are tax-free too.

- Choose a Target Date Fund that aligns with your retirement year (e.g., 2060 or 2055). This fund will automatically adjust risk over time, so you don’t have to manage it.

- Use beginner-friendly apps like M1 Finance or Fidelity Spire to automate contributions and track your growth.

- If your employer offers a 401(k) with a match — always contribute enough to get the full match. That’s free money.

People Nearing Retirement (40s–60s)

It’s not too late to start — but you’ll want to prioritize stability and consistency. Focus on reducing risk while still allowing for some growth.

- Consider a Target Date Fund that’s closer to your retirement year (e.g., 2030, 2035). These funds shift toward bonds and cash as you get closer to retirement.

- If you’re more hands-on, build a 60/40 diversified portfolio (60% stocks, 40% bonds) using index funds like Vanguard’s Total Bond Market (BND) and Total Stock Market (VTI).

- Max out contributions to your IRA or 401(k) — people over 50 can take advantage of catch-up contributions.

- Keep your money accessible, but still growing. Consider low-risk ETFs, dividend stocks, or short-term bond funds for income and preservation.

Common Mistakes to Avoid (And How to Fix Them)

Even the most well-intentioned beginner investors fall into some classic traps — often because they’re chasing fast results or reacting emotionally. These mistakes aren’t just harmless missteps; they can seriously hurt your returns over time. Below, we’ll break down the most common investing mistakes and offer practical, proven solutions for staying on track.

1. Trying to Time the Market

The Mistake:

Many new investors try to “buy low and sell high” by predicting when the market will dip or spike. It sounds smart in theory, but in practice, even the pros get it wrong.

Why It’s a Problem:

Timing the market requires predicting two things: when to get out and when to get back in. Miss either, and you could lose out on major gains. In fact, a 2024 study by DALBAR found that investors who tried to time the market earned 3–4% less annually than those who stayed invested consistently.

The Fix:

Stick to dollar-cost averaging — a strategy where you invest a fixed amount of money on a regular schedule (e.g., monthly). This removes emotion from the equation and ensures you’re buying in both highs and lows, which averages out your cost over time.

2. Checking Your Portfolio Too Often

The Mistake:

Refreshing your investment app multiple times a day? You’re not alone. Many beginners obsessively track their portfolios, especially during market volatility.

Why It’s a Problem:

Frequent checking leads to emotional decisions. You might panic during a dip and sell early or rush to buy a hot stock out of FOMO. This behavior undermines the long-term mindset that’s essential for compound growth.

The Fix:

Once you’ve set up your portfolio, commit to checking it no more than once a quarter. Set a calendar reminder for a brief check-in and use that time to rebalance if needed — not to react emotionally.

3. Putting All Your Money in One Stock (Like Tesla or Apple)

The Mistake:

It’s tempting to go all-in on a company you believe in or one that’s been performing well. But betting your financial future on a single stock is risky and narrow.

Why It’s a Problem:

Individual stocks can be volatile. Even great companies experience massive drops — and if your money is tied up in one place, you could lose a lot in a short time. It’s the opposite of diversification.

The Fix:

Use index funds or ETFs to spread your risk across hundreds (or thousands) of companies. For example, VTI gives you exposure to the entire U.S. market, and VOO covers the top 500 companies. This way, if one company dips, your portfolio stays stable.

4. Freaking Out During Market Drops

The Mistake:

When the market takes a dive, many beginners panic and pull their money out — often locking in losses.

Why It’s a Problem:

Market downturns are natural and temporary. Selling during a dip means you’re selling low — the exact opposite of what you want to do.

The Fix:

Remember historical trends: the market has always recovered, even after major crashes. For example, after the 2008 crash, the S&P 500 rebounded and more than doubled within five years. Stay calm, trust your plan, and ride out the storm — your future self will thank you.

5. Ignoring Fees and Expense Ratios

The Mistake:

Many beginners overlook the fine print — especially expense ratios and management fees that come with certain funds or advisors.

Why It’s a Problem:

Even a small fee can eat into your long-term gains. For instance, a 1% fee on a $100,000 portfolio over 30 years can cost you more than $100,000 in lost growth.

The Fix:

Always check the expense ratio when choosing a fund. The goal? Stick to funds with expense ratios under 0.10%. Index funds and ETFs usually have the lowest fees. Tools like Morningstar, NerdWallet, or your brokerage’s research center can help you compare costs.

Frequently Asked Questions

How much money do I need to start investing?

You can start with as little as $5 to $10 on platforms like Fidelity or Robinhood.

What’s the difference between an ETF and an Index Fund?

Both are similar in diversification, but ETFs trade like stocks. Index funds only trade at the end of the day.

Is it better to invest monthly or all at once?

Monthly investing (dollar-cost averaging) reduces risk and builds discipline.

What’s a Roth IRA, and should I open one?

A Roth IRA allows tax-free growth. Yes, it’s one of the best retirement accounts for beginners.

Are Target Date Funds safe?

They’re designed to reduce risk over time and are ideal for long-term, passive investors.

Should I invest during a market crash?

Yes! Prices are low, so you’re getting more for your money.

What’s the best broker for beginners?

Fidelity, Vanguard, and Charles Schwab all have great options with no minimums.

How often should I check my investments?

Check in once a quarter, or even better — once a year.

What’s a good return on investment?

Historically, the S&P 500 returns about 7-10% annually after inflation.

Can I lose all my money?

If you invest in one stock, yes. If you use diversified funds, it’s very unlikely.

Ready to Start Investing? Let’s Recap.

If you’re a beginner, you don’t need to be a financial expert to start investing. Here’s what you need to remember:

- Start with Index Funds or ETFs — they’re simple and safe

- Consider a Target Date Fund if you want a hands-off approach

- Invest consistently and leave it alone

- Avoid panic selling during market dips

- Use trusted platforms like Vanguard, Fidelity, or Schwab

Get started today by opening your first investment account and setting up an automatic monthly contribution. The earlier you start, the more powerful your compounding advantage.

Thanks for checking out this guide! For more real, relatable financial advice, Subscribe to the Rhodes Brothers YouTube Channel and stay up to date with their latest content on investing, money mindset, and long-term wealth building.

Resource List

Books

- The Simple Path to Wealth by JL Collins

- I Will Teach You to Be Rich by Ramit Sethi

- The Psychology of Money by Morgan Housel

- Unshakeable by Tony Robbins

Podcasts

Tools & Platforms

- Vanguard – Best for long-term index fund investing

- Fidelity – User-friendly for beginners

- Charles Schwab – Great customer service and low-cost funds

- M1 Finance – Automated investing with pie charts

- Personal Capital – Free net worth and investment tracking

- Morningstar.com – Fund ratings and research

- NerdWallet – Investment comparison and reviews

Courses

- Investing for Beginners – Udemy Course

- Bogleheads Investing Start Guide – Free on Bogleheads.org

- Rhodes Brothers YouTube Channel – Subscribe here