“Bitcoin is the least volatile asset in the world.” This bold statement by John S. Rhodes of the Rhodes Brothers challenges everything you thought you knew about cryptocurrency. In a world where financial stability seems like a distant dream, could the notoriously unpredictable Bitcoin be your key to unlocking greater wealth?

In this post, we’ll dive deep into the counterintuitive world of Bitcoin volatility, exploring why it might be the most stable asset you’re not leveraging. We’ll unpack the strategies used by savvy investors to turn market fluctuations into profit, and how you can apply these same principles to your financial journey.

As John S. Rhodes astutely observes, “Over time, that volatility is your friend because the upward swings of price are actually where you get the greatest gains from.” It’s time to reframe our perspective and see Bitcoin’s volatility not as a threat, but as an opportunity.

TL;DR

- Bitcoin’s underlying asset is incredibly stable, with a fixed supply of 21 million coins

- Price volatility in USD terms doesn’t reflect Bitcoin’s inherent stability

- Long-term trends show steady growth despite short-term fluctuations

- Bitcoin represents a tiny fraction (about $1 trillion) of global assets ($950 trillion)

- Understanding volatility can help you leverage it for greater wealth accumulation

- Adopting a Bitcoin-centric mindset can provide a more stable financial outlook

Understanding Bitcoin’s True Nature

To truly grasp Bitcoin’s potential as a wealth-building tool, we must first understand its fundamental nature. This understanding will help us see beyond the surface-level volatility and recognize Bitcoin’s inherent stability and value proposition.

The Illusion of Volatility

When most people think of Bitcoin, they picture wild price swings and unpredictable markets. But as John S. Rhodes points out, this perception is largely based on viewing Bitcoin through the lens of fiat currencies like the US dollar. In reality, “one Bitcoin equals one Bitcoin,” and this fundamental truth never changes.

Let’s break this down:

- Fixed Supply: There will only ever be 21 million Bitcoin. This scarcity is hardcoded into the system.

- Predictable Release: New Bitcoin are mined at a steady, predictable rate.

- Transparent Blockchain: Every transaction is visible and verifiable on the blockchain.

These factors contribute to Bitcoin’s inherent stability as an asset. The volatility we perceive is actually a reflection of the changing value of fiat currencies relative to Bitcoin.

Blockchain Explorers

To truly appreciate Bitcoin’s transparency, try using a blockchain explorer like Blockchain.info or Blockstream.info. These tools allow you to view every Bitcoin transaction in real-time, giving you a firsthand look at the network’s activity and stability.

Example: Let’s say you want to track a specific Bitcoin transaction. You can enter the transaction ID into a blockchain explorer and see details like:

- The amount of Bitcoin transferred

- The sending and receiving addresses

- The transaction fee

- The number of confirmations

This level of transparency is unparalleled in traditional financial systems and contributes to Bitcoin’s fundamental stability.

The Power of Perspective

To truly understand Bitcoin’s stability, we need to shift our perspective. Instead of asking, “How much is Bitcoin worth in dollars?” try asking, “How much are dollars worth in Bitcoin?” This mental shift can reveal a whole new world of financial possibilities.

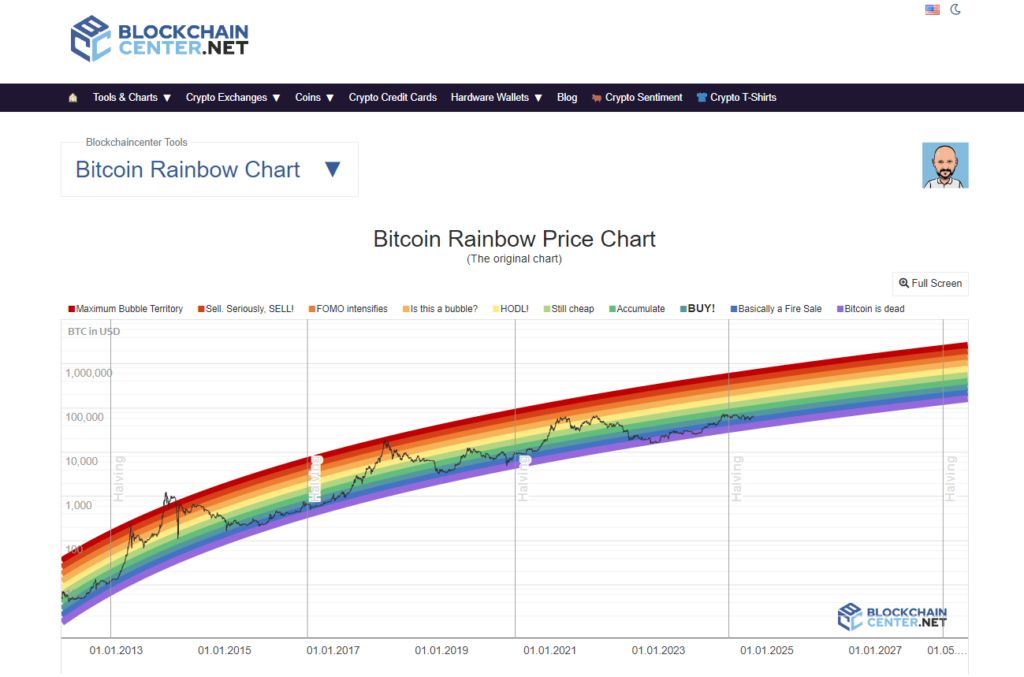

Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart is an excellent tool for visualizing long-term trends and putting short-term volatility into perspective. This chart uses color-coded bands to represent different price levels over time, helping investors identify potential buying and selling opportunities.

Example: Let’s say the current Bitcoin price falls in the “Accumulate” band on the Rainbow Chart. This might suggest that it’s a good time to consider purchasing Bitcoin, even if the short-term price action seems volatile.

Leveraging Volatility for Wealth Creation

While Bitcoin’s perceived volatility may seem daunting, it actually presents a unique opportunity for wealth creation when approached strategically. By understanding and properly leveraging this volatility, investors can potentially amplify their returns and build substantial wealth over time.

Dollar-Cost Averaging (DCA)

One of the most powerful strategies for harnessing Bitcoin’s volatility is dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the current price.

DCA Calculator

Use a DCA calculator like the one provided by dcabtc.com to visualize the potential benefits of this strategy. This tool allows you to input your investment amount, frequency, and timeframe to see how DCA could have performed historically.

Example:

Let’s say you started investing $100 in Bitcoin every week from January 1, 2019, to January 1, 2024:

- Total invested: $26,000

- Bitcoin purchased: Approximately 0.9 BTC

- Value as of January 1, 2024: Approximately $40,000

- Return on Investment: ~54%

This example illustrates how DCA can help smooth out volatility and potentially lead to significant gains over time.

How to implement DCA:

- Choose a fixed amount you can comfortably invest (e.g., $100)

- Set a regular schedule (weekly, bi-weekly, or monthly)

- Use an automated service like Swan Bitcoin or Cash App to make consistent purchases

By following this strategy, you’ll naturally buy more Bitcoin when prices are low and less when prices are high, potentially lowering your average purchase price over time.

HODL: The Ultimate Long-Term Strategy

“HODL” (Hold On for Dear Life) has become a mantra in the Bitcoin community, and for good reason. By holding Bitcoin long-term, you can ride out short-term volatility and potentially benefit from the overall upward trend.

Bitcoin HODL Calculator

Use a HODL calculator like the one at buybitcoinworldwide.com to see the potential returns of holding Bitcoin over different time periods. This can help reinforce the long-term perspective needed for successful HODLing.

Example:

If you had purchased $1,000 worth of Bitcoin on January 1, 2015, and held until January 1, 2024:

- Initial investment: $1,000

- Bitcoin purchased: Approximately 3.14 BTC

- Value as of January 1, 2024: Approximately $136,000

- Return on Investment: ~13,500%

While past performance doesn’t guarantee future results, this example illustrates the potential power of long-term holding.

Steps to become a successful HODLer:

- Secure your Bitcoin in a hardware wallet like Ledger or Trezor

- Set a long-term goal (e.g., hold for 5+ years)

- Resist the urge to sell during market dips

- Educate yourself continuously about Bitcoin to strengthen your conviction

Remember Warren Buffett’s sage advice: “The stock market is a device for transferring money from the impatient to the patient.” The same principle applies to Bitcoin.

Understanding the Bigger Picture

To truly grasp Bitcoin’s potential as a wealth-building tool, it’s crucial to zoom out and consider its place in the broader global economy. This perspective helps us understand not just where Bitcoin is today, but where it could potentially go in the future.

Bitcoin’s Place in the Global Economy

To truly grasp Bitcoin’s potential, we need to zoom out and look at the bigger picture. As John S. Rhodes mentions, the total value of all assets in the world is around $950 trillion, while Bitcoin’s market cap is only about $1 trillion.

Bitcoin Marketcap Comparison

Websites like companiesmarketcap.com offer visual comparisons of Bitcoin’s market cap to other assets, helping put its current size and potential for growth into perspective.

Example:

As of January 2024:

- Bitcoin market cap: ~$875 billion

- Gold market cap: ~$13.7 trillion

- Apple Inc. market cap: ~$3 trillion

This comparison shows that Bitcoin, despite its growth, still has a relatively small market cap compared to traditional assets, suggesting potential room for expansion.

This means:

- Bitcoin has enormous room for growth

- We’re still in the early adoption phase

- Current volatility is partly due to Bitcoin’s relatively small market size

The Path to Mainstream Adoption

As Bitcoin continues to gain adoption, we can expect:

- Decreased volatility as the market matures

- Increased liquidity and ease of use

- More institutional investment and regulatory clarity

Bitcoin Adoption Curve

The Bitcoin Adoption Curve, often discussed by industry analysts, provides a visual representation of Bitcoin’s potential growth trajectory. While not a precise predictive tool, it helps conceptualize the stages of adoption and where we might currently stand.

Example:

Consider the adoption of the internet:

- 1995: ~16 million users (0.4% of the world population)

- 2005: ~1 billion users (15.7% of the world population)

- 2024: ~5.3 billion users (65% of the world population)

Bitcoin’s adoption could follow a similar S-curve, with rapid growth as it moves from early adopters to the early majority.

To stay ahead of the curve, consider:

- Following reputable Bitcoin news sources like Bitcoin Magazine

- Attending Bitcoin conferences or local meetups

- Experimenting with using Bitcoin for everyday transactions

Actionable Steps for Leveraging Bitcoin’s Volatility for Wealth Creation

- Start with dollar-cost averaging (DCA)

- Choose a reputable exchange (e.g., Coinbase, Kraken)

- Set up automatic weekly or monthly purchases

- Start with a small, consistent amount (e.g., $50-$100)

- Secure your Bitcoin

- Get a hardware wallet (e.g., Ledger, Trezor)

- Transfer purchased Bitcoin to your wallet regularly

- Educate yourself

- Read “The Bitcoin Standard” by Saifedean Ammous

- Follow credible Bitcoin news sources

- Join Bitcoin-focused online communities

- Optimize your strategy

- Increase DCA amount as you become more comfortable

- Consider dynamic DCA based on market conditions

- Explore Bitcoin-backed loans for leverage (advanced)

- Diversify

- Allocate only a portion of your portfolio to Bitcoin

- Consider other assets to balance risk

- Hold long-term

- Avoid panic selling during price dips

- Focus on Bitcoin’s long-term potential

- Stay informed

- Keep up with regulatory changes

- Monitor technological advancements in the Bitcoin network

Remember: Never invest more than you can afford to lose. Consider consulting a financial advisor for personalized advice.

Common Mistakes to Avoid

- Trying to Time the Market: Bitcoin’s volatility makes timing extremely difficult. Stick to a consistent strategy instead.

- Overinvesting: Never invest more than you can afford to lose.

- Neglecting Security: Failing to properly secure your Bitcoin can lead to devastating losses.

- Falling for Scams: Be wary of promises of guaranteed returns or “get rich quick” schemes.

- Panic Selling: Emotional reactions to market dips can lead to poor financial decisions.

Frequently Asked Questions

Is Bitcoin too volatile for serious investment?

While Bitcoin does experience short-term price volatility, its long-term trend has been upward. Many investors see this volatility as an opportunity rather than a drawback. By adopting strategies like dollar-cost averaging and holding for the long term, you can potentially benefit from Bitcoin’s overall growth while mitigating the impact of short-term fluctuations.

How does Bitcoin compare to traditional assets in terms of stability?

Bitcoin’s underlying technology and fixed supply make it inherently stable as an asset. The price volatility we see is largely due to its relatively small market size and the fluctuating value of fiat currencies. As adoption increases and the market matures, many experts expect Bitcoin’s price to stabilize further.

What’s the best way to start investing in Bitcoin?

For beginners, a good approach is to start small with a dollar-cost averaging strategy. Set up recurring purchases of a fixed dollar amount at regular intervals. This helps spread out your entry points and potentially reduce the impact of short-term volatility.

How can I protect myself from Bitcoin’s volatility?

Adopting a long-term perspective is key. Instead of focusing on day-to-day price movements, consider Bitcoin’s potential over a multi-year timeframe. Additionally, never invest more than you can afford to lose, and consider diversifying your overall investment portfolio.

Is it too late to invest in Bitcoin?

Many experts believe we’re still in the early stages of Bitcoin adoption. With Bitcoin representing only a tiny fraction of global assets, there’s potentially significant room for growth. However, it’s important to do your own research and make investment decisions based on your personal financial situation and risk tolerance.

How does Bitcoin’s volatility affect its use as a currency?

While short-term price fluctuations can make Bitcoin challenging to use for day-to-day transactions, solutions like the Lightning Network are being developed to address this issue. Additionally, some argue that Bitcoin’s primary value proposition is as a store of value rather than a medium of exchange.

Can Bitcoin’s code be changed to increase the 21 million coin limit?

While technically possible, such a change would require consensus from the vast majority of Bitcoin network participants. Given that Bitcoin’s fixed supply is one of its core value propositions, it’s highly unlikely that such a change would ever be accepted by the community.

How does Bitcoin mining affect its volatility?

Bitcoin mining doesn’t directly affect price volatility. However, it does play a role in Bitcoin’s predictable supply schedule. The mining difficulty adjusts automatically to ensure new bitcoins are created at a steady rate, regardless of the total mining power on the network.

What role do institutional investors play in Bitcoin’s volatility?

As more institutional investors enter the Bitcoin market, it’s expected to bring more liquidity and potentially reduce volatility. However, large institutional trades can also cause short-term price movements. Overall, increased institutional adoption is generally seen as a stabilizing force for the Bitcoin market in the long run.

How can I stay informed about Bitcoin market trends?

Follow reputable Bitcoin news sources, analysts, and educators on social media platforms. Websites like CoinGecko or CoinMarketCap provide real-time price data and market trends. For more in-depth analysis, consider subscribing to research reports from firms specializing in cryptocurrency markets.

Embracing Bitcoin’s Potential

As we’ve explored in this post, Bitcoin’s volatility is not the enemy it’s often portrayed to be. By understanding the true nature of Bitcoin as a stable, limited-supply asset, we can reframe our perspective and potentially leverage this volatility to our advantage.

Remember John S. Rhodes’ insight: “Over the medium and long term that price volatility is actually your friend and it will be what takes you to higher highs over time.” This mindset shift is crucial for anyone looking to build wealth through Bitcoin investment.

The strategies we’ve discussed – from dollar-cost averaging to long-term holding – provide a roadmap for navigating the sometimes turbulent waters of the Bitcoin market. By staying educated, thinking long-term, and avoiding common pitfalls, you can position yourself to potentially benefit from Bitcoin’s growth while managing its inherent volatility.

As you embark on your Bitcoin journey, remember that knowledge is power. Continue to educate yourself, stay informed about market trends, and always invest responsibly. The world of Bitcoin is dynamic and ever-evolving, offering exciting opportunities for those willing to embrace its potential.

For the latest videos and information to help you succeed in your Bitcoin journey, we encourage you to view and subscribe to the Rhodes Brothers YouTube Channel . Your financial future awaits – are you ready to take the first step?

Resource List

Books

- “The Bitcoin Standard” by Saifedean Ammous

- “Layered Money” by Nik Bhatia

- “The Price of Tomorrow” by Jeff Booth

- “The Bullish Case for Bitcoin” by Vijay Boyapati

- “The Internet of Money” series by Andreas M. Antonopoulos

Podcasts

- “What Bitcoin Did” with Peter McCormack

- “The Investor’s Podcast – Bitcoin Fundamentals” with Preston Pysh

- “Stephan Livera Podcast”

- “Bitcoin Audible” with Guy Swann

Courses

- Bitcoin for Everybody by Saylor Academy (free)

- Programming Bitcoin from Scratch by Jimmy Song

- Bitcoin and Cryptocurrency Technologies by Princeton University (Coursera)

Tools

- Blockstream.info – Bitcoin block explorer

- Mempool.space – Real-time Bitcoin transaction and fee data

- Bitcoin Rainbow Chart – Long-term price analysis tool

- Glassnode Studio – On-chain Bitcoin metrics and analysis

- Bitcoin Stock-to-Flow Model – Price prediction model

Websites

- Bitcoin.org – Official Bitcoin website

- Lopp.net – Comprehensive Bitcoin information resource

- BitcoinMagazine.com – News and analysis

- Bitcointalk.org – Forum for Bitcoin discussion

- Nakamotoinstitute.org – Collection of essential Bitcoin literature

Hardware Wallets

Mobile Wallets

- BlueWallet (iOS/Android)

- Muun Wallet (iOS/Android)

- Phoenix Wallet (Android)

Bitcoin Buying Services

- Swan Bitcoin – Automated Bitcoin savings

- Cash App – Simple Bitcoin purchases

- Kraken – Advanced trading platform

- Bisq – Decentralized Bitcoin exchange

Remember to always do your own research and consult with financial professionals before making investment decisions. This resource list is intended for educational purposes only and should not be considered financial advice.