For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

Have you ever found yourself staring at your bank account, wondering why it seems impossible to get ahead financially? Millions of people struggle with poverty, but here’s the truth: financial success is within your reach. With the right strategies and mindset, you can break free from the cycle of poverty and build lasting wealth.

In this comprehensive guide, we’ll explore nine powerful reasons why you might be poor and, more importantly, how to overcome them. Drawing from the wisdom of financial expert John S. Rhodes of the Rhodes Brothers, we’ll dive deep into practical solutions that can transform your financial future.

As John S. Rhodes wisely states, “What you focus on grows.” Let’s focus on growth, abundance, and financial mastery together.

TL;DR

- Learn to pay yourself first and build a financial buffer

- Understand the true cost of debt and how to eliminate it

- Discover strategies to increase your income and control spending

- Master the art of saving, investing, and tax optimization

- Develop a caring mindset towards your finances and others

The Power of Paying Yourself First

In the world of personal finance, few principles are as powerful and transformative as paying yourself first. This concept, championed by financial experts like John S. Rhodes, is the cornerstone of building long-term wealth and financial security.

Breaking the Paycheck-to-Paycheck Cycle

One of the most common reasons people remain poor is failing to pay themselves first. It’s easy to fall into the trap of paying bills, debts, and expenses before setting anything aside for your future. But this approach leaves you with nothing at the end of the month.

John S. Rhodes emphasizes, “Paying yourself first means setting money aside. It could be 1%, 5%, 10%, or even as high as 50%.” Start small if you need to, but make it a non-negotiable part of your financial routine.

Step-by-step guide to paying yourself first:

- Calculate your monthly income

- Determine a percentage to save (start with 5-10% if possible)

- Set up automatic transfers to a separate savings account

- Adjust your budget to accommodate this new “expense”

- Gradually increase the percentage as your financial situation improves

Debunking the Myth of “Good Debt”

Debt is often portrayed as a necessary evil in our financial lives, with some types even labeled as “good debt.” However, this perspective can be misleading and potentially harmful to your financial health. Let’s explore why all debt should be approached with caution.

The Hidden Costs of Borrowing

Many people justify certain types of debt as “good debt,” such as mortgages or student loans. However, Rhodes challenges this notion, stating, “No debt is good debt. In fact, no debt is the best debt.”

While some debt may be necessary, it’s crucial to understand the true cost of borrowing. Interest payments can significantly erode your wealth over time, especially if you’re only making minimum payments.

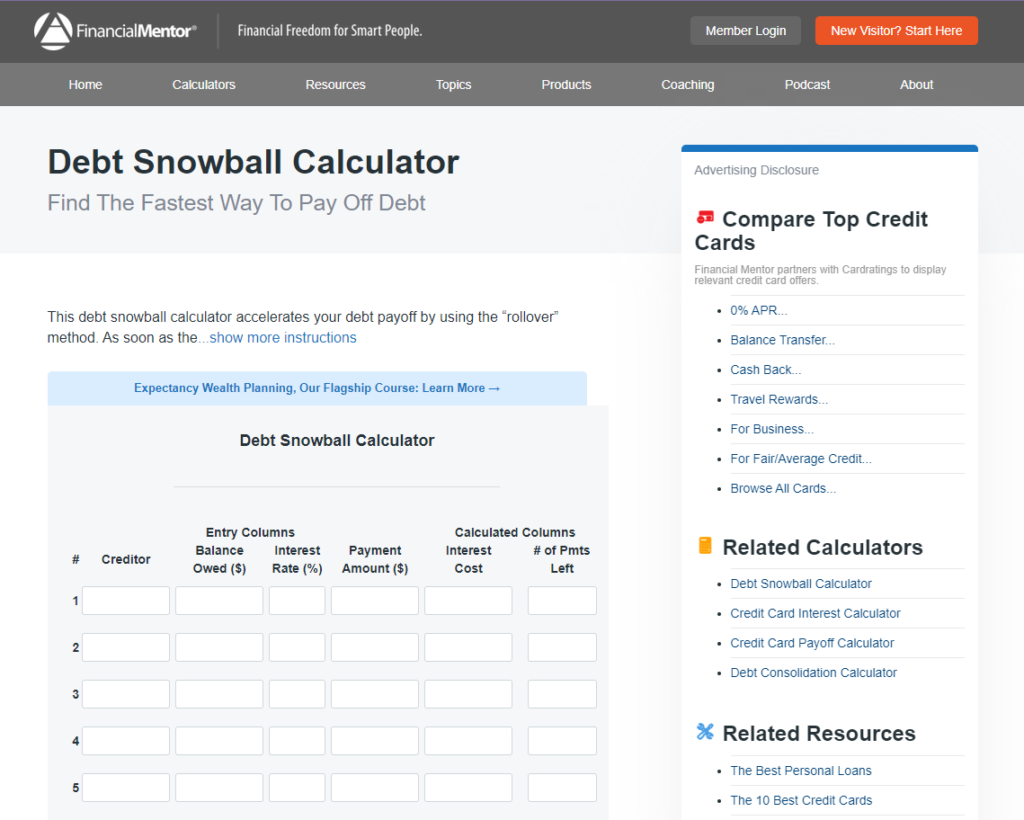

Tools to help you tackle debt:

- Debt snowball calculator

- Credit score monitoring apps

- Budgeting apps like YNAB or Mint

Building a Financial Buffer: Your Safety Net

Life is unpredictable, and financial emergencies can strike at any moment. That’s why having a solid financial buffer is crucial for long-term financial stability and peace of mind.

Preparing for Life’s Unexpected Turns

Life is unpredictable, and without a financial buffer, you’re always one emergency away from financial disaster. As the old saying goes, “Dig the well before you’re thirsty.”

Rhodes recommends building an emergency fund that covers 3-12 months of expenses. This buffer provides peace of mind and prevents you from falling into debt when unexpected costs arise.

Steps to create your financial buffer:

- Determine your monthly expenses

- Set a realistic goal (e.g., 3 months of expenses)

- Open a high-yield savings account

- Automate regular contributions

- Resist the urge to dip into this fund for non-emergencies

The Art of Increasing Your Income

While managing expenses is important, there’s a limit to how much you can cut. On the other hand, your income potential is virtually limitless. Let’s explore strategies to boost your earnings and accelerate your journey to financial freedom.

Exploring New Opportunities for Growth

Accepting a stagnant income is a surefire way to remain poor. Rhodes encourages seeking new opportunities to boost your earnings, whether through job changes, side hustles, or additional training.

“I can’t tell you the number of people that I know that have simply jumped from one job to another, really one company to another, doing basically the exact same job. The interesting thing is that the salary goes up,” Rhodes notes.

Strategies to increase your income:

- Negotiate a raise at your current job

- Explore job opportunities in your field

- Develop in-demand skills through online courses

- Start a side hustle or freelance business

- Invest in yourself through education and training

Mastering Mindful Spending

In our consumer-driven society, it’s easy to fall into the trap of mindless spending. However, taking control of your expenses is a crucial step towards financial stability and wealth building.

Taking Control of Your Financial Outflow

Uncontrolled spending is a major obstacle to financial success. Rhodes advises, “If it’s in my pocket, then it’s spent.” This mindset encourages you to be more conscious of your spending habits.

Actionable tips for mindful spending:

- Track all expenses for a month

- Identify and eliminate unnecessary costs

- Use cash envelopes for discretionary spending

- Wait 24 hours before making non-essential purchases

- Find free or low-cost alternatives for entertainment

The Power of Consistent Saving

Saving money is more than just a good habit – it’s a fundamental pillar of financial success. By consistently setting aside a portion of your income, you’re building a foundation for future wealth and security.

Transforming Savings into Investments

Saving money is crucial, but it’s only the first step. Once you’ve built your emergency fund, it’s time to focus on long-term wealth building through investing.

As Warren Buffett famously said, “Do not save what is left after spending, but spend what is left after saving.”

Steps to maximize your savings:

- Automate your savings

- Explore high-yield savings accounts

- Consider certificates of deposit (CDs) for short-term goals

- Research low-cost index funds for long-term investing

- Regularly review and adjust your savings strategy

Navigating the Tax Landscape

Taxes are an inevitable part of our financial lives, but they don’t have to be a mystery. Understanding how taxes work and how to optimize your tax situation can significantly impact your overall financial health.

Optimizing Your Tax Situation

Many people overlook the impact of taxes on their financial health. Understanding your effective tax rate and exploring legal tax optimization strategies can significantly boost your wealth over time.

Tools for tax optimization:

- Tax preparation software

- IRS withholding calculator

- Retirement account contribution calculators

The Importance of Early Investing

When it comes to investing, time is your greatest ally. The sooner you start, the more you can benefit from the power of compound interest and long-term market growth.

Harnessing the Power of Compound Interest

Procrastination is the enemy of wealth building. The sooner you start investing, the more time your money has to grow through compound interest.

Albert Einstein reportedly called compound interest “the eighth wonder of the world,” saying, “He who understands it, earns it; he who doesn’t, pays it.”

Steps to get started with investing:

- Educate yourself on basic investment principles

- Open a retirement account (e.g., 401(k) or IRA)

- Consider low-cost index funds for diversification

- Set up automatic contributions

- Regularly review and rebalance your portfolio

Cultivating a Wealth Mindset

Your mindset plays a crucial role in your financial journey. Developing a positive, abundance-focused attitude towards money can open up new opportunities and drive you towards your financial goals.

The Emotional Component of Financial Success

Rhodes emphasizes the importance of caring deeply about your finances. This involves both internal reflection and external focus on helping others.

“Caring is of critical importance here. Caring is what makes us all work,” Rhodes explains. This mindset shift can be transformative in your financial journey.

Actionable Steps for Breaking Free from Poverty

For Those in Severe Financial Distress:

- Focus on meeting basic needs first (food, shelter, utilities)

- Seek assistance from local food banks, community organizations, or government programs

- Negotiate with creditors for hardship programs or payment plans

- Consider credit counseling from a reputable non-profit organization

For Low-Income Individuals:

- Prioritize increasing your income through skills development and job searching

- Take advantage of free or low-cost educational resources to improve your employability

- Look for ways to reduce major expenses like housing and transportation

- Build a support network of people with similar financial goals

For Middle-Income Earners:

- Maximize retirement account contributions, especially if there’s an employer match

- Consider house hacking or other real estate strategies to reduce housing costs

- Develop multiple streams of income to increase financial stability

- Start thinking about long-term wealth building through diversified investments

For High-Income Earners:

- Focus on avoiding lifestyle inflation as your income grows

- Explore advanced tax optimization strategies with a professional

- Consider starting your own business or investing in income-producing assets

- Look into philanthropic strategies that align with your values and offer tax benefits

Start where you are, use what you have, and do what you can. Consistency and persistence are key to long-term financial success.

Common Mistakes to Avoid When Trying to Break Free from Poverty

Mistake: Ignoring the importance of financial education

Solution:

- Dedicate time each week to learning about personal finance

- Start with free resources like library books, podcasts, and reputable online courses

- Join local financial literacy workshops or community classes

Mistake: Relying solely on cutting expenses without increasing income

Solution:

- Focus on both reducing expenses and increasing income simultaneously

- Invest time in developing marketable skills

- Explore side hustles or part-time work opportunities

Mistake: Falling into the payday loan trap

Solution:

- Avoid payday loans at all costs

- Explore alternatives like credit union loans, paycheck advances from employers, or small personal loans from banks

- Build an emergency fund to cover unexpected expenses

Mistake: Not having a budget or financial plan

Solution:

- Create a simple budget using the 50/30/20 rule as a starting point

- Use free budgeting apps to track expenses

- Review and adjust your budget regularly

Mistake: Letting emotions drive financial decisions

Solution:

- Implement a “cooling off” period before major purchases

- Develop a written financial plan to guide decisions

- Seek advice from a trusted, financially savvy friend or professional before making big financial moves

Mistake: Neglecting to build an emergency fund

Solution:

- Start small, even $5 per week, and gradually increase

- Keep emergency funds separate from regular savings

- Aim for 3-6 months of living expenses over time

Mistake: Trying to keep up with others’ lifestyles

Solution:

- Focus on your own financial goals rather than comparing to others

- Practice gratitude for what you have

- Find free or low-cost alternatives for social activities

Mistake: Not negotiating bills or seeking better deals

Solution:

- Regularly review and negotiate recurring bills (e.g., phone, internet, insurance)

- Compare prices for major purchases and services

- Don’t be afraid to ask for discounts or better rates

Mistake: Avoiding difficult financial conversations with family

Solution:

- Schedule regular “money talks” with your partner or family

- Be open about financial goals and challenges

- Work together to create a family financial plan

Mistake: Focusing only on short-term financial needs

Solution:

- Set both short-term and long-term financial goals

- Start investing for the future, even if it’s just a small amount

- Consider how current decisions impact your long-term financial health

Mistake: Not utilizing available resources and assistance programs

Solution:

- Research government assistance programs you might qualify for

- Look into local non-profit organizations that offer financial help or resources

- Don’t be ashamed to use food banks or other community resources when needed

Mistake: Falling for get-rich-quick schemes

Solution:

- Be skeptical of promises of fast, easy money

- Research thoroughly before investing time or money in any opportunity

- Remember: if it sounds too good to be true, it probably is

Mistake: Not protecting against identity theft and fraud

Solution:

- Regularly check your credit report for free at AnnualCreditReport.com

- Use strong, unique passwords for financial accounts

- Be cautious about sharing personal information online or over the phone

Mistake: Overlooking the importance of insurance

Solution:

- Evaluate your need for health, life, and disability insurance

- Shop around for the best rates on necessary insurance

- Don’t skimp on coverage to save money in the short term

Mistake: Not seeking professional help when needed

Solution:

- Consider meeting with a financial advisor or credit counselor for complex financial issues

- Look for free or low-cost financial counseling services in your community

- Don’t be afraid to ask for help when you’re feeling overwhelmed

Everyone makes financial mistakes. The key is to learn from them and make better choices going forward. By avoiding these common pitfalls and implementing the suggested solutions, you can create a stronger foundation for your financial future and increase your chances of breaking free from poverty.

Statistics and Research

According to a 2023 Federal Reserve report, 35% of Americans would struggle to cover a $400 emergency expense. This underscores the importance of building an emergency fund.

Frequently Asked Questions

How can I start saving money when I’m living paycheck to paycheck?

Start by tracking all your expenses for a month to identify areas where you can cut back. Then, set a small, achievable savings goal, even if it’s just $20 per paycheck. Automate this savings to ensure consistency. Gradually increase your savings as you find more ways to reduce expenses or increase income.

Is it better to pay off debt or start investing?

Generally, it’s best to focus on paying off high-interest debt (like credit card balances) before investing heavily. However, if you have low-interest debt, you might consider a balanced approach of paying down debt while also starting to invest, especially if your employer offers a 401(k) match.

How much should I have in my emergency fund?

Aim for 3-6 months of living expenses. Start with a smaller goal, like $1,000, and build from there. The exact amount depends on your individual circumstances, such as job stability and financial obligations.

What’s the best way to increase my income?

There are several strategies: negotiate a raise at your current job, develop new skills to qualify for higher-paying positions, start a side hustle, or consider changing careers. Focus on adding value and solving problems to increase your earning potential.

How can I improve my credit score?

Pay all bills on time, reduce credit card balances, avoid applying for new credit unnecessarily, and keep old credit accounts open. Regularly check your credit report for errors and dispute any inaccuracies.

What’s the difference between saving and investing?

aving typically involves putting money aside in low-risk, easily accessible accounts like savings accounts or CDs. Investing involves putting money into assets like stocks, bonds, or real estate with the goal of generating higher returns over time, but with more risk.

How can I start investing with little money?

Consider micro-investing apps, robo-advisors with low minimum investments, or invest in low-cost index funds through a brokerage account. Many platforms allow you to start with as little as $5.

What’s the best way to budget?

The best budgeting method is one you’ll stick to. Popular options include the 50/30/20 rule (50% needs, 30% wants, 20% savings), envelope budgeting, or zero-based budgeting. Experiment to find what works for you.

How can I reduce my tax burden legally?

Maximize contributions to tax-advantaged accounts like 401(k)s and IRAs, take advantage of deductions and credits you qualify for, and consider tax-efficient investing strategies. Consult with a tax professional for personalized advice.

How do I stay motivated on my financial journey?

Set clear, achievable goals and celebrate small wins. Visualize your future financial success. Find an accountability partner or join a financial community for support. Regularly educate yourself on personal finance to stay inspired and informed.

Your Path to Financial Freedom

Breaking free from poverty and building lasting wealth is a journey, but it’s one that’s absolutely worth taking. By implementing the strategies we’ve discussed – from paying yourself first to cultivating a wealth mindset – you’re setting yourself up for financial success.

Remember, as John S. Rhodes says, “What you focus on grows.” Focus on your financial health, make consistent efforts to improve, and watch your wealth grow over time.

Take action today. Start with one small step, whether it’s creating a budget, opening a savings account, or educating yourself further on personal finance. Every journey begins with a single step, and your path to financial freedom starts now.

For more valuable insights and strategies to help you succeed financially, we encourage you to view and subscribe to the Rhodes Brothers YouTube Channel . Our latest videos and information are designed to support you on your journey to financial mastery.

Resource List

Books

- “Your Money or Your Life” by Vicki Robin and Joe Dominguez

- “The Simple Path to Wealth” by JL Collins

- “Rich Dad Poor Dad” by Robert Kiyosaki

- “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

- “The Psychology of Money” by Morgan Housel

Podcasts

- “ChooseFI” – Financial Independence podcast

- “BiggerPockets Money” – Personal finance and wealth-building strategies

- “So Money with Farnoosh Torabi” – Candid conversations about money

- “The Dave Ramsey Show” – Debt-free living and wealth building

- “Afford Anything” by Paula Pant – Making smart decisions about money

Courses

- “Financial Peace University” by Dave Ramsey

- “Fundamentals of Personal Financial Planning” by University of California, Irvine (Coursera)

- “The Complete Financial Analyst Course” by Udemy

Tools and Apps

- Mint – Comprehensive budgeting and expense tracking

- YNAB (You Need A Budget) – Zero-based budgeting system

- Personal Capital – Investment tracking and financial planning

- Acorns – Micro-investing and round-up savings

- Credit Karma – Free credit score monitoring and financial product recommendations

- Robinhood – Commission-free stock trading

- Digit – Automated savings app

- Truebill – Bill negotiation and subscription management

- Rakuten – Cash back for online shopping

- Trim – Automated financial assistant for finding savings

Websites and Blogs

- Mr. Money Mustache – Early retirement and financial independence

- The Simple Dollar – Frugal living and personal finance advice

- NerdWallet – Financial product comparisons and advice

- Investopedia – Financial education and investing resources

- Bogleheads – Investment and personal finance forum

These resources cover a wide range of financial topics and cater to various learning styles and preferences. Whether you prefer reading, listening, or interactive learning, there’s something here to support your financial education and growth.