For More Free Videos, Subscribe to the Rhodes Brothers YouTube Channel.

“Wealth is not about having a lot of money; it’s about having a lot of options.” – Chris Rock

“Can you really get rich just by reading?”

That question might sound too good to be true, especially in today’s hustle culture where every side hustle seems to demand selling, coding, or endless networking. But what if the real goldmine is in your bookshelf—or better yet, your brain?

The truth is, with the right strategy, reading can be your roadmap to financial freedom. You don’t need to be a tech wizard, a high-pressure salesperson, or even an extrovert. If you’re someone who loves to read and learn quietly, there’s a powerful way to turn that habit into passive and scalable income, thanks to artificial intelligence and smart investing.

In the words of John S. Rhodes of the Rhodes Brothers: “The value is in the knowledge you’re acquiring. If you acquire the right knowledge, it can give you an edge—and that edge is what can create wealth over time.”

This blog post dives deep into the exact method John used, breaks it down step-by-step, and shows you how to get rich reading—without selling, socializing, or developing software. We’ll explore dividend growth investing, how AI can help you pinpoint the right knowledge, and how to leverage simple tools to turn your reading into results.

Let’s dig in.

TL;DR

- Reading can lead to real wealth when paired with the right strategies and knowledge.

- The #1 method: Dividend Growth Investing—buy stocks that pay increasing dividends over time.

- Use AI tools (like ChatGPT) to find opportunities, analyze markets, and guide your learning.

- Focus on implementing knowledge—don’t just read, but leverage what you learn.

- No selling, no phone calls, no social interaction required.

- Perfect for introverts, beginners, retirees, students, and side hustlers.

- Tools like Seeking Alpha, Simply Wall Street, and ChatGPT can help you get started.

- This is all about scalable, passive income from smart reading habits.

Why Reading Could Be Your Richest Skill

Most people treat reading as a leisure activity. But what if it could be your most profitable investment?

People spend years acquiring degrees for the sake of earning a better income. But you don’t need a diploma to earn from your intellect. Reading the right material, asking the right questions (especially with the help of AI), and acting on that knowledge can yield consistent, growing returns.

We’re not talking about vague ideas or “just believe in yourself” fluff. We’re talking about a proven and practical system:

Dividend Growth Investing.

This method involves investing in companies that pay regular dividends—and increase those dividends every year. Over time, your income grows without you lifting a finger.

Let’s say you read up on a company like ExxonMobil. You learn they’ve been increasing their dividend every year for over a decade. You invest. You earn passive income. That income increases each year. That’s compound growth in action.

You learned. You acted. You earned.

Step-by-Step: How to Profit from Reading Using A.I.

Reading becomes a powerful wealth-building tool when paired with the right strategy—and AI takes it to the next level. Instead of aimlessly flipping through books or burying yourself in blog posts, you can use AI tools to target exactly what you need to learn, filter out the fluff, and guide your next action. Here’s how to turn your reading habit into a money-making machine—one step at a time.

Step 1: Start with a Smart Prompt

Use tools like ChatGPT to guide your learning. Try a prompt like:

“What are the best dividend-paying stocks with a strong history of growth and low risk for a beginner investor?”

This is similar to the exact prompt John Rhodes used—and it works. The AI will give you a curated list of companies, explain dividend growth, and even help you compare investment strategies.

Step 2: Learn the Basics of Dividend Growth Investing

Focus your reading on:

- What dividends are

- How dividend growth works

- Why reinvesting dividends accelerates wealth

- What makes a good dividend stock (e.g., payout ratio, dividend history, sector stability)

Books to start with:

Step 3: Research and Select Stocks

Use tools like:

- Seeking Alpha – for dividend stock analysis and news

- Simply Wall Street – for visualizing dividend history and stock health

- Yahoo Finance – for tracking performance and earnings reports

Look for companies with:

- 10+ years of consecutive dividend increases

- Low payout ratios (means they’re not overpaying dividends unsustainably)

- Stable industries (utilities, consumer goods, etc.)

Step 4: Invest Consistently

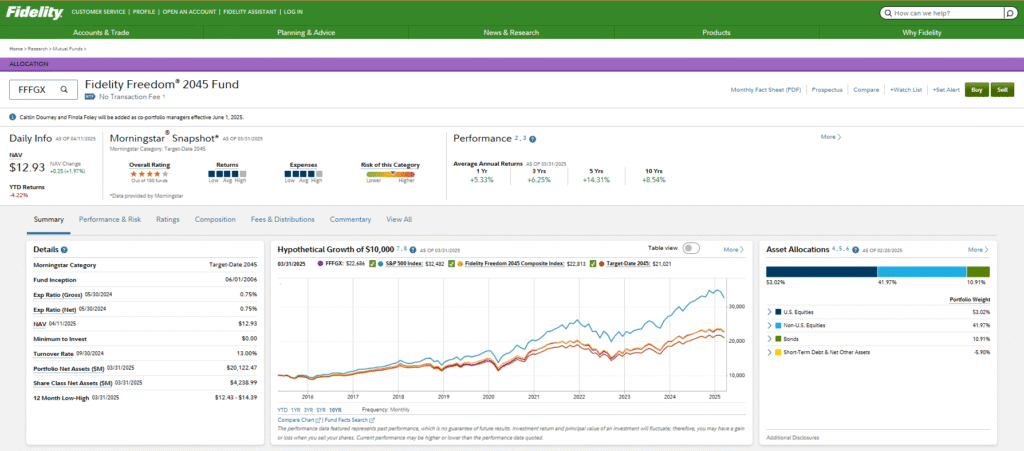

Open a brokerage account—like Fidelity, Charles Schwab, or Robinhood—and begin investing.

Start small. Even $50/month into dividend stocks can grow into thousands over the years.

Use DRIP (Dividend Reinvestment Plans) to automatically reinvest your earnings.

Step 5: Track and Optimize

Use spreadsheets or apps like:

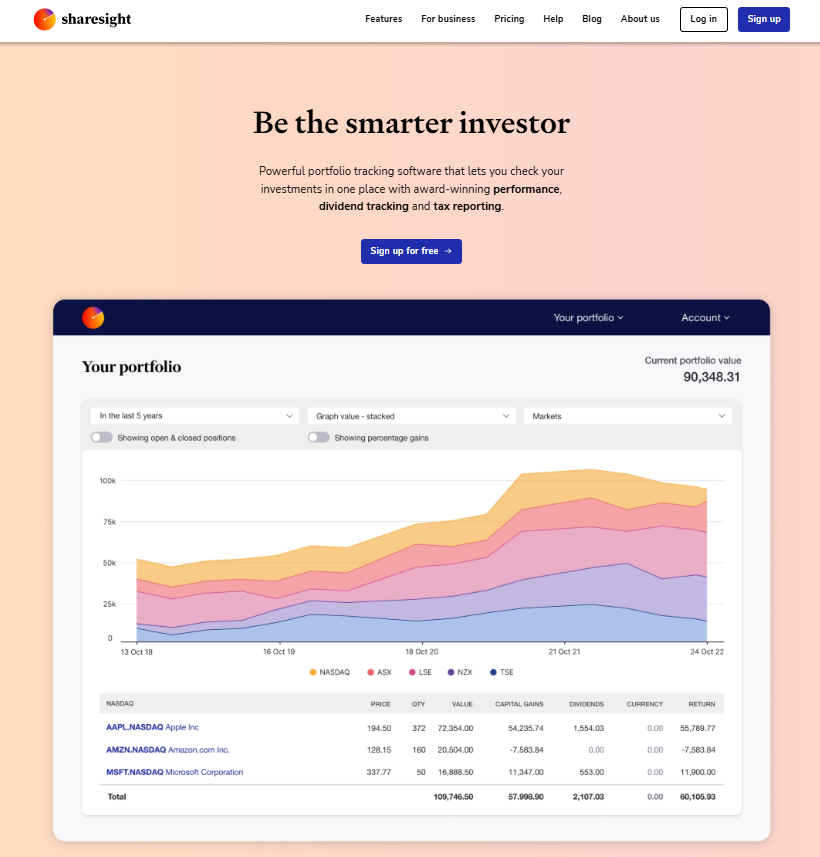

- Sharesight – for tracking dividend income

- Personal Capital – to view portfolio performance

- Ziggma – for analyzing portfolio health

Let AI help you find what to read next, which stocks to analyze, and where to expand your knowledge.

Actionable Steps for Different Demographics

No matter your age or experience level, the path to building wealth through reading—and leveraging A.I.—can be tailored to fit your lifestyle, goals, and financial starting point. Let’s break down practical, applicable strategies based on where you are in your journey.

For Beginners: Build Your Financial Foundation

If you’re just starting out, the key is to understand the basics without getting overwhelmed. Here’s how to ease into dividend growth investing and smart financial literacy using reading and AI tools:

- Start with beginner-friendly resources.

Books like Invested by Danielle Town or The Simple Path to Wealth by JL Collins offer clear, engaging explanations of investing fundamentals. Pair these with explainer videos on YouTube—channels like Graham Stephan, The Plain Bagel, or even the Rhodes Brothers provide beginner-focused content. - Use AI as your personal tutor.

Don’t understand terms like “dividend yield,” “EPS,” or “payout ratio”? Ask ChatGPT to explain them in simple language. You can even copy-paste paragraphs from articles and have AI summarize or clarify them. - Focus on blue-chip dividend stocks.

These are large, established companies with a history of paying and increasing dividends—think Coca-Cola, Johnson & Johnson, or Procter & Gamble. They’re a safe starting point for beginners looking to grow their income slowly and steadily. - Practice before you invest real money.

Start with a stock simulator app (like Investopedia Simulator or MarketWatch Virtual Stock Exchange) to build confidence. - Set realistic goals.

Start small—$25 to $100 per month. The goal isn’t to hit it big overnight but to build a habit of consistent investing with a focus on learning.

For Millennials: Make It Automated, Ethical, and Scalable

Millennials often juggle student debt, rising living costs, and the desire for work-life balance. The good news? You don’t need to be glued to a stock ticker. Here’s how to turn your reading habit into long-term wealth—on autopilot.

- Use micro-investing and automation tools.

Platforms like M1 Finance, Acorns, or Betterment allow you to invest small amounts automatically and even set up recurring deposits. M1 Finance lets you create custom “pies” of dividend stocks, which is perfect for building a personalized passive income machine. - Read with your values in mind.

Dive into literature and articles about ESG investing (Environmental, Social, Governance). Millennials tend to prefer companies that align with their ethics. Look for dividend-paying companies that also rank highly on ESG indexes. - AI for optimization and forecasting.

Use ChatGPT to compare dividend growth rates or ask it to generate a list of ESG-friendly dividend stocks. AI can even summarize earnings reports so you don’t have to read lengthy documents. - Invest in scalable income streams.

Consider turning your reading into content—book reviews, investment explainers, or blog posts. Use AI tools like Jasper or ChatGPT to help you write, edit, and publish. Monetize via Medium Partner Program, Substack, or affiliate links. - Diversify smartly.

Mix dividend stocks with ETFs and REITs (real estate investment trusts). Tools like Morningstar, Ziggma, or Simply Wall Street offer performance insights to help you fine-tune your holdings.

For People Nearing Retirement: Prioritize Stability and Income

If you’re in your 50s or 60s, your investing goals shift from growth to income preservation and security. The good news is that dividend growth investing is one of the most effective and low-risk strategies for this stage of life.

- Choose high-yield, low-volatility dividend stocks.

Focus on sectors like utilities, healthcare, and consumer staples. These industries continue to perform well even in economic downturns. Look for stocks with a 5+% yield and a history of steady payouts. - Use A.I. to manage risk.

Tools like Morningstar Premium or Simply Safe Dividends rate dividend safety scores and provide deep insights into company fundamentals. You can also use ChatGPT to help you understand earnings calls or market trends in plain English. - Shift focus to income over growth.

Rather than reinvesting dividends (as younger investors might), consider taking them as cash to supplement your income. Set up monthly dividend-paying portfolios to create a reliable income stream. - Explore dividend ETFs and REITs.

These offer built-in diversification and regular payouts. Funds like Vanguard High Dividend Yield ETF (VYM) or Schwab U.S. Dividend Equity ETF (SCHD) are excellent options for retirees. - Keep learning, but make it efficient.

Use tools like Blinkist to get key insights from investing books in 15 minutes. AI summarizers can also help you digest market news quickly so you can stay informed without spending hours reading.

Common Mistakes to Avoid

Even with the best strategy in hand, many people stumble on the path to building wealth through reading and investing. The good news? These mistakes are completely avoidable—if you recognize them early and take corrective action. Here’s a deeper look at the most common pitfalls, why they happen, and exactly how to sidestep them.

Mistake #1: Chasing High Yields Without Understanding the Risk

One of the most tempting traps for new investors is to go after stocks with unusually high dividend yields—sometimes 8%, 10%, or even more. At first glance, this looks like easy money. Who wouldn’t want a double-digit return just for holding a stock?

The Problem:

High yields often come from financially stressed companies. These businesses might be using dividends as a way to attract investors while hiding deeper issues, like declining revenue or unsustainable debt levels. If the stock price crashes or the dividend gets cut, you’re left holding a bad investment.

The Smart Move:

Focus on dividend growth, not just yield. Stick with Dividend Aristocrats—companies that have increased their dividend payouts for 25+ consecutive years. These are typically stable, mature businesses with a track record of weathering economic downturns.

Tools That Help:

- Simply Safe Dividends gives a safety score for each dividend.

- Use ChatGPT to analyze a company’s dividend history and payout ratio.

Mistake #2: Only Reading, Never Acting

This is especially common among self-educators. You read books, watch videos, take notes, and… do nothing.

The Problem:

Reading feels productive. It keeps your brain engaged and gives you the comfort of “one day” planning. But unless you take action—like actually making an investment or applying a strategy—you won’t see real-world results.

The Smart Move:

Create a reading-to-action system. Each week or month, commit to:

- Reading one article or chapter on dividend investing

- Researching one new dividend stock

- Executing one small action (e.g., investing $50, tweaking your portfolio, reviewing a stock’s dividend history)

Pro Tip:

Use a simple habit tracker or spreadsheet to log what you’ve read and the actions you’ve taken. This transforms passive reading into an active wealth-building routine.

Mistake #3: Drowning in Information (a.k.a. Analysis Paralysis)

In the age of the internet, information is abundant—too abundant. Articles, podcasts, newsletters, Reddit threads, YouTube channels, TikTok advice… it never ends.

The Problem:

Trying to consume everything leads to decision fatigue. You become overwhelmed, unsure who to trust, and afraid to make the wrong move—so you make no move at all.

The Smart Move:

Curate your inputs. Pick 2-3 trusted sources for dividend investing and use AI to filter and summarize content. For example:

- Ask ChatGPT to summarize a long earnings report

- Use it to compare two companies’ dividend growth records

- Request a pros-and-cons list for a stock you’re researching

Also:

Keep a “knowledge journal” where you jot down key takeaways and how you intend to apply them. This prevents scattered learning and keeps you focused on what matters.

Mistake #4: Waiting for the “Perfect Time” to Start Investing

A lot of people delay investing because they’re waiting for:

- The market to drop

- A better job

- A little more savings

- A “sign” that it’s the right moment

The Problem:

There’s no perfect time. Markets fluctuate, life gets busy, and the longer you wait, the more you miss out on compound growth—the most powerful force in investing.

The Smart Move:

Start now, even if it’s just with $10 or $25 a month. The habit is more important than the amount.

Why It Works:

- You build confidence through experience

- You can benefit from dollar-cost averaging, which smooths out market ups and downs

- You overcome the mental barrier of getting started, which is often the hardest part

Helpful Tools:

- Acorns or M1 Finance for automatic small-dollar investing

- A simple AI-generated portfolio plan based on your goals and timeline

Frequently Asked Questions

How do I get started with dividend investing if I have no experience?

Start by watching beginner videos on YouTube and reading one book on dividends. Use ChatGPT to simplify terms and help you research.

What’s the best platform to start investing?

Begin with Robinhood, Fidelity, or M1 Finance—they’re beginner-friendly and offer commission-free trades.

How much money do I need to start?

You can start with as little as $10. The key is consistency over time.

Is this strategy truly passive?

Yes. Once you pick your stocks and set up DRIP, it can be fully passive. You just monitor it monthly.

Can I lose money?

Yes, like any investment. However, focusing on stable, long-term dividend stocks reduces risk significantly.

How do I find quality dividend stocks?

Use tools like Seeking Alpha, Simply Wall Street, and AI prompts to filter strong candidates.

How long until I see results?

You may see small dividends within months, but true growth compounds over years, not weeks.

Can I use AI to automate investing decisions?

Not fully, but AI can help analyze data, predict trends, and guide your reading and research.

Should I diversify my holdings?

Absolutely. Invest in different sectors and companies to spread risk.

What if I don’t have time to read a lot?

Use AI summarizers or tools like Blinkist to get key takeaways from books in minutes.

Build Wealth Quietly, Starting Today

You don’t need to be loud to be wealthy.

You don’t need to sell, pitch, or network.

You need focus, knowledge, and action—and reading is your gateway to all three.

Now you know how to turn a simple habit into a wealth-building machine. Start small, stay consistent, and let your knowledge compound. Whether you’re a student, a retiree, or just someone who loves books, this path is yours to take.

Get started today by running your first AI prompt.

Open a brokerage account and buy your first dividend stock.

Thanks for joining us for this guide! For more insights, tutorials, and expert breakdowns, subscribe to the Rhodes Brothers YouTube Channel and stay ahead on your journey to financial freedom.

Resource List

Books

- The Little Book of Big Dividends by Charles B. Carlson

- The Intelligent Investor by Benjamin Graham

- Invested by Danielle Town

- Unshakeable by Tony Robbins

Podcasts

- The Dividend Guy Blog Podcast

- BiggerPockets Money Podcast

- We Study Billionaires (by The Investor’s Podcast Network)

Tools & Apps

- Seeking Alpha – for stock screening and dividend news

- Simply Wall Street – for visual stock data

- Sharesight – track dividend income

- Ziggma – portfolio analysis

- Robinhood / M1 Finance / Fidelity – beginner-friendly investing platforms

- ChatGPT – for prompts, summaries, and research

- Blinkist – for reading book summaries fast